Tax Compliance

We work alongside you to ensure that your filing obligations and deadlines are met effectively.

Our expertise ranges from helping you manage your corporate tax activities to becoming FATCA compliant. Whether you are a multinational organisation or an individual, we believe in quality relationships and services.

With an increasing focus on governance and regulations, tax compliance has never been so important for organisations today. Additionally, with so many difficulties surrounding interpretation of tax laws, there has been an increase in disputes.

See how we can help you with our Tax Dispute Resolution services

Failing to comply with local regulations represents not only huge financial risks such as penalties and possible increase in tax charges, but also serious business and reputational risks.

Compliance across all taxes, statutory accounting and tax reporting is becoming increasingly complex. Organisations need to remain competitive and one way to do it is to strengthen their tax compliance while continuing to create value for their customers.

We are using our experience of providing cross-border tax compliance services to deliver both domestic and global multi-tax compliance services for our clients.

Our Tax Compliance services

01 July 2021 marks the end of the grandfathering period. What’s next for GBC2?

Companies issued with a Category 2 Global Business Licence (“GBC2”), on or before 16 October 2017, will be grandfathered till 30 June 2021. The GBC2 companies will then have to be either converted to a Global Business Licence Company or an Authorised Company (“AC”) before 30 June 2021.

Value Added Tax (VAT)

Our dedicated VAT team can guide you through the entire process of VAT and assist you at any stage from registration all the way through to filing and compliance. We are here to make sure that your VAT obligations are met.

How we can help

We can offer the following:

Review your input and output invoices to ensure compliance with the VAT Act;

Review / compute the calculation of the VAT liability or any excess VAT carried forward;

Highlight any potential VAT exposure by reviewing your VAT system;

Advise on the filing and payment due dates;

Electronic filing of the VAT returns;

Prepare and submit repayment claim for input VAT on capital goods.

VAT Health Check

The number of VAT audits and assessments from the tax authorities have significantly increased over the years. To ensure that your VAT system is effective and that your VAT is properly captured and reported, we can assist you with a VAT health check.

As part of our review, we will perform the following:

Interview the person responsible for VAT and perform a walk through test;

Review on a sample basis your monthly VAT computations, input and output listings;

Review of your VAT returns and identify any weaknesses in the recording system that may expose the Company to fines and penalties;

Identify VAT problematic areas and suggest the best solutions for the company;

Advise the company of any potential tax planning opportunities to minimise the overall VAT liability;

Review any correspondence from/to the tax authorities; and

Review the reconciliation between the turnover as per audited financial statements and as per VAT returns.

How healthy is your VAT system?

VAT on Digital and Electronic Services

Mauritius has introduced VAT on digital and electronic services from 01 January 2026. Foreign suppliers will now be required to register, comply and report VAT when serving Mauritian customers. Our dedicated VAT team is ready to guide you through every step of the process - ensuring smooth navigation of the new requirements.

Corporate Tax

Our dedicated tax staff service over 450 corporate tax compliance clients. By utilising our deadline tracker and our experTaxTM software, in conjunction with our experience, we are able to ensure that your filing obligations are met in an efficient and timely manner.

How we can help

Our taxation compliance services consist of the final return and 3 quarterly Advanced Payment System (APS) statements. We can:

Prepare/review tax computation for major tax risk areas and seek additional information, together with any substantive evidence as appropriate;

Review financial statements (including disclosure notes) for any items which may impact on the tax computation;

Re-compute supporting schedules to ensure accuracy, where relevant;

Review key expense categories for unallowable deductions;

Review any current and future tax developments which may impact on the client's taxation affairs;

Participate in conference calls, meetings, presentations to deal with any issues, where relevant;

Issue a report to summarise the key tax risks and issues arising from our tax compliance review, including any recommendations thereon;

Advice on the filing and payment due dates; and

Assist in filing the tax return as appropriate.

In addition to the above, for the purposes of the APS services, we can also:

Review the tax computation and the tax return for APS;

Deal with any queries arising thereon from the client;

Deal with quarterly notifications of submission deadlines and payments;

Follow-up in terms of submission of the APS to the tax authorities via internet.

Tax Deduction at Source (TDS)

TDS is becoming more complex as the regulators have widened the types of payment that are captured under the TDS regime. Also, businesses are often unsure as to whether payments to non-residents should be subject to TDS.

How we can help

We can provide:

Advice on whether a payment falls under the TDS regime;

Advice in determining the correct amount of tax to be withheld

Advice on whether a non-resident performing in Mauritius creates a permanent establishment (‘PE’); and the TDS implications on payment for such services;

Advice in relation to the interaction of TDS and relief under the double taxation agreements;

Advice on the TDS filing and payment due dates;

Electronic submission of monthly and annual TDS returns to the tax authorities.

Personal Tax

Effective tax planning is key in protecting your wealth. At PwC we have a team of experienced advisors from diverse background including former tax officers to help you manage your personal tax.

How we can help

Preparation and submission of your income tax return;

Income tax planning; and

Advice on charge to personal tax for expats including interaction with the double taxation agreements. See our Immigration services.

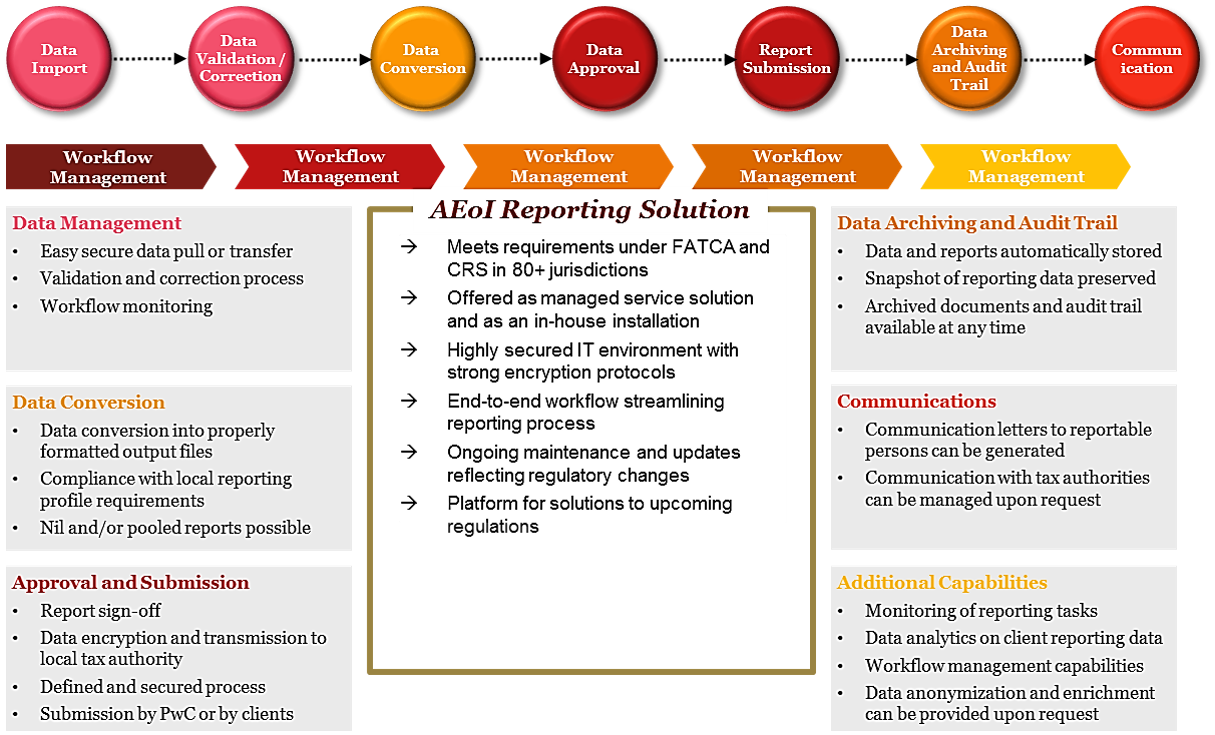

FATCA Compliance

Our FATCA conversion tool can assess whether your organisation has a FATCA filing obligation, make the necessary conversions and file your return with the Internal Revenue Service (IRS) through the tax authorities.

What makes us different?

Technology is our backbone!

- With the PwC Mauritius in-house developed tax compliance software experTaxTM, we ensure that your tax returns are prepared in a systematic way where breakdowns and classifications in the tax returns are consistent year-on-year, thus minimising the risk of tax investigations due to variances.

- At PwC Mauritius, we monitor all tax filings, including APS, using our in-house software iTax, and can ensure that you won't miss any tax filings and thus are tax compliant.

Our success stories

- We were recently appointed tax advisors for one of the largest banks in Mauritius, and are working closely with them to address all tax risks and explore any tax optimisation.

- We are currently engaged in the tax compliance for one of the largest conglomerates in Mauritius, with activities across a range of industries including hospitality, food and agriculture, textile, financial services and medical sector.

"Amazing team work and coordination to ensure the group's tax filing and payment were made in time. You understood my priorities and went the extra mile to deliver in time."