The COVID-19 pandemic has fundamentally challenged the role of Commercial Real Estate, given the uncertainty around how many business tenants will survive the crisis, and what the future work space requirements will be for those that survive or prosper.

We put into perspective the impact of COVID-19 crisis on Corporate Real Estate, and what responses the demand supply imbalance is driving across the value chain. We highlight how industry players can manage through these challenges to emerge stronger in the post COVID-19 landscape.

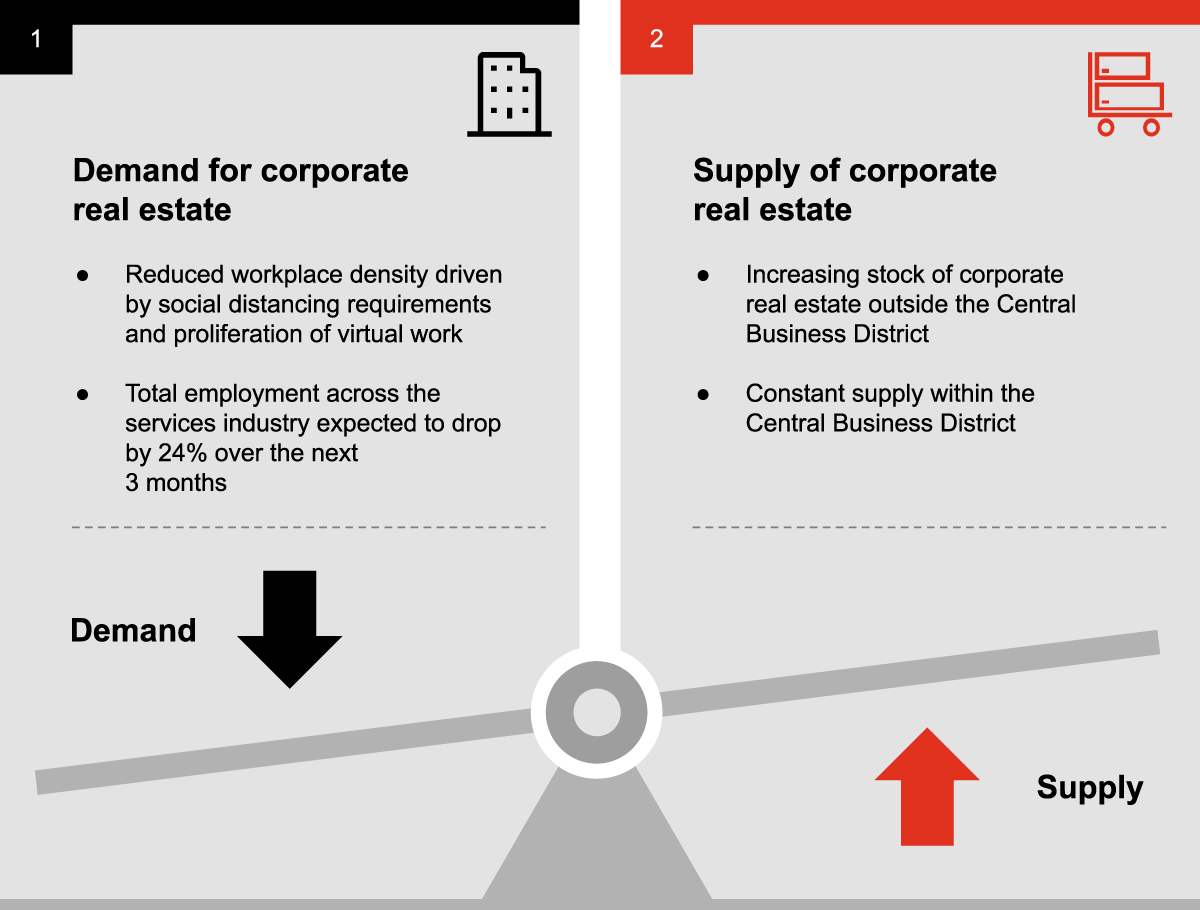

Imbalance in demand and supply

Slide in demand led by changing work patterns

3 out of 4

respondents from Asia Pacific believe that there will be an enduring shift towards remote collaboration in working

PwC’s COVID-19 CEO Panel Survey

Blended physical and virtual working

- Virtual working has delivered short term benefits, albeit with some implementation issues, for both employers and employees.

- With the provision of flexible working opportunities in both location and working hours, employees will benefit from a work community, the culture & social interactions whilst maintaining access to resources and tools that are in the office.

Reimagined work environment

- Primary function of the key or marque corporate real estate will be for internal and external collaboration/engagement. It will remain the key location to drive the corporate brand, culture and values.

- Increase in multiple purpose, dynamically reconfigurable zones, connecting virtual participants for a shared experience.

- Focus will be on increasing space to initiate and develop relationships.

Employee Value Proposition critical

- Employee Value Proposition (EVP) needs to be updated to cover Physical and Virtual environments.

- Employee Value Proposition will continue to vary by industries.

- The office environment will still be key in acquiring and onboarding employees to build a solid relationship with the company and colleagues.

Surge in supply driven by upcoming new spaces

New commercial real estate spaces continues to grow

- Impetus for decentralisation is now accentuated due to the new normal following COVID; the geographical urgency for CBD-based real estate is abating. Furthermore, conversion of CBD real estate to mixed developments may be accelerated.

- Innovation in construction sector will drive the government’s plans

Managing through the imbalance

Demand & supply imbalance driving responses across the business value chain

Managing through the imbalance

1

Shift in demand will force pivoting back to value proposition

- Companies need to be agile and develop capabilities for blended physical & virtual work practices

- Property services operators (including Lease & Sale management) must align their customer propositions with this rapid change

2

Immediate action due to lag effect & lead-time to implement

- Developers and construction operators should engage with Government to understand refinements to the Master Plan – keep fast feedback loops

- Whilst impacts will be amortised over the long term, indecision now will increase the downside driven by the construction ‘time lag’ from proposal to occupancy

3

Facilities Management (FM) need to satisfy short-term requirements and build future foundations

- FM companies must deliver the return to workplace requirements

- Use the ‘adjustment’ period to prepare for move to strategic repositioning by leveraging industry knowledge

- Rigorous service delivery and shift towards value-based contracting

- Engage adjacencies (design / technology) to form partnership for future services