Introduction of Common Application Form (‘CAF’) for Foreign Portfolio Investors (‘FPIs’)

In brief

The Securities and Exchange Board of India (‘SEBI’) has introduced a Common Application Form (‘CAF’) for Foreign Portfolio Investors (‘FPIs’) who intend to invest into India. The CAF consolidates the FPI registration with SEBI, application for Permanent Account Number (‘PAN’), Know Your Client (‘KYC’) formalities for opening of bank and securities (demat) accounts in India, into one single master form.

The release of the CAF is part of the Indian Government’s initiative to enhance FPI’s ease of access to the Indian capital markets. It is expected to provide significant relief to FPIs by offering a single window clearance and reduce the FPI registration and account opening timelines resulting in faster trade readiness for portfolio investors.

Browse this page

Further to the notification by the Ministry of Finance (Department of Economic Affairs) of India, the Securities and Exchange Board of India (‘SEBI’) issued a circular stating that applicants seeking a Foreign Portfolio Investor (‘FPI’) registration in India shall be required to duly fill a Common Application Form (‘CAF’) together with the appropriate annexure to CAF and provide supporting documents and applicable fees for SEBI registration and issuance of Permanent Account Number (‘PAN’). The other intermediaries, such as brokers, clearing members, etc dealing with FPIs may rely on the information provided in the CAF for the purpose of KYC.

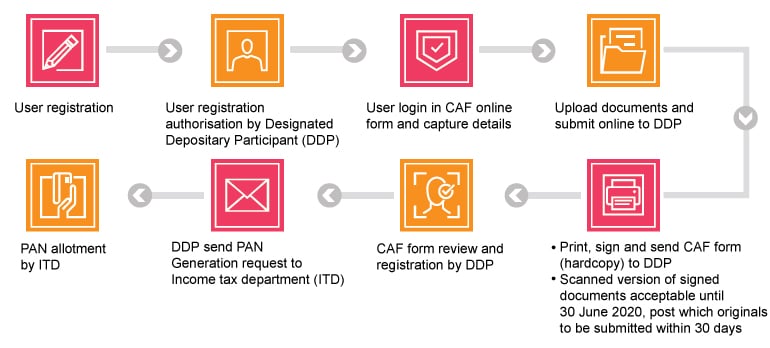

Procedure for submission of CAF

The introduction of the CAF has eliminated the extensive, time-consuming process of making separate applications with different regulators and thereby obtaining approvals. With this consolidated form, the Indian government seeks to seamlessly integrate interactions with all Indian regulators and provide the FPIs an end-to-end single-window entry to the Indian securities market.

Filing of CAF

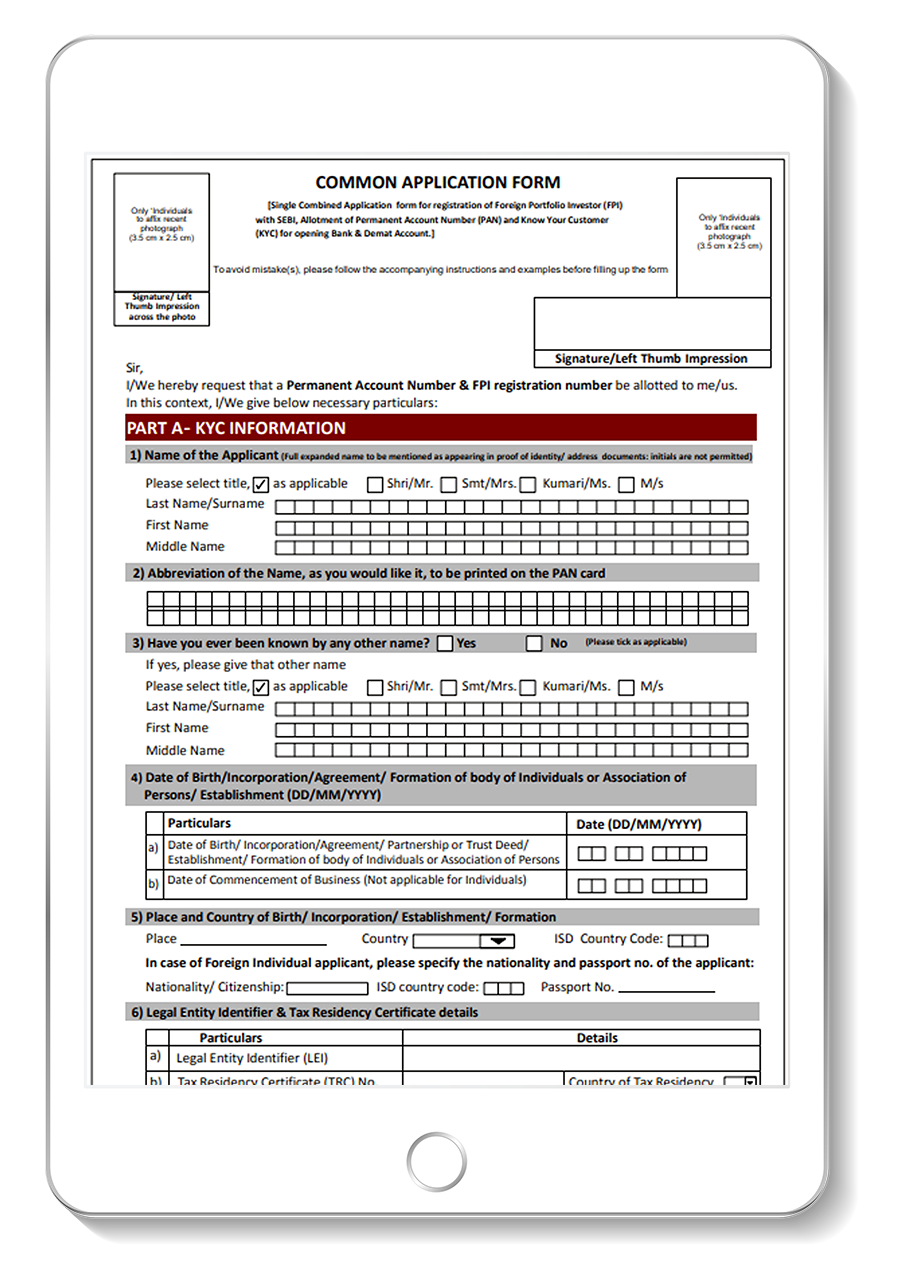

The applicant for a FPI registration is required to duly fill in the CAF with the appropriate annexure.

The CAF is divided into six parts as follows:

1. KYC information

Details such as name, date of incorporation, country of incorporation, address for communication, income details, etc.

Details regarding ultimate beneficial owners (end natural persons) of the FPI

- Details of documents submitted as proof of identity and proof of address

2. FPI registration

Category under which FPI registration is sought, details of investment managers and compliance officers, global and local custodians, FATCA/ CRS declaration, details of home country regulator (if applicable) etc.

Details of DDP, custodian of securities, disciplinary history of the FPI

Information regarding common foreign investor group (for clubbing of investment limits)

3. Additional information for obtaining PAN

If the applicant already holds a valid PAN, only the PAN number needs to be mentioned

If the applicant does not hold a valid PAN, details such as legal status, assessing officer, registration number, proof of address, proof of identity, whether FPI is listed, etc., are necessary

4. Additional information applicable only for individuals

This is generally not applicable for FPIs

5. Depository and bank account opening

Details such as authorisation of the depository participant to open the depository account, mode of operation, request to open special non-resident Indian rupee account

This part is only applicable for investing FPI

6. Declaration and undertaking

Declaration that the information/ details provided in the CAF, documents and annexures are complete and true

The declaration and undertaking requires the FPI applicant to confirm to Annexure A

Declaration for not holding more than one PAN in India

How can we help?

At the time of set-up

Conceptualisation and implementation of structure for the purpose of investing in India; and

Obtaining the Permanent Account Number (PAN) in India (i.e. tax identification number) and FPI registration with the SEBI.

On-going compliance and advisory services

Compliance services such as determination of tax liability for repatriation purposes, assistance in preparation of annual income-tax return and assistance in tax audit with the Indian tax authorities;

Providing customised reports as per the requirements of the Mauritius funds; and

Any other tax or regulatory advice, which may be required by the funds.