The landscape of the global online gaming industry is evolving, and one market that has in the past few years captured the attention of operators worldwide, is the United States (US). With a burgeoning appetite for online sports betting and casino gaming, the US presented a wealth of opportunities, including for European iGaming companies seeking to expand their reach.

The online gambling market in the US is expected to reach €53bn in gross win (i.e., stakes or bets less player wins) volume by 2028 from €15bn in 2022, reflecting a compound annual growth rate (CAGR) of 24%. The market’s growth potential is underpinned by a few drivers — the most prevalent ones being the rapid legalisation of online gambling activities across multiple states and the increasing popularity of online sportsbook, which is the fastest-growing segment of online gambling in the US.

Rapid legalisation of online gambling

The ongoing legalisation and regulation of online gambling and sportsbook in several states has opened an attractive growth avenue to one of the largest markets in the world. The annulment of the Professional and Amateur Sports Protection Act (PASPA) in 2018 by the US Supreme Court paved the way for individual states to decide on the legality of sports betting.

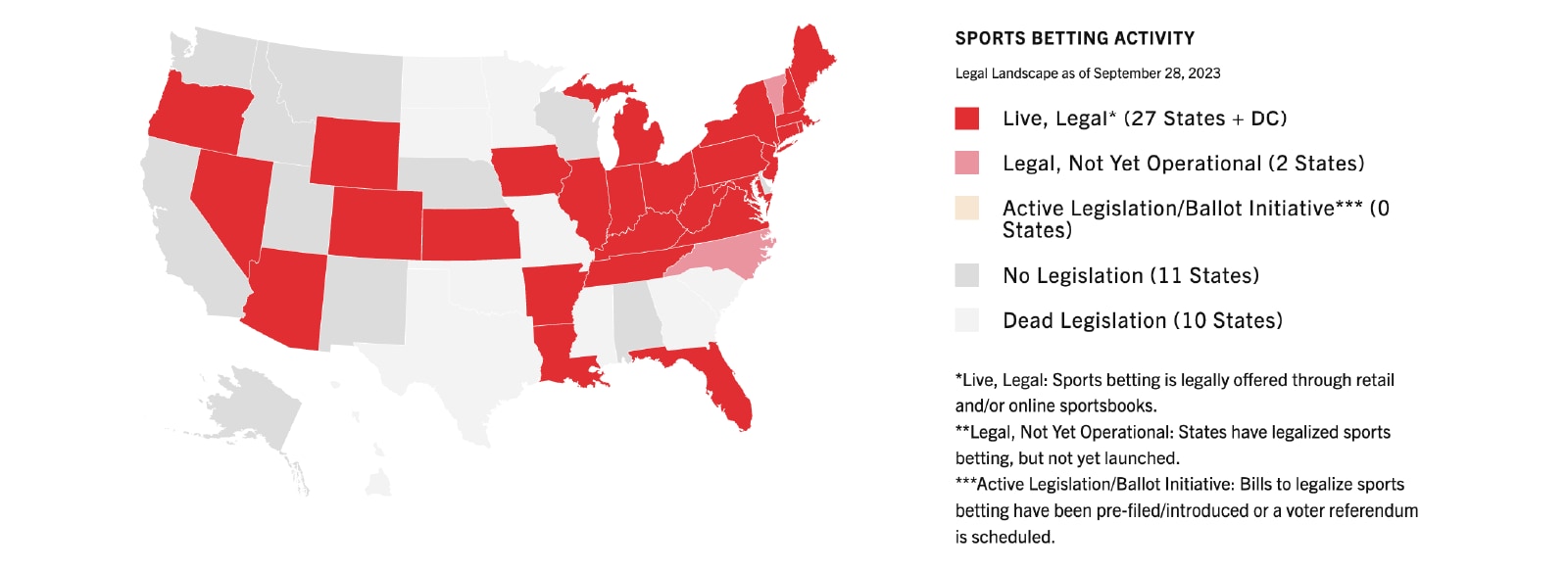

As of September 2023, online sportsbook is legal and live in 27 US states and Washington DC, which represents about 57% of American adults in the US. Online sportsbook is also live in Vermont and North Carolina but not yet operational, and 21 states remain without legislation or with inactive legislation. Online casino, on the other hand, has experienced a much slower progression in terms of legalisation and is currently legal and live in only six states including New Jersey and Pennsylvania which are the two biggest states for online casino.

Source: American Gaming Association

Currently, New Jersey is the largest market for regulated online gambling. Amid the rapid regulation and increasing popularity of sportsbook activities, H2 Gambling Capital forecasts that the top 5 US states for online Gambling in 2028 will be New York, Pennsylvania, Illinois, New Jersey and Michigan.

Increasing popularity of Sportsbook

Historically, sportsbook was considered as an add-on relative to casino activities in the US, particularly from a retail perspective. However, as the retail-to-online shift has taken place sportsbook has been surging in popularity in recent years and has become the fastest-growing segment of online gambling. The online sportsbook segment is forecasted to reach $24bn in annual gross win by 2028 — up from $8bn in 2022 (CAGR of 21%).

Besides the withdrawal of PASPA, several factors have also contributed to the growing popularity of sportsbook:

- Cultural shift

- Media Partnerships

- In-Game Betting

- Technological Advancements

Cultural shift

There has been a gradual cultural shift in the perception of sports betting. As more states legalise and regulate it, the activity is becoming more normalised and accepted as a form of entertainment – mirroring the cultural shift that occurred in the European market historically.

Media Partnerships

Sportsbetting operators have entered into various partnerships with sports leagues, teams, and media outlets. This integration into mainstream sports coverage and advertising has increased the visibility of sports betting and generated interest among fans.

In-Game Betting

The rise of in-game or live betting has added a new dimension to sports wagering. Bettors can place bets on various outcomes during a game, such as the next goal or point, enhancing overall engagement and excitement.

Technological Advancements

Advancements in technology, particularly mobile technology, have made it easier for individuals to engage in sports betting. Mobile apps and online platforms provide convenient and accessible ways for people to place bets from their smartphones or computers.

New market players face intense competition in regulated states from established market players, with the top 4 players having about 90% of the US Sportsbook market share.

Despite only recently becoming regulated, regulated states have become saturated quickly. This is mainly due to the market share won by established brands in this sector including FanDuel, DraftKings, BetMGM and Caesars. According to research published by Eilers & Krejcik in Spring 2023, the top four brands in the online sportsbook space, these being FanDuel, DraftKings, BetMGM / Borgata, and Caesers account for 90% of the market in the regulated states. A similar reality extends to the online casino market share where the top five brands in the online casino space account for 83% of the market.

These key market players, aside from leveraging on their scale in the US entertainment market, adopted different strategies to expand their competencies and presence in the iGaming sector, including M&A, strategic and brand partnerships, as well as efforts on shifting existing fantasy users to sportsbook customers.

What strategies have these key players adopted to win market share in the US market?

Caesars Entertainment pursued an M&A strategy whereby it acquired William Hill and subsequently divested William Hill’s non-US assets (sold to 888 Holdings), to reinforce its focus on the US market. This allowed the operator to leverage Caesars' brand and existing customer base.

MGM Resorts pursued a dual strategy both by acquiring Leovegas, a leading sportsbook and casino operator with an established presence in European markets, and by setting up a strategic partnership with Entain, an operator with several established sportsbook and casino brands such as Bwin and partypoker, and ‘Bet MGM’ to target newly regulated states in the US. The collaboration strategically combined Entain’s iGaming expertise with MGM's established presence in the US, resulting in a powerful force in the online gambling space.

Flutter Entertainment, an established European operator (formerly PaddyPower Betfair) acquired FanDuel (operating its legacy fantasy sports business) business in 2018, securing first mover advantage in the US market following the US Supreme Court’s decision on PASPA, as well as the acquisition of The Stars Group a year after. This together with a shift of the fantasy user base to their sportsbook products, helped Flutter acquire around 46% of the total US sportsbook market share.

DraftKings, similar to FanDuel, leveraged its fantasy league user base, with fantasy games based on the US professional leagues (for example the NFL, MLB, NHL, and NBA), to launch its sportsbook product. This, together with the investment in their online proprietary sportsbook platform (including through the reverse merger with SBTech in 2021), paved the way towards DraftKings’s success in the US.

Marketing efforts made by key players have paved the way for success for the 4 main players including but not limited to sportsbook partnerships with professional leagues including:

National Hockey League (NHL) partners– DraftKings, FanDuel, Bet MGM, Caesars (Outside top 4: Betway, Bet365, PointsBet);

National Basketball Association (NBA) partners – FanDuel, DraftKings, BetMGM;

National Football League (NFL) partners – FanDuel, DraftKings, Caesars Entertainment; and

Major Leagues Baseball (MLB) partners – FanDuel and MGM Resorts.

Currently, there are about 40 licensed sportsbook operators in the US, implying that about 10% of the market share is shared amongst 35 operators

The success of the top 4 market players has driven challenges for other licensed operators to gain traction in the market. Indeed, some licensed operators have decided to scale down their US sportsbook business including:

Kindred have publicly disclosed their decision to exit the US market and focus on core markets going forward. The reason for the exit was attributed towards the intense competition in the market and the significant investment “needed to close the gap to market leaders” which “at [Kindred’s] current capacity this is untenable”.

WynnBET has also significantly descaled its US online sportsbook operations by exiting from 8 out of 12 states, including Arizona, Colorado, Indiana, Louisana, and New Jersey. The operator has cited significant Customer Acquisition Costs (CAC) required to onboard new customers.

PointsBet (licensed in 12 states) has also divested its US business (sold to Fanatics) due to the significant marketing investment required to compete with the major players.

MaximBet (licensed in 2 states) wound down its US operations disclosing the lack of scale and high cost base required to successfully operate in the market.

Similarly, licensed operators such as Esports Entertainment Group (licensed under Vie.gg) and Fubo Sportsbook, have also scaled down their sportsbook plans in the US.

As the US market continues to regulate, it remains unclear to what extent other players outside the top few will be able to win market share. What remains clear is that unless operators have the appetite to undertake significant investment in the market, it will remain challenging to gain traction resulting in more licensed players continuing to exit the US market going forward.

Read our latest gaming publications

Contact us