Your challenges

In each dynamic landscape, success is largely dependent on understanding the entities of change and the frameworks in which these entities operate. Such is the case with the oil and gas industry in the region. The industry has undergone substantial reform and accounting standards have improved in an attempt to stabilise and strengthen the markets following the Asian financial crisis. The resultant deregulation and privatisations have, in turn, created opportunities for foreign and domestic investments.

From an upstream viewpoint, energy security and price instability have been, and will increasingly continue to be, the most important energy issues faced by regional economies. They are looking at strategising energy security to counter short–term interruptions due to contingencies (e.g. accidents or acts of war) and ensure sustainable energy supply to fuel economic growth.

The trend of Asian majors gaining a stronger hold regionally, and globally, is being evidenced as they race to secure supply and replace declining reserves. There is also a move towards consortium investment which offers the possibility of sharing investment risks in an environment of capital constraints. The lack of major oil discoveries in the region, in recent years, has also increased the focus on gas portfolios.

On the downstream side, the privatisation of major refineries and deregulation of the industry, and the inadequacy of facilities enabling transportation of oil and gas within the region, and for export to elsewhere in the world, present investment opportunities.

Oil and Gas sector challenges (A regional perspective)

- Market volatility/competing growth targets

- Energy security

- Reserve enhancement/replacement and role of technology

- Inadequate energy infrastructure (stranded reserves)

- Environmental concerns

- National participation/carried interest

- Domestic market obligations

- Dissimilar, and complex, fiscal regimes

- Cross-border operations and associated risk, management, cost, contractual and regulatory considerations

Meeting your needs

Despite the great potential the industry holds, a failure to comprehend the intricacies of the social, political and economic diversity of countries in the region can very well translate into failure for companies hoping to profit from producing and supplying energy.

PwC’s Oil & Gas team comprises experienced professionals with an in-depth understanding of business/industry-specific regulations and real deal issues specific to the local environment. We have also been involved in most of the significant deals in the region over the past few years. As such, PwC is well-positioned to help you navigate the maze of complex laws and regulations, as well as understand the highly complex market and financial dynamics in the region.

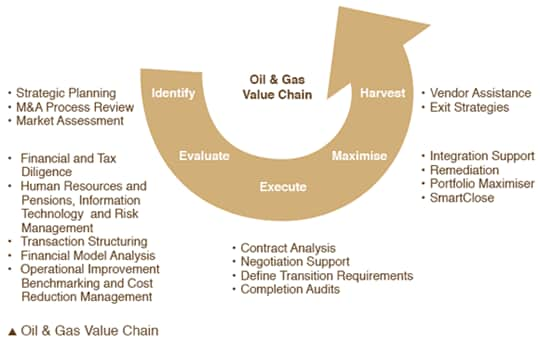

What sets PwC apart from others is our considerable weight of experience in the sector. We provide due diligence and structuring advice to help our clients assess the financial, tax, commercial and other risks before acquiring, divesting or farming in/out of the target asset(s). Our team of multi-disciplinary experts, including cross-border specialists, are able to deliver an integrated suite of services to enhance your oil and gas value chain.

Our experience

Leading Exploration & Production Asian Major - Due Diligence and Deal Completion Support

PwC was engaged by our client, an Asian major with significant Exploration & Production portfolio, to carry out due diligence and other advisory services for a cross-border opportunity in a contiguous market.

Our multi-disciplinary team of local industry specialists, together with regional experts, were able to offer pre-eminent services to our client by sharing our regional deal experience and in-depth local knowledge – including culture, language, taxation and accounting.

The team’s in-depth knowledge of the industry enabled us to identify real deal issues that saved considerable dollars for our client through purchase price and valuation adjustments. We also added value to the deal process by assisting in formalising specific representations and warranties in the Sales and Purchase Agreement, devising an effective and robust working capital and deal-closing mechanism, optimising deal structure, and preparing for post-deal urgent actions.

During the course of our work, we continually shared our industry knowledge and understanding of potential issues, and identified critical success factors that helped our client in making better informed decisions.

Contact us