The COVID-19 pandemic has caused many employers to rethink their workforce and constantly evolve their workplace. More than ever, employers are being challenged to balance their increasing employment costs with the need to meet their talent demands to support the return to sustainable growth.

Indeed, employers are under enormous pressure to effectively manage employment costs and maximise the return on the overall investment in their workforce. These uncertain times have pushed many companies to take a fresh look at their total reward strategy to ensure that it aligns with the new and evolving needs of their workforce.

The remuneration landscape in Mauritius

The dilemma for many companies today is how to continue attracting and retaining their workforce without having to add more and more to their employment costs. Most of the increases in employment costs over the last year were not by choice, they were statutory, and employers simply had to comply. For instance, in Mauritius, we’ve had the introduction of the Portable Retirement Gratuity Fund (PRGF) in January 2020. On top of that, the Contribution Sociale Généralisée (CSG) was introduced in September 2020.

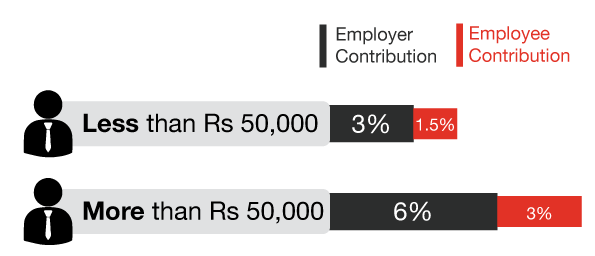

CSG has replaced the old National Pension Fund (NPF) system, and is intended to guarantee a monthly income to retired citizens above the age of 65 as from July 2023. For private sector employees, the employer must contribute 3% of basic salary of an employee earning less than Rs50,000 per month, and 6% for an employee earning more than Rs50,000 per month. In addition to the employer contribution, employees also contribute 1.5% and 3% of their basic salary respectively (see diagram). Compared to the NPF system, there is no ceiling applicable to the amount to be contributed for CSG.

Contribution Sociale Généralisée (CSG)

By way of an example, in January 2020, an employer was contributing Rs1,124 towards NPF for an employee earning Rs55,000 per month. Now, under CSG, the employer contributes Rs3,300 per month for the same employee. This represents an increase in the employer’s contribution of almost 3 times. Without any increase in the employee’s basic salary or benefits, there’s already almost a 4% increase in employment cost. Notwithstanding that, the same employee would also be out-of-pocket with an additional Rs1,088 per month that they need to contribute towards CSG.

Having said that, there are ways for companies to continue attracting and retaining their workforce without having to add more to their employment costs.

As someone who has been in the PwC family for more than 10 years, and is currently part of the People & Organisation Consulting team specialising in Remuneration and Employment Solutions, I would like to share my insights on what an ideal remuneration structure in these challenging times would look like.

Visualising the ideal remuneration structure

So, what should the ideal remuneration structure look like? In a nutshell, an ideal remuneration structure should promote simplicity, flexibility and better understanding. It should also encourage financial wellness through training and education.

Employees should be offered lifestyle choices, instead of being given options that might be perceived as paternalistic. Providing a remuneration structure that aligns with the unique challenges of an employer’s workforce can help employees better cope and manage their personal lives, and encourage them to bring their best selves to work to contribute to the business, both during and after the pandemic.

The Total Guaranteed Package (“TGP”) model is gaining in popularity and could support companies in achieving this ideal remuneration structure. TGP refers to a remuneration structure in which all current benefits, both compulsory and add-on, are converted to a monetary value. Employees are then at liberty to request their employers to structure their TGP based on their personal lifestyle and choices.

How flexible benefits can be structured

In such a structure, there would normally be prescribed minimum core benefits for medical, retirement and life/permanent disability cover. Employees then have the flexibility of structuring their package based on what they truly need, rather than simply accepting compulsory benefits that are provided by their employers.

For example, PwC Mauritius introduced a TGP remuneration structure in July 2019 and, at the time, more than 55% of employees elected to contribute less towards their retirement and to receive the additional cash on a monthly basis to cater for their needs. This came as no surprise as most of these employees are under the age of 35 and retirement is not their top priority. Instead, they prefer driving a flashy car, or simply enjoying their younger years. The clear message for employers is: The corporate world has to evolve to attract and retain this younger generation.

On the other hand, employees closer to retirement elected to contribute the maximum towards their retirement. It’s important that there is still a minimum pension benefit as it would be irresponsible of an employer to allow their employees to convert, for example, the full retirement contribution into cash only. Further, any choices offered should be in line with the rules of the retirement fund. If not, rule amendments might be required and should be approved by the Financial Services Commission (FSC).

Another good example of flexible benefits would be to offer medical care with the option for employees to upgrade and/or add their dependents at their own cost, should they wish to have a more comprehensive cover. A group medical policy will normally be more affordable for employees to participate in than for them to get additional medical cover in their personal capacity.

A company’s remuneration structure should evolve to be motivational and exciting

Why this is the perfect time for optimising remuneration structures

There are many ways in which employers can offer a compelling, simple and flexible remuneration structure which support a thoughtful and purposeful employee experience. However, changes to any remuneration structure need to be managed carefully. Active employee engagement and buy-in are critical to ensure successful implementation as part of a continuously evolving process which ensures that employees are well educated and informed to make the right decisions.

All in all, a company’s remuneration structure should evolve to be motivational and exciting. Just like every other part of a business, reward functions need to evolve to deliver on higher expectations. It’s the perfect time to reimagine remuneration.

Budget 2021 - 2022

Dr The Honourable Renganaden Padayachy, Minister of Finance, Economic Planning and Development presented the Budget 2021-2022 on Friday 11 June 2021. Our panel of specialists have analysed the measures and shared some key insights, industry reviews and a summary of tax measures.

.jpg)