Discover the pulse of Singapore’s FinTech ecosystem

In 2022, Singapore’s FinTech industry experienced remarkable growth, driven by substantial funding and the transformative impact of the COVID-19 pandemic. Today, an updated analysis of this dynamic sector reveals key insights drawn from over 160 FinTech firms and exclusive interviews with industry leaders.

Key insights

Decade of development

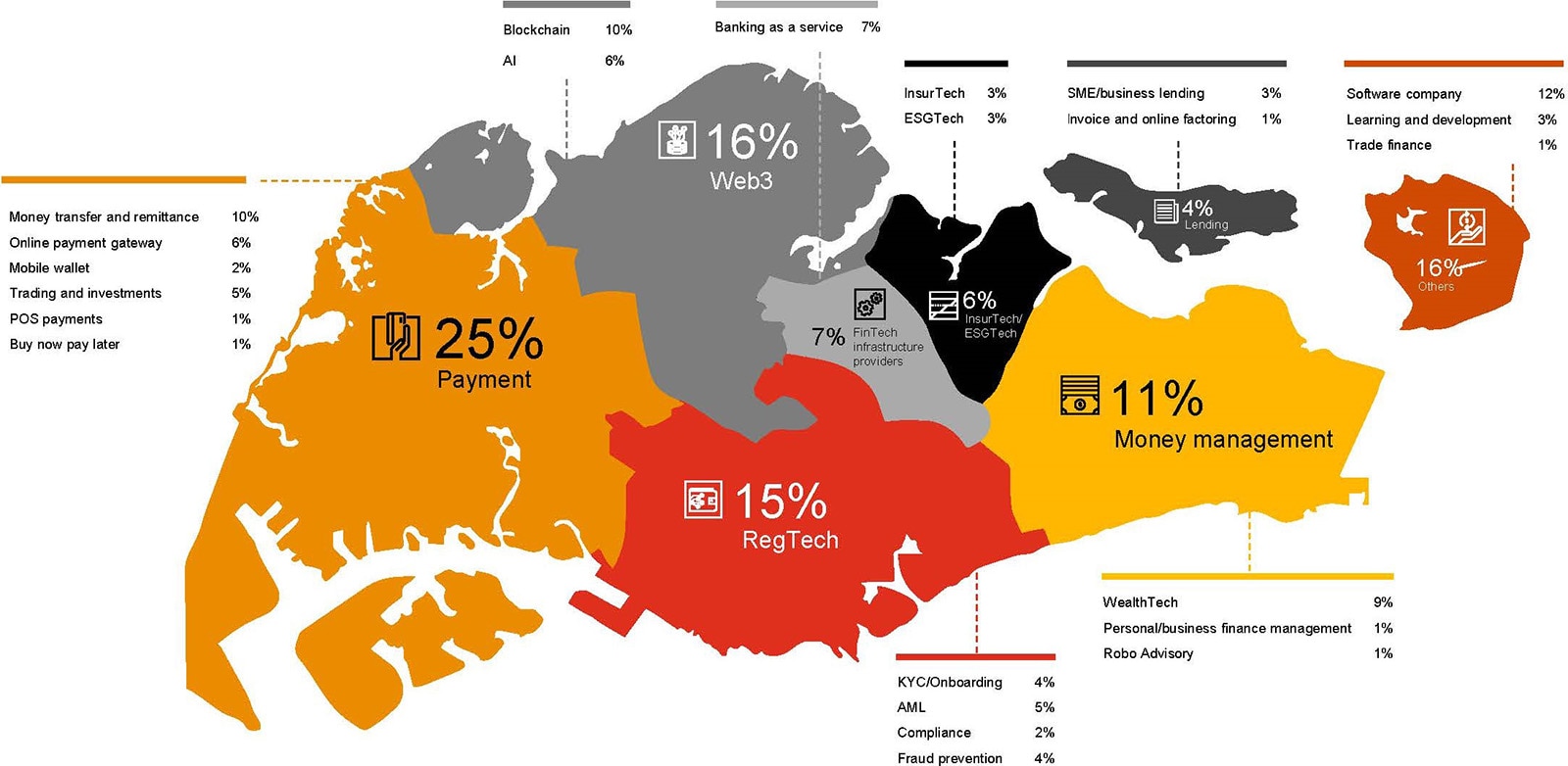

- 55% of FinTech companies in Singapore are concentrated in Payments, Web3, and RegTech, indicating a strong emphasis on digital transactions, blockchain technologies, and regulatory technologies.

- The average FinTech company is 5.5 years old, showing a relatively young but maturing industry.

Sectoral growth

While the overall FinTech industry is expanding, different sub-sectors are growing at varying rates. Web3 companies have seen substantial growth, likely due to advancements and regulatory support in blockchain and digital assets. Conversely, the lending sector has experienced a slowdown, which could be due to market saturation or regulatory challenges.

Outlook

The number of new FinTech companies may stabilise, but existing firms are expected to continue growing. This growth will occur both organically, by expanding their customer base, and inorganically, through mergers and acquisitions. The payments sector, being the most mature, is likely to drive this expansion.

Prominent sectors to watch

The FinTech landscape is evolving, with significant growth in Web3, InsurTech, and ESGTech sectors. Other key finding include:

- 78% of firms have recalibrated their business models in the past three years, introducing new products and services or changing their target business models.

- Funding has declined in 2023 and 2024, but mergers and acquisitions have increased, particularly in the payments sector.

- Companies are focusing on profitability, cost efficiency, and market expansion.

Future trends

The FinTech market is continuously reinventing itself to meet the demands of geopolitical events and economic shifts. Survey results shown that 80% of respondents are optimistic about the future growth of FinTech in Singapore. Some key trends identified includes:

Mapping Singapore’s 2024 FinTech industry

Understanding Singapore’s FinTech landscape 2024

FinTech’s state of play 2.0

About the survey

This survey recorded over 160+ responses from a diverse mix of FinTech firms offering various products and solutions. Categories and subcategories were developed with input from the Singapore FinTech Association. Additionally, insights were gathered from industry experts such as Ms. Sharon Lourdes, Co-Founder and CEO of Headquarters, and Mr. Chuang Shin Wee, Co-Founder and CEO of Pand.ai, focusing on emerging trends in Artificial Intelligence (AI) and Quantum Computing (QC). More details can be found in the full report.

Contact us