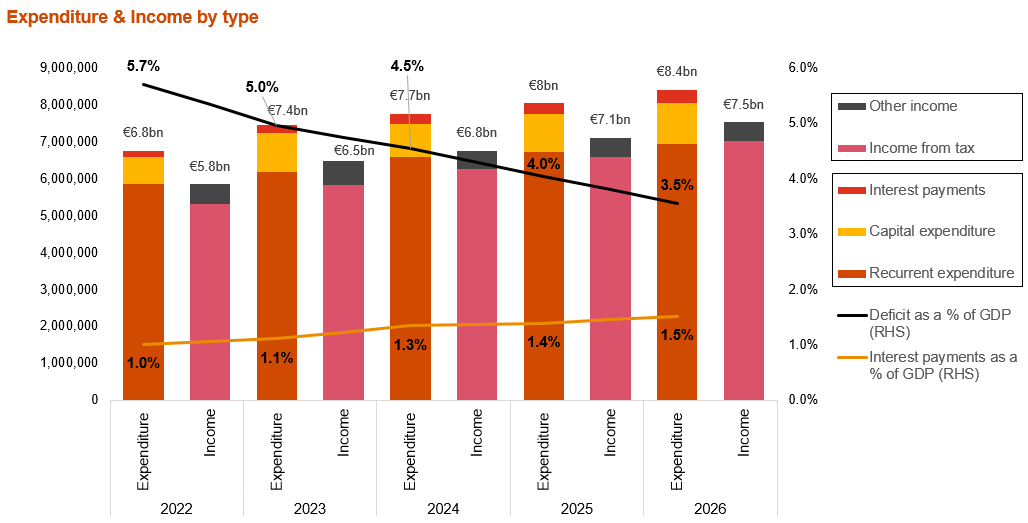

The General government deficit is set to remain high from a historical perspective, estimated at 5.0% of GDP in 2023, declining to 4.5% in 2024, within the context of a medium-term goal of reducing this to 3.0% by 2027.

Government deficit is set to decline in the coming years, more so as a percentage of GDP than in monetary terms. According to the budget’s estimates, the deficit as a percentage of GDP is set to fall by roughly 0.5 percentage points every year to the end of the forecasted period, that is 2026, with the government aiming to ultimately meet the 3% criteria in 2027. Malta registered one of the highest deficits as a percentage of GDP in the EU during 2023 and will also be amongst the highest again in 2024.

Sources: Malta - Government of Malta, Other countries - European Commission economic forecast (Spring 2023)

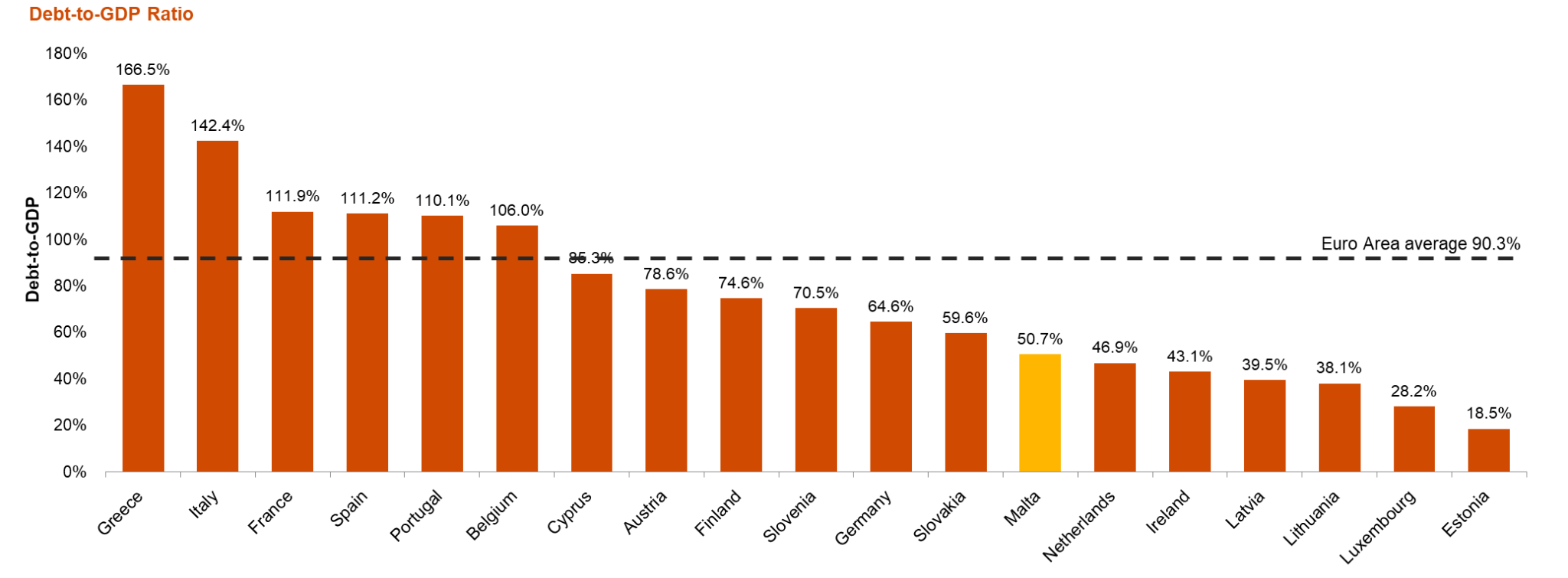

As a result, the Government’s debt-to-GDP ratio is set to increase from 52.3% in 2022 to 52.8% in 2023 and 55.3% in 2024, all the while remaining below the 60% Maastricht criteria threshold.

Malta’s debt-to-GDP ratio for FY 2023 fared better than expected in last year’s forecasts, where it was projected to reach almost 59% but is now set to stand at 52.8% by year-end 2023. In fact, the actual reported figure registered for the second quarter of 2023 was 50.7%. This suggests a relatively healthy debt-to-GDP ratio, where not only is it further away from the 60% threshold, but also stands way below the Euro Area average of 90.3% for the same period.

Source: Eurostat (Q2 2023)

Delving deeper into the Government’s projections, in monetary terms the deficit is set to decline only marginally from €0.9bn to €0.8bn over the 2023-2026 period. Recurrent expenditure is set to grow significantly, while capital expenditure is set to fall slightly, with the balance being offset by anticipated consistent growth in income tax revenue.

Source: Government of Malta

The Government is projected to increase its spending on recurrent expenditure over the next three years whilst capital expenditure is set to be scaled back slightly in 2024, only picking up marginally thereafter.

Looking at the year ahead, Government is set to decrease capital expenditure by nearly 15% on FY23 levels (by €155m), whilst recurrent expenditure is budgeted to increase by 6.4% (by €395m). This highlights the government’s intentions of cushioning the cost-of-living pressures on society, which has only continued to increase over the past year. In fact, inflation was expected to fall to 3.7% in 2023 according to last year’s Government’s projections, however, it is now expected to average 5.7% for the full year of 2023, primarily due to increases in the prices of food and services.

Meanwhile, the deficit is projected to decline only marginally in monetary terms from €0.9bn to €0.8bn by 2026, as the average year-on-year increases in total government revenue are set to slightly outpace the increases in total expenditure. The expected decline in deficit to GDP ratio is in fact more a reflection of the expected strong growth in GDP rather than any significant improvement in the balance between government expenditure and revenue.

Finally, the increase in government debt from €10.0bn to €13.1bn by 2026 amidst a high interest rate environment will increase Government’s debt servicing requirements, leading to an increase in interest payments on government debt from €209m in 2023 to €349m by 2026. When expressed as a percentage of GDP, i.e. from 1.1% to 1.5% over the period, this does not appear too alarming, given that the average in the EU was 1.7% in 2022.

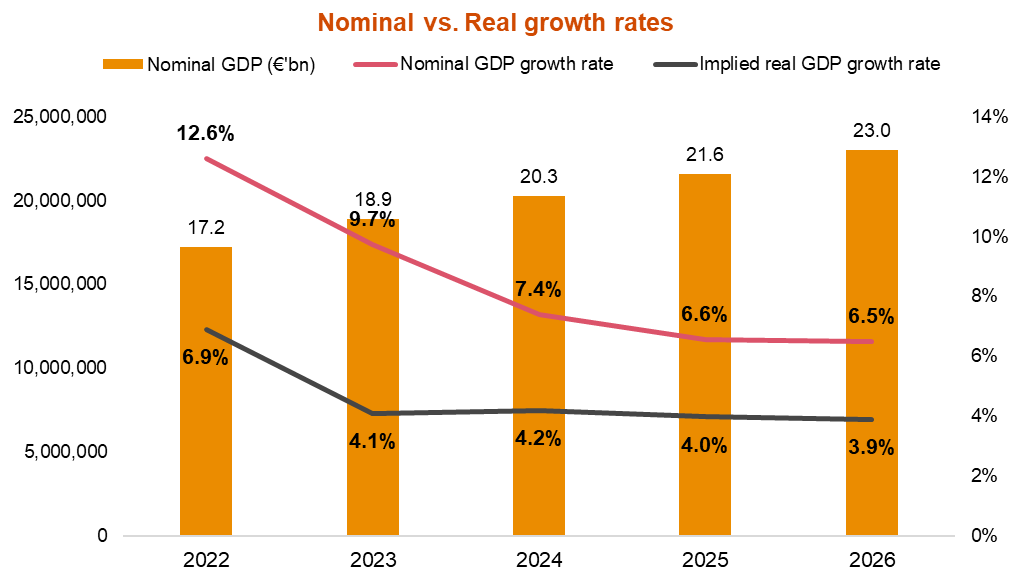

In fact, Government’s estimates rely heavily on an assumption of strong nominal GDP growth, expected to average 7.5% over the forecast period, with nominal GDP set to rise from €18.9bn in 2023 to €23bn by 2026 - implying a real average growth rate of around 4% over the period.

GDP growth had exceeded initial expectations for 2022 and will do so once again for 2023. Government projected growth of 3.5% in real terms for 2023 last year, but has now revised it to 4.1% with two months left. Due to high inflationary pressures, the difference between the nominal and real growth rates was more pronounced last year, with the gap between the two set to normalise as inflation stabilises in the coming years. In real terms, Malta’s growth rate is set to remain relatively constant over the period, at around an implied 4% per annum. Despite the relative slowdown in Malta’s real GDP growth rate, it is still set to outpace the Euro Area average over the medium term.

Sources: Nominal GDP - Government of Malta. The implied real growth rate presented above is estimated based on a projected GDP deflator published by the Central Bank of Malta and other internal assumptions.

A high level sensitivity assessment suggests that should the real growth rate over the period average 3% instead of the assumed 4%, the 60% debt-to-GDP rule could be exceeded by 2026.

Malta’s debt-to-GDP ratio is projected to reach 56.9% by 2026 if the Government achieves its target of growing the size of the economy to €23bn. To assess Malta’s ability to sustain its public finances, we considered a scenario where Malta’s economy had to underperform (i.e. GDP growth slows and also, as a result, less tax revenue is collected). For example, if GDP grows by 3% instead of 4%, the debt-to-GDP ratio could slightly exceed the 60% threshold in 2026. On the other hand, if GDP had to grow by 0.5pp less each year, the Government would likely still maintain the ratio below the 60% criteria throughout the forecasted period.

Furthermore, the Government's target of reaching a 3.0% deficit by 2027 would be even more challenging to achieve, given that any deviation downwards from the assumed 4% real growth rate would result in a deficit above the 3% rule.

A fall in GDP growth would also lead to a fall in the income tax revenue collected, resulting in an increase in the deficit. An increase in the deficit coupled with lower GDP growth consequently means that the deficit as a percentage of GDP would increase, moving further away from the 3% rule. Considering a scenario of a 1pp deviation downwards from the forecasted GDP growth could result in a deficit of around 4.5% of GDP by 2026.

In conclusion, while government finances are relatively strong compared to European peers, the expectation to remain sustainable is sensitive to the assumption of achieving a real annual average growth rate of around 4% over the next 3 years - something which has been achieved, and indeed, exceeded, in the recent past, but may become increasingly more challenging to sustain going forward given the international economic environment.

Contact us