{{item.title}}

{{item.text}}

{{item.text}}

November 2020

By Andrew Tan, Corporate Secretarial Consultant, PwC Malaysia

Suruhanjaya Syarikat Malaysia (“SSM”) or the Companies Commission of Malaysia recently issued the Guideline for the Reporting Framework for Beneficial Ownership of Legal Persons. All companies (local and foreign), limited liability partnerships (local and foreign) and businesses (sole proprietors and partnerships) have up to 31 December 2020 to obtain and update their beneficial ownership information.

In this blog, we will share how the Guideline defines beneficial owners and the relevant provisions, what steps companies need to take to meet the requirements of the Guideline and how we at PwC can help.

The implementation of this requirement follows in the footsteps of many countries across the globe that have adopted this practice, one of the jurisdictions being the United Kingdom which has taken the lead on this. In 2016, they became one of the first countries in the world to create a public register of the beneficial owners of companies as a measure to tackle corporate corruption and tax evasion, amongst other things.

Closer to home, we see that even Singapore has, with effect from 31 March 2017, mandated that companies incorporated in Singapore and even Limited Liability Partnerships are required to maintain beneficial ownership information in the form of a Register of Registrable Controllers, and that this information is made available to public agencies upon request. The purpose of this is to make ownership and control of corporate entities more transparent and reduce opportunities for illicit, corrupt practices.

As you can see, there is a move, internationally, towards greater transparency and disclosure of the beneficial ownership of corporate entities. Malaysia, in a bid to keep up with global corporate practices, has also fleshed out similar requirements under the Companies Act 2016 (“CA 2016”). Therefore, it is vital that companies treat this matter with utmost importance to maintain higher standards of corporate governance in the years to come.

For greater clarity, the CA 2016 defines the term ‘beneficial owner’ as the ultimate owner of the shares of a company and does not include a nominee of any description. Beneficial owners are natural persons who ultimately own or control an entity or arrangement. Section 56 of the Companies Act 2016 provides companies with the necessary powers in order to achieve this transparency.

Section 56(1) of the CA 2016 provides that the company may issue a notice in writing to any member of the company to provide confirmation whether the member holds any voting shares as beneficial owner or as trustee. If the member is holding shares as a trustee, then they are required to disclose the identity and particulars of the beneficiary.

Under Section 56(2), the company may issue a notice in writing to any other person who has an interest in any of the voting shares in the company. The notice will require such persons to provide confirmation whether they hold the voting shares as a beneficial owner or as a trustee. Similarly, if this other person is holding it as trustee, they are required to disclose the identity and particulars of the beneficiary.

It is important to note that pursuant to Section 56(6), authorities and regulators such as SSM, the stock exchange and the Securities Commission may exercise powers under this section and issue a notice in writing to the company, for the company to invoke its powers under the aforementioned Sections 56(1) and (2) and to provide the authorities and regulators with the information obtained on beneficial ownership.

Referring to the Guideline for the Reporting Framework for Beneficial Ownership of Legal Persons issued by SSM, under this Beneficial Ownership (“BO”) reporting framework, a company or a limited liability partnership is required to:-

(a) take reasonable steps to identify, obtain and verify the BO information;

(b) enter the BO information into the register of BO;

(c) keep the BO information accurate and up-to-date and accessible in a timely manner;

(d) update the BO information whenever there is a change to the particulars of the BO and then notify the Registrar;

(e) maintain the BO information and supporting documents at the registered office or where the register of members/register of partners is being kept; and

(f) give access to competent authorities and law enforcement agencies, whose name has been entered in the register of BO and any other person authorised by the BO.

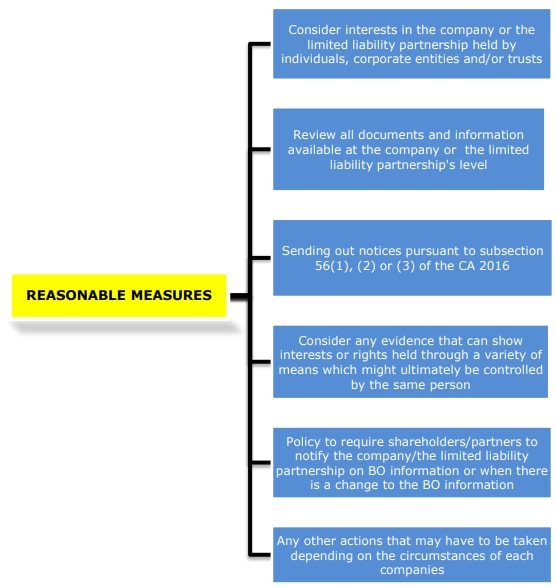

The Guideline goes on to highlight what would be considered as reasonable measures for a company to take in identifying, obtaining and keeping the BO information accurate and up-to-date:-

Source: Suruhanjaya Syarikat Malaysia (SSM)’s Guideline for the Reporting Framework for Beneficial Ownership of Legal Persons

One of the recommendations within the Guideline (Paragraph 24(e)) is for companies to have an appropriate internal policy on BO reporting. It also requires shareholders to notify the company, or partners to notify the limited liability partnership on the identity of the BO and when there are changes in the BO information. If necessary, this policy may be reflected in the constitution of the company, as this would ensure that the policy is properly documented to ensure consistent compliance in the years to come.

To further highlight the importance of this, SSM has made it a requirement for persons preparing the form for submission to SSM to make a declaration confirming that the facts and information in the document are true and to the best of their knowledge, and that all due diligence and vetting processes have been performed on the beneficial owner.

As with any new legal requirement set out under the CA 2016, there are penalties that companies should be aware of in the event of non-compliance.

It is an offence under Section 591 of the CA 2016 to make or authorise the making of a statement that a person knows is false or misleading. That person may be liable, upon conviction, to imprisonment for a term not exceeding ten (10) years or to a fine not exceeding RM3 million or both.

To ensure continuous compliance for companies, it is pivotal that companies adopt an internal policy for BO reporting prior to the transitional period which ends on 31 December 2020.

To safeguard the compliance of companies in Malaysia and to uphold their governance, we recommend that this internal policy be adopted into the Constitution of companies in tandem with the adoption of beneficial ownership reporting by other countries across the globe.

Getting your beneficial ownership reporting in order is not just another item to tick off your checklist by the deadline. Keeping abreast of your reporting requirements will ensure that you maintain strong corporate governance practices that are in line with not only the Malaysian laws on governance, but also on par with leading global standards as well.

Speak to us today and let us help navigate you through this new landscape of beneficial ownership reporting.

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}