Payroll SOPs: the key to compliance, accuracy and efficiency

10/11/23

Payroll is one of the most critical functions in an organisation, that helps manage and remunerate a workforce.

A number of significant consequences arise when employee payments and contributions are done incorrectly. Non-compliance not only increases the risk of potential legal implications from statutory bodies, but it could also have a negative effect on an organisation’s reputation in the market.

Let's look at how these can be minimised by creating a payroll standard operating procedure (SOP) and the benefits associated with it.

What is a payroll standard operating procedure?

A payroll standard operating procedure (SOP) outlines the step-by-step processes required when running a payroll operation. It acts as a reference point for the entire end-to-end payroll process.

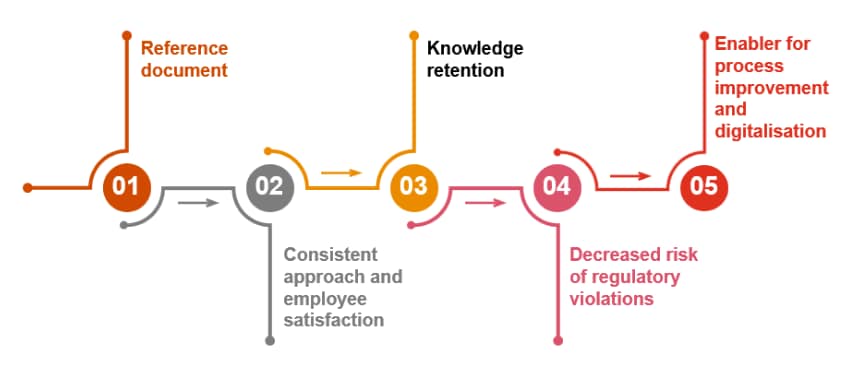

The following are some of the benefits of developing an SOP:

Reference document - An SOP serves as a repository encompassing all the steps required to run an end-to-end payroll operation, offering a one-stop reference for all aspects of the payroll process.

Consistent approach and employee satisfaction - Having documented guidelines would enable the payroll team to follow a similar process when processing a pay run. This will also help provide a sense of direction, for example, if clarification is required on the application of a specific allowance, its associated amount, new hire calculations, or the final payment calculated for a terminated employee. Having a documented process leads to increased employee satisfaction and improves productivity as well.

Knowledge retention - The intention of an effective SOP would be to act as a live document that needs to be updated every time there is a change in the payroll process by the payroll team. This practice would ensure that it has all the latest requirements captured in a way that helps the payroll team to be informed of any new updates. Having this document in place would assist the payroll team to operate and deliver as required with minimal impact from changes within the team, such as employee turnover, absence of team members or even managing the administrative complexities that come with having offices in various markets.

Decreased risk of regulatory violations - Since the SOP states each step and the proposed timelines of every activity such as deadlines for releasing statutory contributions or employee payments, this would mitigate the risk of missing any statutory deadlines and act as a reminder for the payroll team to ensure all contributions and payments have been filed in a timely manner.

Enabler for process improvement and digitalisation - Since the SOP will provide an overall view of what an ideal end-to-end payroll process should be, it will highlight any potential gaps and provide opportunities for improvement on the current processes. This can also be used to analyse payroll data using data analytics, ultimately aiding in better workforce planning, through more effective integration with other parts of the business.

Now, let's delve into a high level overview of the steps to be included in a payroll management SOP.

What should be ideally included in an SOP:

Employee setup - Ensure all employee records have been included and are updated with most recent changes, such as any applicable allowances and deductions.

Collation of payroll input data - Combine data from various sources for processing, for instance if overtime is applicable.

Validation of payroll input data - Verify data received for accuracy and completeness, and raise any queries for clarification if necessary.

Action adhoc requests - Manage special requests related to entitlements, including those related to overtime, new hires and termination payments.

Process pay run - Run the standard payroll process.

Verify payroll results - Following the step above, perform analysis for accuracy of payroll data and confirm that statutory deductions have been calculated, such as Employees’ Provident Fund (EPF) and Employment Insurance Scheme (EIS).

Payroll reports - Generate standard payroll reports and perform review in order to address any nuances or anomalies. Once reviewed, submit these reports to the payroll manager for approval.

Provide clarification - Address and act upon any queries raised by stakeholders and employees.

Salary disbursement and payslip - Once approved, prepare and release the bank file to pay salaried employees, then generate the payslips.

Statutory handling - Perform any required statutory requirements for new hires and terminations.

Statutory contributions - Release statutory contributions such as tax, EPF, SOCSO and EIS to the relevant statutory bodies, ensuring compliance to the deadlines.

Year-end compliance - Prepare and collate required data for year-end compliance.

To summarise, an SOP provides a detailed snapshot of your payroll process, guiding the payroll team through the entire operation and ensuring a smooth and efficient process.

An SOP can bolster management reporting and support in strategic decision making with analytics and clear processes in place. By identifying potential gaps, it would assist in improving the overall people and business strategy and facilitating informed decision-making to enhance the entire payroll process and experience.

Our specialists can support you across various aspects of payroll. Speak to us today to find out more about payroll standard operating procedure and how we can customise it for your business.

Keep up-to-date with the latest blog posts via RSS

Contact us