"Now is the time. As companies ramp up on digitalisation, the tax function must be part of the digital strategy, to be technology-enabled to address the increasingly challenging landscape."

The future of tax is now. What does this mean for your business?

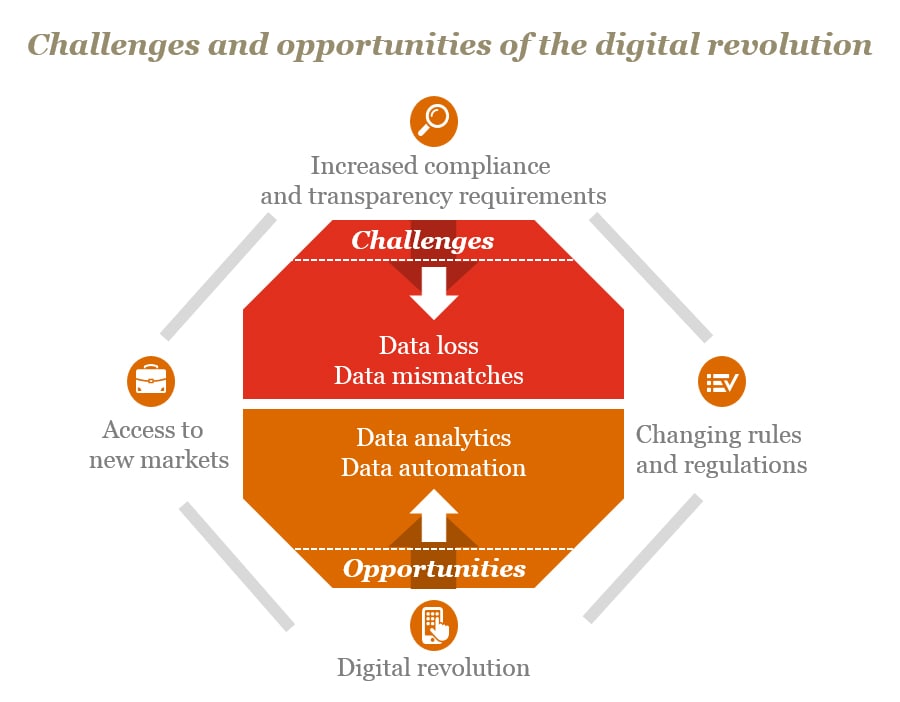

The tax function will need to evolve as businesses adapt to an increasingly digitised environment. With increasing global compliance requirements, businesses will need to start leveraging technology to achieve operational efficiency, reducing over-reliance on spreadsheets and strained resources and enhance intelligence from data analytics to manage company-wide risks. With technology, the tax function of tomorrow is set to transform.

To increase strategic impact

There is an increasing need for businesses to place more emphasis on their tax and processes, and keep up with the demands of the tax authorities. Due to increased regulatory disclosure requirements (e.g. Country-by-Country Reporting and related party disclosures), businesses have to move onto the e-platforms to better take on these requirements (e.g. Singapore's compulsory e-filing of corporate tax returns by Year of Assessment 2020). For immediate and sustainable success, the right transformation and digital strategy, talent and technology will need to come together.

Contact us