By Anthony Leung Shing

Country Senior Partner - PwC Mauritius

Deputy Regional Senior Partner - PwC Africa East Market Area (EMA)

Mauritius posted 4.7% GDP growth in 2024, driven by construction, tourism, and financial services. Unemployment remains at 6%, with ongoing labour shortages, while inflation stays elevated at 3.8% due to imported cost pressures. Public sector debt has climbed to 90% of GDP. The 2025–2026 Budget aims to spur economic renewal under the "Innovative Mauritius" vision, centred on research and development, a Waste-to-Wealth initiative, a renewed Blue Ocean strategy, and enhanced trade through Economic Partnership Agreements to better integrate Mauritius into global value chains. However, the full scope and execution plan for these initiatives remain unclear. While some fresh ideas have been introduced, many proposals echo past commitments. What is needed now is decisive and clear action!

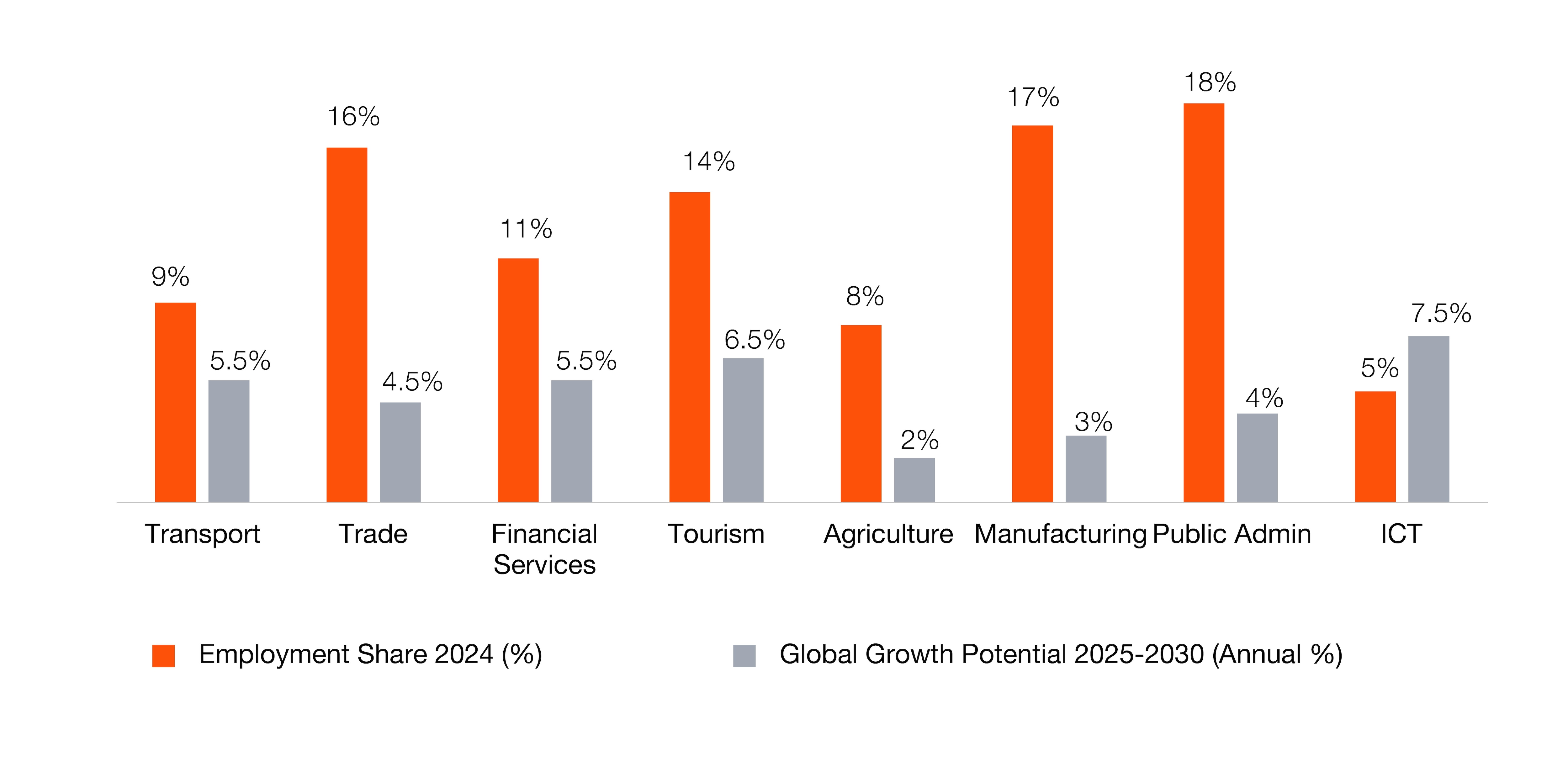

The Budget outlines plans to repurpose key resources—labour, land, and capital—to boost productivity. Mauritius’ workforce remains heavily concentrated in public administration and manufacturing, which together account for 35% of employment but offer limited long-term growth prospects. High-potential sectors such as ICT and tourism remain underutilised, employing just 5% and 14% of the workforce respectively (Figure 1). However, the Budget does not go far enough in addressing the structural reforms needed to realign workforce allocation with future economic priorities. Despite past announcements, progress on digital transformation within the public sector has been limited, hindering improvements in efficiency, transparency, and citizen engagement. Given persistent labour shortages, the proposed fast-tracked, rules-based work permit system for foreign labour is a welcome step. However, past attempts have often faltered in implementation—highlighting the urgent need for follow-through and institutional capacity to deliver on these reforms.

Figure 1: Repurposing labour force

Fiscal consolidation remains a key priority, with the budget deficit standing at 9%. While pre-Budget expectations suggested that economic constraints would necessitate difficult sacrifices, the Government (despite recognising the unsustainable path of social allowances, pensions, and benefits) has avoided substantive reform. Instead, it proposes a gradual phasing out over three to five years, effectively preserving the existing welfare framework. Recurrent expenditure is projected to rise by 4% in the coming year, with only marginal reductions elsewhere. To finance this, the Budget leans on a 10% increase in tax revenues and the use of Rs10bn from the Chagos Settlement. Significantly, the fiscal burden is being shifted to the private sector and the Government is maintaining operational spending it previously criticised - marking a missed opportunity for meaningful, forward-looking reform.

Mauritius stands at a critical juncture, where reigniting growth, enhancing competitiveness, and reinforcing its attractiveness as an investment hub are imperative. While maintaining social stability and pursuing fiscal consolidation are necessary, they cannot be achieved without robust business activity.

In recent years, levies such as the Solidarity Levy and the Climate Change Levy have eroded business confidence and incentive to invest, undermining the momentum required to sustain economic dynamism. This year’s Budget introduces new tiered taxation, a “fair share” contribution on high-income earners and companies, an alternative minimum tax on specific sectors, a capital gain tax on non-citizen property resale and a top-up tax on global businesses. Compounding these challenges is the discontinuation of previously successful initiatives like the Smart City Scheme. However, such measures (introduced at a time when Mauritius seeks to attract private wealth and foster emerging sectors) risk dampening investor sentiment. Tax policy should be aligned with growth objectives, not impede them.

Public sector investment remains a central pillar of the Government’s strategy, with Rs180 bn earmarked over the next five years, particularly for road and water infrastructure.

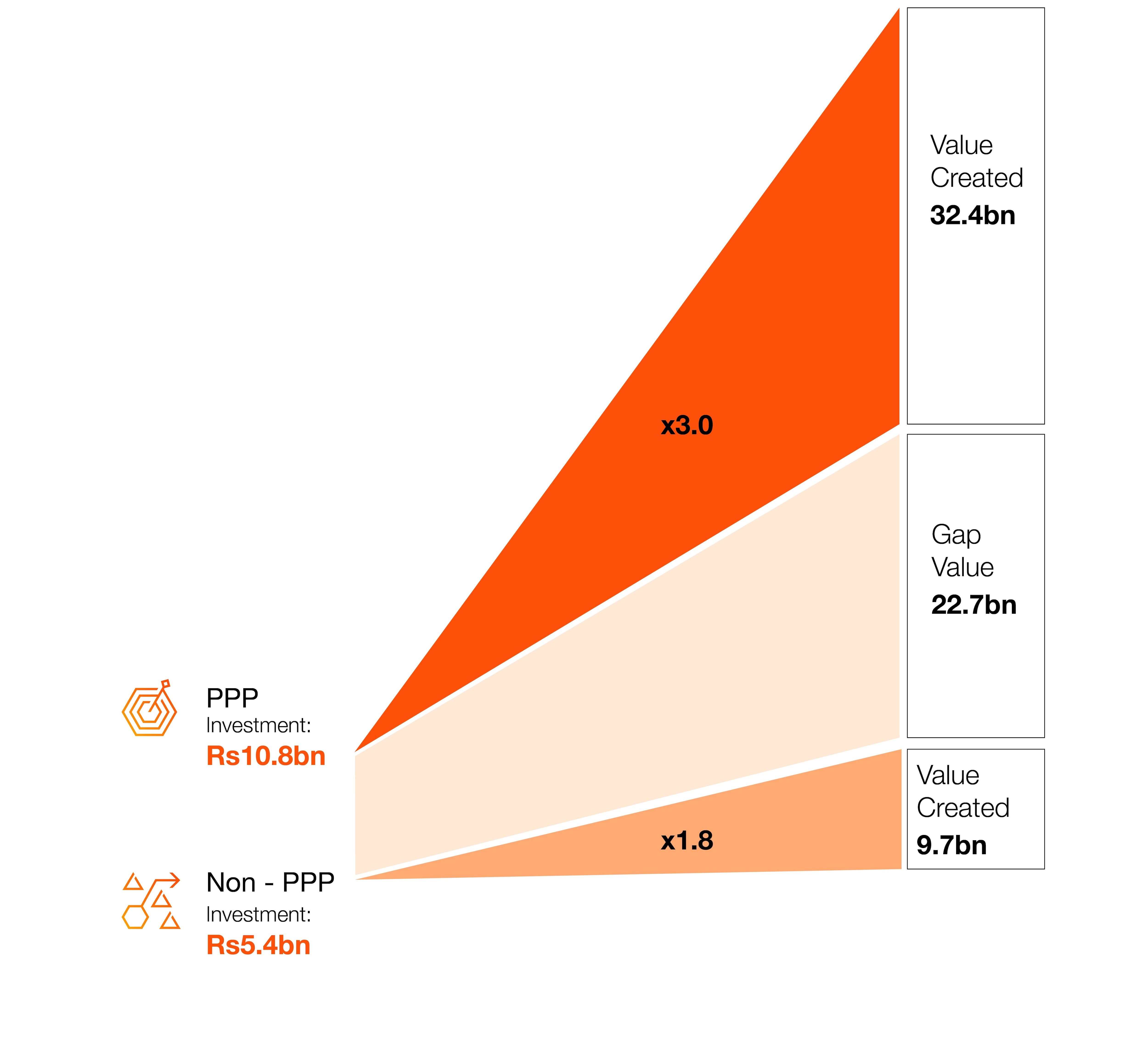

However, the Budget overlooks a critical opportunity to harness Public-Private Partnerships (PPPs) as a strategic lever to accelerate infrastructure development. Amid fiscal constraints, PPPs offer a powerful avenue to unlock additional capital and technical expertise through private sector engagement.

For instance, the current allocation of Rs5.4 bn for port development is lower in both scale and expected returns. In contrast, a well-structured PPP could double the capital mobilisation to Rs10.8 bn and nearly triple the economic impact, driven by higher investment efficiency and operational productivity. The combination of greater upfront funding and a stronger economic multiplier reveals a value gap of Rs22.7bn between PPP and non-PPP models—underscoring a significant missed opportunity for transformative infrastructure advancement (Figure 2).

Figure 2: Bridging the gap with PPP

Overall, the Budget introduces some fresh ideas to support emerging sectors, but in substance, it remains largely aligned with past priorities. The rollout of new taxes risks undermining investor confidence and could dampen economic activity at a time when renewed momentum is essential.

For a small island economy like Mauritius, policy continuity can be an asset—but only when paired with bold, decisive implementation that translates plans into tangible outcomes

Yet, the lack of clarity and detail surrounding key budget measures raises concerns. This is a critical moment to move beyond intentions and deliver measurable impact.