#1 Leading mid-market deal maker internationally

Corporate Finance

Ranked globally as the #1 financial advisory firm by deal count (2012-2024), the PwC Corporate Finance team combines local expertise with regional perspective across Southeast Asia.

Trusted advisor for mid-market deals that create value

Our diverse, global team of experienced, execution focused investment bankers work with your team throughout the deal lifecycle to create, preserve, and realise results that make an impact–from global multinational corporations and regional mid-sized companies to fast growing early-stage startups. We deliver on cross-border transactions and provide clients with the right blend of transaction experience, sector insights and local relationships to drive strategic objectives and value beyond regional borders.

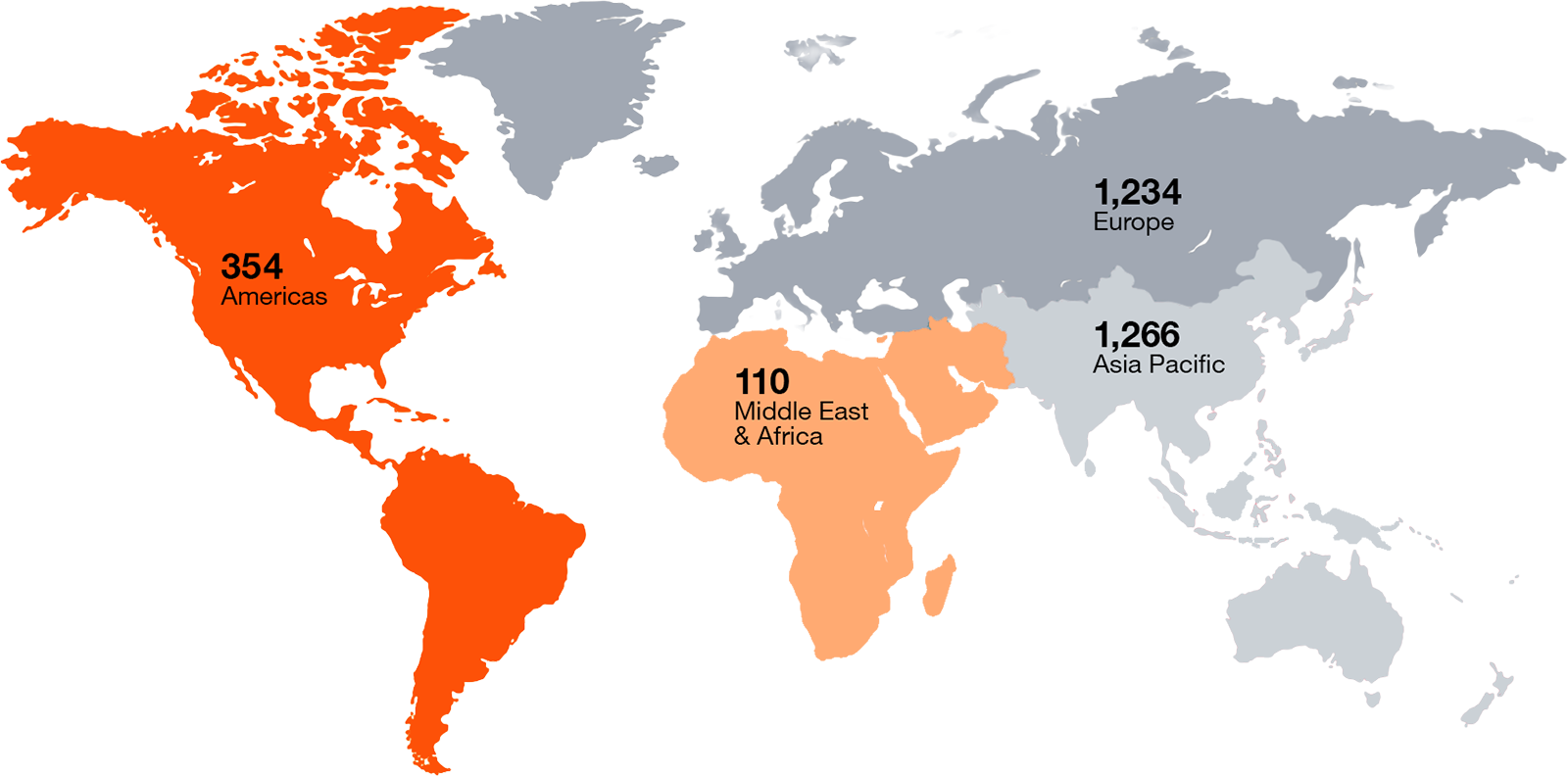

Our global team

- Our local team draws upon the PwC Global Network of more than 2,900 professionals across 60 countries.

- Our global network provides immediate and effective connectivity for buyers and sellers.

- Every year more than 70% of our M&A assignment involve an international investor.

- We are a trusted global brand with deep global connectivity.

Our recent transactions

Filter by:

Transaction type

- Acquisition

- Sale

Industry

- Consumer

- Education

- F&B

- Industrial

- Technology

Year completed

- 2024

- 2023

- 2022

- 2021

- 2020

- 2019

PwCCF Singapore acted as exclusive lead financial advisor to the Estate of Mr. Lim Tze Jong, founding and major shareholder of Dyna-Mac, on its sale to global ocean solutions provider Hanwha Ocean.

PwC Vietnam acted as the exclusive financial advisor to Gene Solutions throughout the fundraising round, with support from PwC Singapore’s Corporate Finance team. The team in Singapore assisted in preparing the financial model and facilitated Q&A sessions with Gene Solutions’ stakeholders.

PwCCF Singapore and PwC Indonesia jointly acted as financial advisors to the majority stake sale of Singapore Intercultural School by Actis Group to Adivira Capital.

PwC Germany and PwCCF Singapore jointly acted as financial advisors to the sale of RAM SMAG Lifting Technologies Pte Ltd to Dymon Asia Private Equity.

PwCCF Singapore and PwC Indonesia jointly acted as financial advisors to the sale of PT Hipernet Indodata to PT XL Axiata.

PwCCF Singapore acted as financial advisor to the sale of Paddington Enterprises Pte Ltd to Affirma Capital.

PwCCF Singapore acted as financial advisor to the majority stake acquisition of OJJ Holdings Pte Ltd by FairPrice Group.

PwCCF Singapore acted as financial advisor to the acquisition of CEI Limited (SGX:AVV) by AEM Holdings Ltd (SGX:AWX) through a Voluntary Conditional Offer.

PwCCF Singapore acted as financial advisor to the sale of Argus Group to Waystone Group.

PwCCF Singapore acted as financial advisor to the sale of cavAsia Pte Ltd to Johnson Controls International.

PwCCF Singapore acted as financial advisor to the sale of Aver Asia (S) Pte Ltd to Sumitomo Corporation by CDH Investments.

PwCCF Singapore acted as financial advisor to the sale of Fassler Gourmet Pte Ltd to Barramundi Group Ltd.

PwCCF Singapore acted as financial advisor to the sale of Food Junction Singapore Pte Ltd to BreadTalk Group Limited by Auric Pacific Group.

PwCCF Singapore acted as financial advisor to the acquisition of Courts Asia Limited by Nojima Asia Pacific Pte Ltd.

PwCCF Thailand and PwCCF Singapore jointly acted as financial advisors to the sale of KT Restaurant Company Limited to Food Factors Company Limited.

PwCCF Singapore acted as financial advisor to the majority stake acquisition of Kopitiam Investment by FairPrice Group.

PwCCF Singapore acted as financial advisor to the majority stake sale of Tialoc Investment Pte Ltd to Complant Hong Kong Limited.

PwCCF Singapore and PwCCF Thailand jointly acted as financial advisors to the sale of Yum Restaurants International Thailand Limited’s KFC stores to The QSR of Asia.

PwCCF Singapore acted as financial advisor to the acquisition and privatisation of Poh Tiong Choon by a consortium consisting of Tower Capital and Poh Choon Ann.

PwCCF Singapore acted as financial advisor to the acquisition of SMEC Holdings Limited by Surbana Jurong Pte Ltd.

PwCCF Singapore acted as financial advisor to the sale of Phoon Huat & Company (Private) Limited to Standard Chartered Private Equity (now known as Affirma Capital).

Additional support for businesses

Strategic Solutions and Turnaround Group

Support businesses to ensure clients can navigate complex business and financial situations to deliver solutions that transform, create, preserve and recover value.

Learn more

Venture Hub

A one-stop-shop approach to providing solutions and services to support businesses and investors build resilience, achieve sustainable growth and expand into key markets.

Learn more

Begin your career with us

Make your PwC experience truly yours as we reimagine new ways of working and thriving together in an inclusive environment where you can be part of the community of solvers.

gsap_scrolltrigger

Contact us