Leverage a proven model for KYC remediation

Conducting a remediation exercise can be challenging and complex and to make matters worse, is often undertaken in a high-stress environment since failure can often leave a financial institution exposed to reputational and regulatory risk.

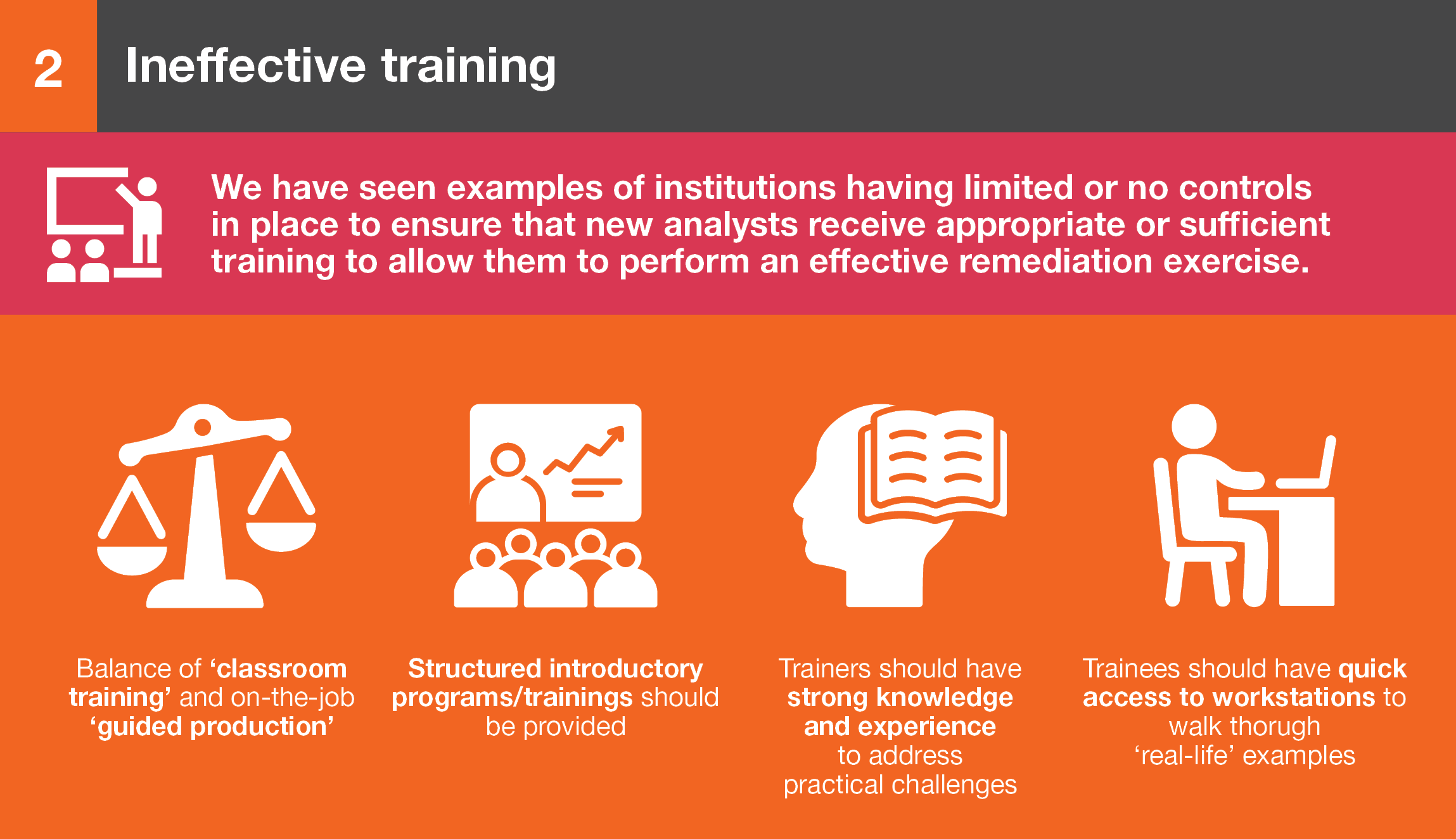

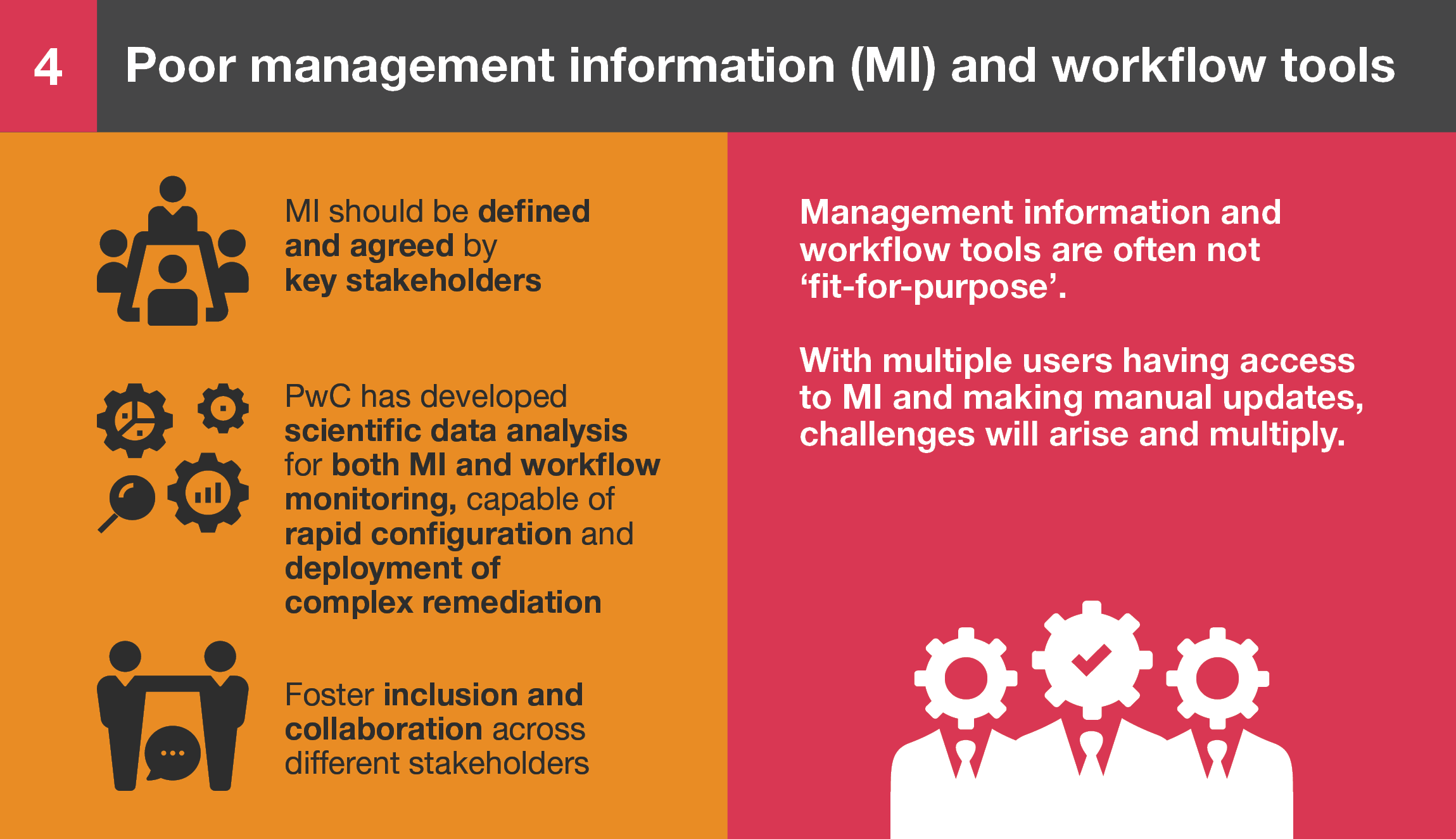

Through our experience supporting clients with remediation, we have come to understand some of the most common pitfalls that arise repeatedly across different institutions. There are four key issues that we have observed: 1) Burnout, 2) Ineffective training, 3) Underestimating the complexity and 4) Poor management information (MI) and workflow tools.

These issues encompass a mix of granular, operational-level issues to systemic issues surrounding organizational structure, governance culture, technology and policy. In our experience, a successful approach to tackling these challenges begins with acknowledging the scale and scope of the remediation exercise and providing teams with the appropriate tools and resources to tackle them. Our recommendations in these areas therefore recognize the multi-faceted and inter-connected nature of these problems, thereby enabling institutions to tackle these challenges holistically.

© 2015 - 2025 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.