{{item.title}}

{{item.text}}

{{item.text}}

The much awaited Finance (Miscellaneous Provisions) Act 2021 is out. Download our Tax and Regulatory summary of the announced measures. Click here

Taxation

This section provides a summary of the tax measures announced, classified by the differents types of taxation.

80% exemption extended to include:

Licensed investment dealers

Leasing of locomotives and trains including rail leasing

Dividends paid by a non-resident to another non-resident is not taxable in Mauritius

Non-resident foreign limited partnerships are not required to submit return of dividend

Companies engaged in the medical, biotechnology and pharmaceutical will be taxed at 3% instead of 15%

3% corporate tax applicable to private universities set up in Mauritius

The list of priority areas of intervention on which companies can utilise 25% of their CSR Fund has been extended to include the restoration of building designated as national heritage under the National Heritage Fund Act 2003

Companies contributing to the COVID-19 Vaccination Programme Fund allowed to claim the amount contributed as a tax deduction from their taxable income

Large manufacturers entitled to 110% deduction on purchase of products manufactured locally by SMEs

Double deduction available:

to manufacturing companies on expenditure incurred on market research and product development targeting the African market

on the acquisition of specialised software and systems

to private health institutions for expenses related to international accreditation

Manufacturing companies can carry forward unrelieved investment tax credit for a period of 10 years

Biotechnology and pharmaceutical companies allowed a full tax credit on the costs of acquisition of patents

Research & Development (“R&D”) tax incentive scheme extended by 5 years up to June 2027

Tax holiday on Family Offices and Fund and Asset Managers extended from 5 to 10 years

Companies registered with the Economic Development Board (“EDB”) as a holder of an Investment Certificate are eligible to:

a 5% tax credit over 3 years on capital expenditure incurred on new plant and machinery (manufacturing company only) until 30 June 2023

an 8-year tax holiday in the case of new companies

The above new incentives are applicable to companies operating in the following sectors:

Aquaculture

Industrial Fishing

Seafood processing

High Tech manufacturing

Pharmaceutical research and manufacturing

Agro Processing

Food Processing

Healthcare, Biotechnology and Life Sciences

Nursing and residential care

Digital technology and innovation

Marina

Tertiary Education

Seeds Production

Other activities as approved by the EDB

Foundations and trusts benefiting from a preferential tax regime has to comply with prescribed substance requirements

Small enterprises that elect to pay a presumptive tax of 1% of their turnover will be exempted from CSR obligations

As from 1 July 2021 and for period of 2 years, SMEs will be allowed to use their unutilised contribution of training levy with the Human Resource Development Council (“HRDC”) to finance external business advisory services up to a maximum amount of Rs 50,000

Salary compensation paid to the employees of an SME, for the period January to June 2021, will be refunded as follows:

The salary compensation is not applicable where an SME has benefitted from the Wage Assistance Scheme in that month

As from 1 July 2021, a self-employed individual will benefit from SEAS only if he pays Contribution Sociale Généralisée (CSG). A self-employed individual whose income does not exceed the income exemption threshold will be required to file a simplified return based on an estimate of income derived

SEAS extended to tourism-related businesses for the 3 months period ended September 2021

An individual can claim as dependent a bedridden next of kin who is in his care even if financial assistance is provided to the bedridden person under the National Pensions Act

Exemption for dependent pursuing tertiary education increased to Rs225,000 irrespective of place of study and total income of household

Medical insurance premiums increased to Rs20,000 for individual and first dependent and increased to Rs15,000 for every other dependent

Tax deduction up to Rs30,000 for donations to approved NGOs

Tax deduction up to Rs30,000 for contributions to individual pension scheme

Tax deduction of amount contributed to the COVID-19 Vaccination Programme Fund by an individual

Carry forward of unrelieved deduction for 2 successive income years

Tax incentive to employees of licensees issued with an Asset Manager Certificate, Fund Manager Certificate or Asset and Fund Manager Certificate available to those managing an asset base of USD 50m or more

Emoluments of asset manager, fund manager or asset and fund manager who have been issued with a certificate on or after 1 September 2016 will be granted an additional 5-year tax holiday

New certificate holders will be granted a 10-year tax holiday.

A Mauritian citizen acquiring a house, apartment or bare land to construct a residential unit in the financial year 2021-2022 will be eligible to a payment of 5% of the declared value of the immovable property capped to Rs500,000. The amount is refundable if the property is sold within 1 year of acquisition.

Preparation and supply of dumplings made up of meat, fish, squid, crab, chicken, vegetables or milk, whether cooked or uncooked, to final consumers

Animals for the purpose of training, breeding and re-export

Companies operating in specific sectors and registered with the EDB as a holder of an Investment Certificate will benefit from VAT exemption on plant, machinery and equipment and construction of purpose-built building and plant and equipment (excluding vehicles) for research and development

Companies providing healthcare, nursing and residential care services will benefit from VAT at 0% on the item listed above

Rate of tax on transfer of leasehold rights in state lands for hotel will be reduced to 5% for the buyer and 5% for the seller, for a period of 2 years starting from 1 July 2021

Exemption from payment of tax on sale of a residential unit in a project developed on state land relating to senior living under the Property Development Scheme.

VAT is payable on the transfer of a commercial or industrial buildings. Land and duties will be levied on the value of the immovable property excluding VAT and this amendment will take effect from 1 January 2021

30% customs duty rebate on buses will be extended up to 30 June 2022.

Tax of 6 cents per gram of sugar on locally manufactured and imported non-staple sweetened products will be effective as from 1 July 2022.

Sugar-sweetened products with total sugar content of up to 4 grammes per 100 grammes or 4 grammes per 100 millilitres, exempted from tax.

Excise duty rebate scheme on motor vehicles extended up to 30 June 2022.

10% tax imposed on winnings will also cover winners of Lotterie Vert.

Licensed operators to submit statement of the amount of winnings in excess of Rs20,000 to the MRA

Levy paid by gambling operators will not be allowed as a deduction for tax purposes.

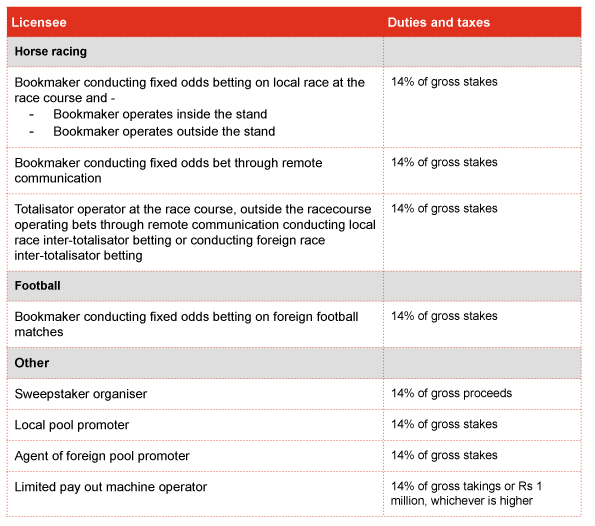

Increase in duties and taxes on the gambling

Taxpayers having assessments pending before the Assessment Review Committee (ARC), the Supreme Court or Judicial Committee of the Privy Council may take advantage of full waiver of penalties and interests under TASS by withdrawing the case before these institutions

TASS remains open to SMEs up to December 2021

Monetary thresholds for submission of information reduced by half

Bank or a non-bank deposit taking institution to report:

In case of an individual, a société or succession, a deposit in excess of Rs250,000 or deposits in excess of Rs2m in aggregate

In case of a corporate, a deposit in excess of Rs500,000 or deposits in excess of Rs4m in aggregate

Money changer or an exchange dealer to report any foreign currency transaction equivalent to Rs100,000 or more

Insurance company to report insurance premium in excess of Rs250,000 paid

MRA may conduct virtual meetings with taxpayers through a teleconferencing device

MRA to issue assessments, without seeking authorisation of the Independent Tax Panel of the ARC, in cases of fraud or non-submission of tax return by a taxpayer

The aggrieved taxpayer shall be entitled to the objection and appeal process

The definition of 'money laundering' in the MRA Act will be aligned with the definition provided under the Financial Intelligence and Anti-Money Laundering Act

Mandatory attendance and production of documents before the ARC by any person including a retired Government officer. Under Current Payment System (CPS): Amendment to be made to cater for persons subject to tax at the rate of 10%

Under Advance Payment System (APS): Amendment to be made to cater for companies which are subject to corporate tax at a lower rate than 15%

Under CPS: Income tax liability due in the income year 2020/2021 to be deferred up to October 2021

Under APS: Income tax liability due in November 2020 up to May 2021, to be deferred until 30 June 2021

Present fee of Rs300 will not be applicable for amendments made to the aircraft/ship cargo manifest due to causes beyond the control of the master or agent of the aircraft

MRA Customs may issue clearance to any departing aircraft/ship electronically

Economic operators may submit a consolidated Bill of Entry for goods of minimal value imported/exported by air during a month

Electronic submission of bill of lading and other documents required for clearance of goods will be allowed

An administrator, executor, receiver or liquidator appointed to manage or wind up the business of a person transacting business, has to inform the MRA Customs of his appointment within 15 days

Penalty and interest will be applicable in case of non-payment of duties and taxes by the due date under the Deferred Payment Scheme

Definitions for jewellery, precious metal and precious stone will be introduced in line with those in the Financial Intelligence and Anti-Money Laundering Act

The MRA Customs has the power to enforce customs laws where there is suspected money laundering involving precious stones and metals or any goods of high value

Goods may be imported for a maximum period of twelve months under the Temporary Admission Scheme and for a maximum period of three years for goods imported in connection with the implementation of a project

A manufacturer engaging in different types of economic activities is now required to make a single application for all excise licences and the fee for each excise licence will remain payable

Manufacturers of sugar sweetened products will be allowed to submit a consolidated Bill of Entry for goods warehoused and cleared during a month and taxes should be paid within 5 working days from the end of that month

Penalty and interest payable on late payment of excise duty will be harmonised with those under the Customs Act

MRA Customs will be empowered to recover erroneous payments made to exporters/recyclers in respect of waste PET bottles exported/recycled

The validity period of excise licences granted to importers/manufacturers of single use plastic products, which was due to expire on 31 December 2020 is extended until 14 January 2021 with retrospective effect

10 year family Occupation Permit introduced for those contributing USD 250,000 to the COVID-19 Projects Development Fund.

Paper based Occupation Permit will be replaced by a smart card.

Requirement for OP applicants to enter Mauritius on a business visa will be waived.

A non-citizen will be eligible for an OP irrespective of his visa category when entering Mauritius.

A Privilege Club Scheme will be implemented providing incentives such as privilege access to hotels, golf courses etc to OP holders and retirees.

A non-citizen who purchases or otherwise acquires an apartment used, or available for use, as residence, in a building of at least 2 floors above ground floor, provided the purchase price is not less than USD 375,000 will be issued with a residence permit, including for his dependents, and exempted from the requirement of a work or occupation permit.

Validity of OP as professional extended from 3 to 10 years.

Flexibility to switch job without the need to file a new application provided minimum criteria are met.

Monthly basic salary applicable for an OP in financial services (fund accounting and compliance only) brought down to Rs30,000 for companies holding an FSC licence provided the employee has at least 3 years relevant work experience.

Exemption from OP or Work Permit application for spouse of OP holders willing to invest or work in Mauritius.

Maximum age limit of 24 years for dependent children will be waived.

Foreign Carers and maids will be eligible for a work permit.

20 hours per week work permit will be provided to international students enrolled in a recognised educational institution.

10-year PRP automatically extended to 20 years.

Flexibility to switch categories between investor, professional and retired for holders of PRP upon renewal of PRP.

A holder of a premium Visa spending 183 days or more, will be subject to income tax as follows:

(i) the Mauritian-sourced income of a Premium Visa Holder (e.g. emoluments for work performed remotely in Mauritius) will be taxed on a remittance basis;

(ii) money spent in Mauritius through the use of foreign credit or debit cards by the holder of a Premium Visa will not be deemed to have been remitted to Mauritius; and

(iii) income brought and deposited in a bank account in Mauritius will be liable to tax except if a declaration is made by the holder of a Premium Visa that the required tax has been paid thereon in his country of origin or residence

Holders of a premium travel visa having acquired a unit under the Invest Hotel scheme will not have any restrictions with regards to the number of days they can occupy their units.

{{item.text}}

{{item.text}}

Anthony Leung Shing, ACA, CTA

EMA Deputy Regional Senior Partner, Country Senior Partner, PwC Mauritius

Tel: +230 404 5071