.jpg.pwcimage.370.208.jpg)

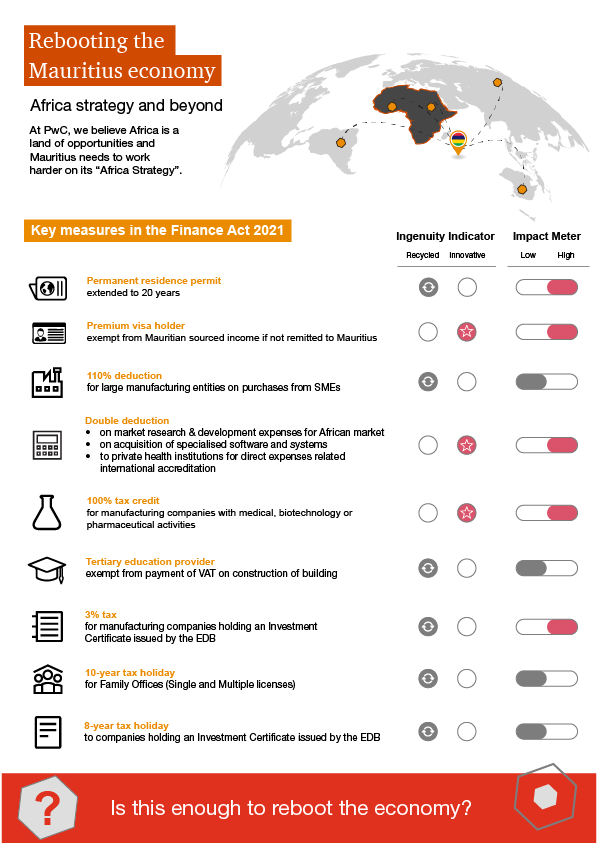

The Finance (Miscellaneous Provisions) Act 2021

Summary of Tax and Regulatory measures, prepared in collaboration with PwC Legal (Mauritius) Ltd.

The Finance (Miscellaneous Provisions) Act 2021 (“Finance Act”) has been enacted following debate at the National Assembly. With the fight against the Pandemic entering its second year and a race against time to vaccinate its population, each country is rethinking its strategy to put the economic engine back into full power. Mauritius is not an exception! Despite the recent increases in the number of COVID-19 cases, Mauritius opened its borders on 15 July 2021. Fiscal and regulatory measures are also following suit.

We invite you to register and download our summary of Tax and Regulatory measures.

A competitive tax environment has been one of the main spearheads of Mauritius in its quest to develop and maintain a sustainable economic growth. The government should continue providing that desired environment to boost investment.

Dheerend Puholoo

PwC | Tax Leader

d.puholoo@pwc.com

+230 404 5079

The Finance Act 2021 certainly does not bring about any major legal reforms although it is heartening to read that much effort is being made to consolidate the AML/CFT framework.

Late Mr Razi Daureawo

Former Head of PwC Legal (Mauritius) Ltd

PwC Legal (Mauritius) Ltd is an independent law firm registered in Mauritius under the Law Practitioners Act and forms part of the PwC network of firms.

Contact us

Anthony Leung Shing, ACA, CTA

EMA Deputy Regional Senior Partner, Country Senior Partner, PwC Mauritius

Tel: +230 404 5071