{{item.title}}

{{item.text}}

{{item.text}}

Companies

Limited liability partnerships (LLPs)

Co-operatives

(Individuals are excluded)

Unlisted shares: Shares of unlisted companies incorporated in Malaysia

Section 15C shares: Shares of a foreign controlled company deriving value from real property in Malaysia under section 15C of the ITA 1967. See examples below

Foreign capital assets: Movable or immovable property situated outside Malaysia including any rights or interest thereof, such as shares of companies incorporated outside Malaysia, intellectual property, buildings and land, paintings, and so on

Where the gains or profits from the disposal of shares are revenue in nature, such gains or profits are treated as business income under section 4(a) of the ITA 1967 and are subject to tax at the prevailing income tax rate of the disposer.

Shares, in relation to a company, includes stock other than debenture stock.

| Taxable assets | Unlisted shares and section 15C shares |

Foreign capital assets |

| CGT rate | 10% on net gain (chargeable income) OR 2% on gross disposal price (optional rate for shares acquired before 1 January 2024) |

Prevailing income tax rate on gains received in Malaysia

|

The gains from the disposal of shares of a controlled company incorporated outside Malaysia (‘Foreign Controlled Company’) shall be deemed to be derived from Malaysia if the Foreign Controlled Company derives value from real property in Malaysia pursuant to section 15C of the ITA 1967.

For illustration purposes, the scenarios under section 15C can be depicted as follows. Please note that permutations are non-exhaustive.

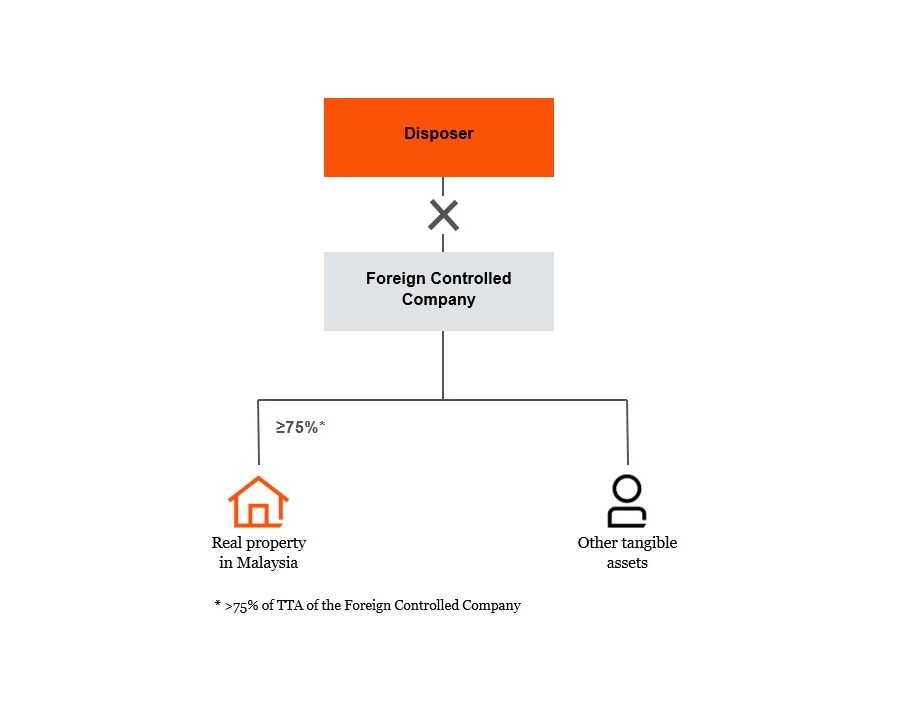

Shares in a Foreign Controlled Company are in-scope shares for CGT purposes if the defined value (i.e., market value) of real property situated in Malaysia (including any right or interest thereof) owned is not less than 75% of the value of its total tangible assets (TTA) at the relevant date of acquisition.

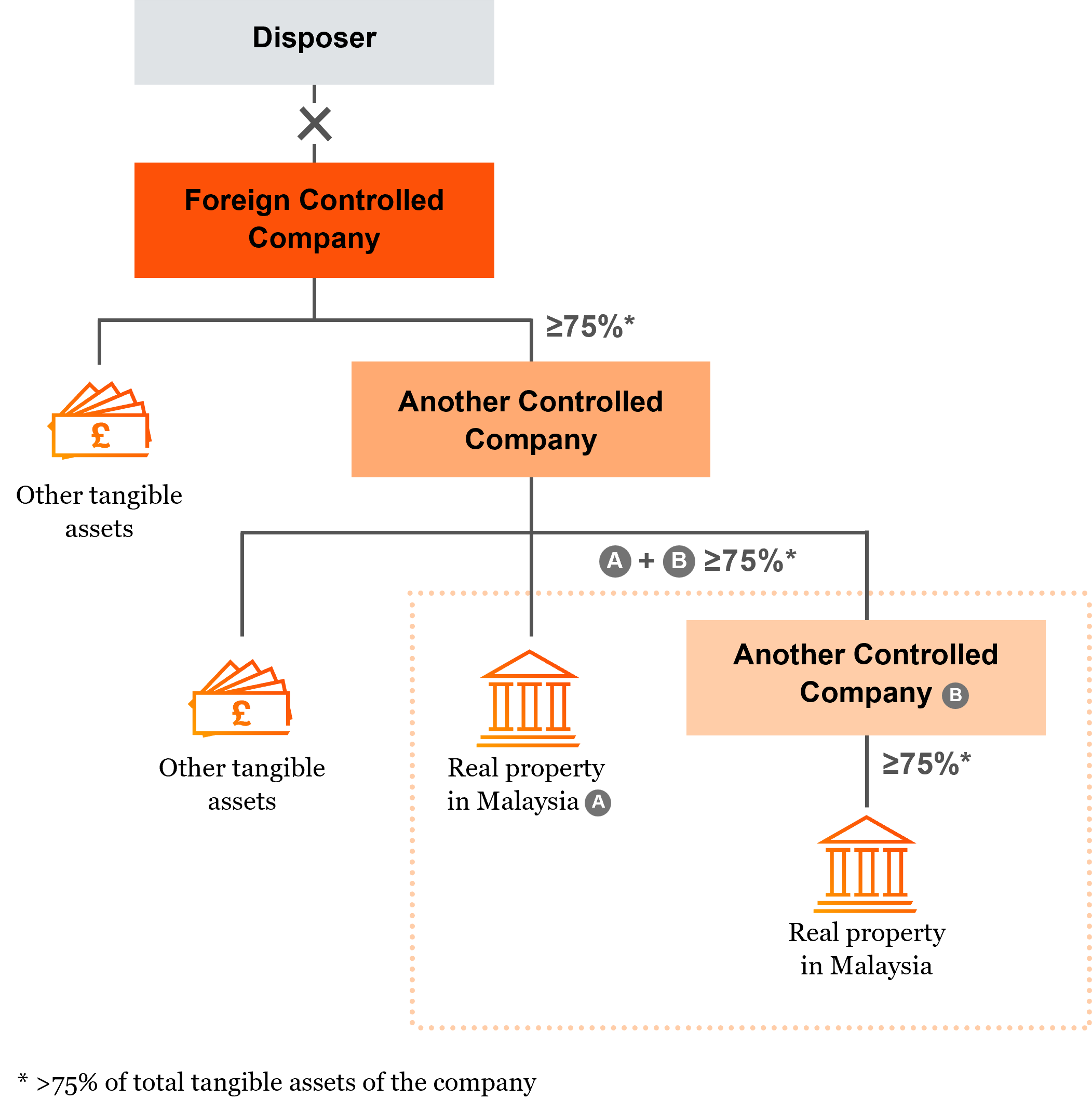

Shares in a Foreign Controlled Company are in-scope shares for CGT purposes if the defined value of shares of Another Controlled Company owned by Foreign Controlled Company is not less than 75% of the value of Foreign Controlled Company’s TTA at the relevant date of acquisition.

“Another Controlled Company” means a controlled company which owns real property situated in Malaysia (including any right or interest thereof) or shares in another controlled company, or owns both, where the defined value of the real property or shares, or both, is not less than 75% of the value of its total tangible asset.

The assessments are based on the ‘defined value’ of shares or real property owned by the tested entities. ‘Defined value’ means ‘the market value of real property or the acquisition price of shares of another controlled company as determined under section 15C(4)’.

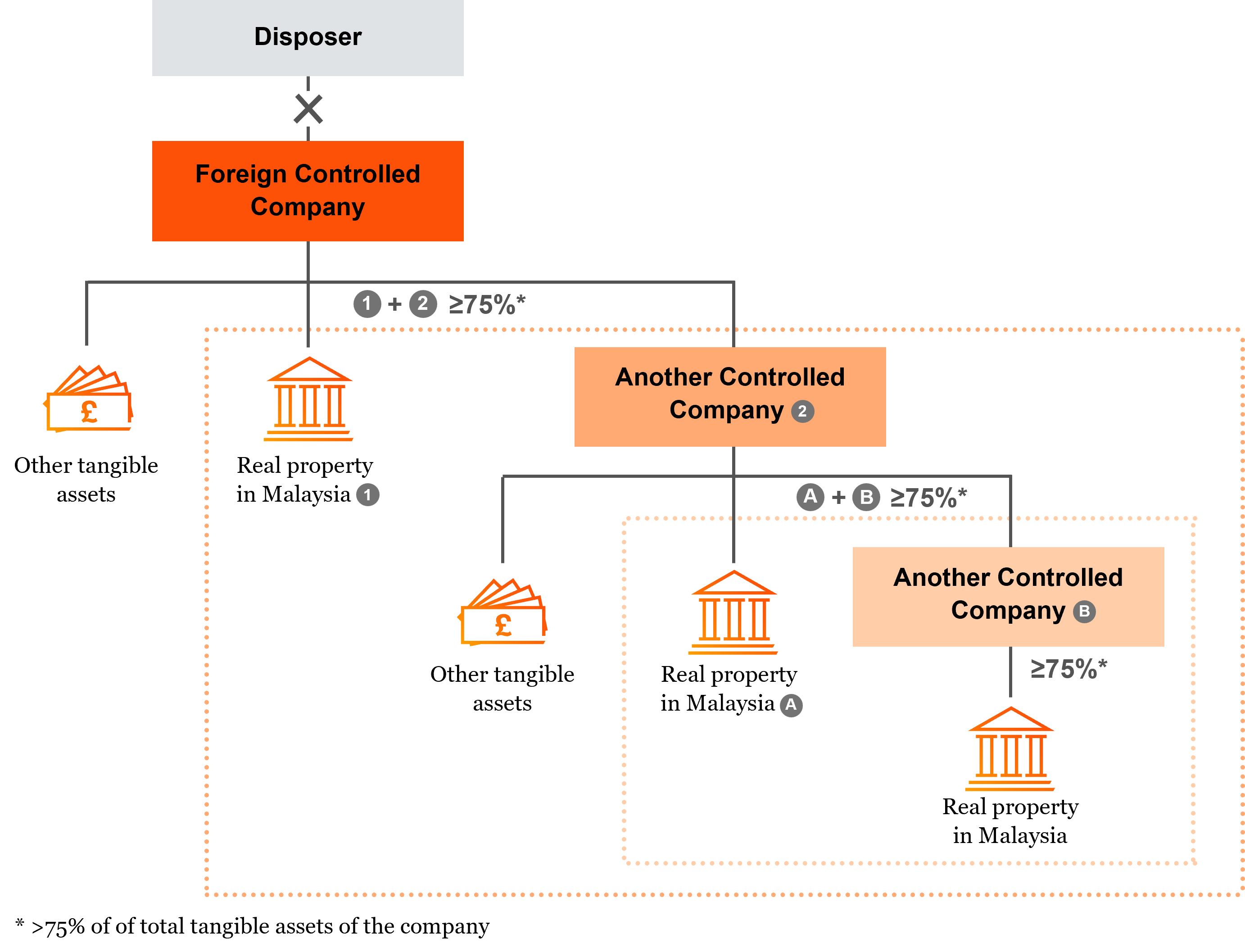

Shares in a Foreign Controlled Company are in-scope shares for CGT purposes if the defined value of real property situated in Malaysia and shares of Another Controlled Company owned by Foreign Controlled Company is not less than 75% of the value of Foreign Controlled Company’s TTA at the relevant date of acquisition.

“Another Controlled Company” means a controlled company which owns real property situated in Malaysia (including any right or interest thereof) or shares in another controlled company, or owns both, where the defined value of the real property or shares, or both, is not less than 75% of the value of its total tangible asset.

The assessments are based on the ‘defined value’ of shares or real property owned by the tested entities. ‘Defined value’ means ‘the market value of real property or the acquisition price of shares of another controlled company as determined under section 15C(4)’.

If the disposer is disposing shares owned prior to 1 January 2024 and the shares were shares in a real property company (RPC) under the Real Property Gains Tax Act 1976 (RPGT Act), the disposal of such shares are subject to CGT and the acquisition date and acquisition price of those RPC shares based on RPGT Act will be adopted for CGT purposes.

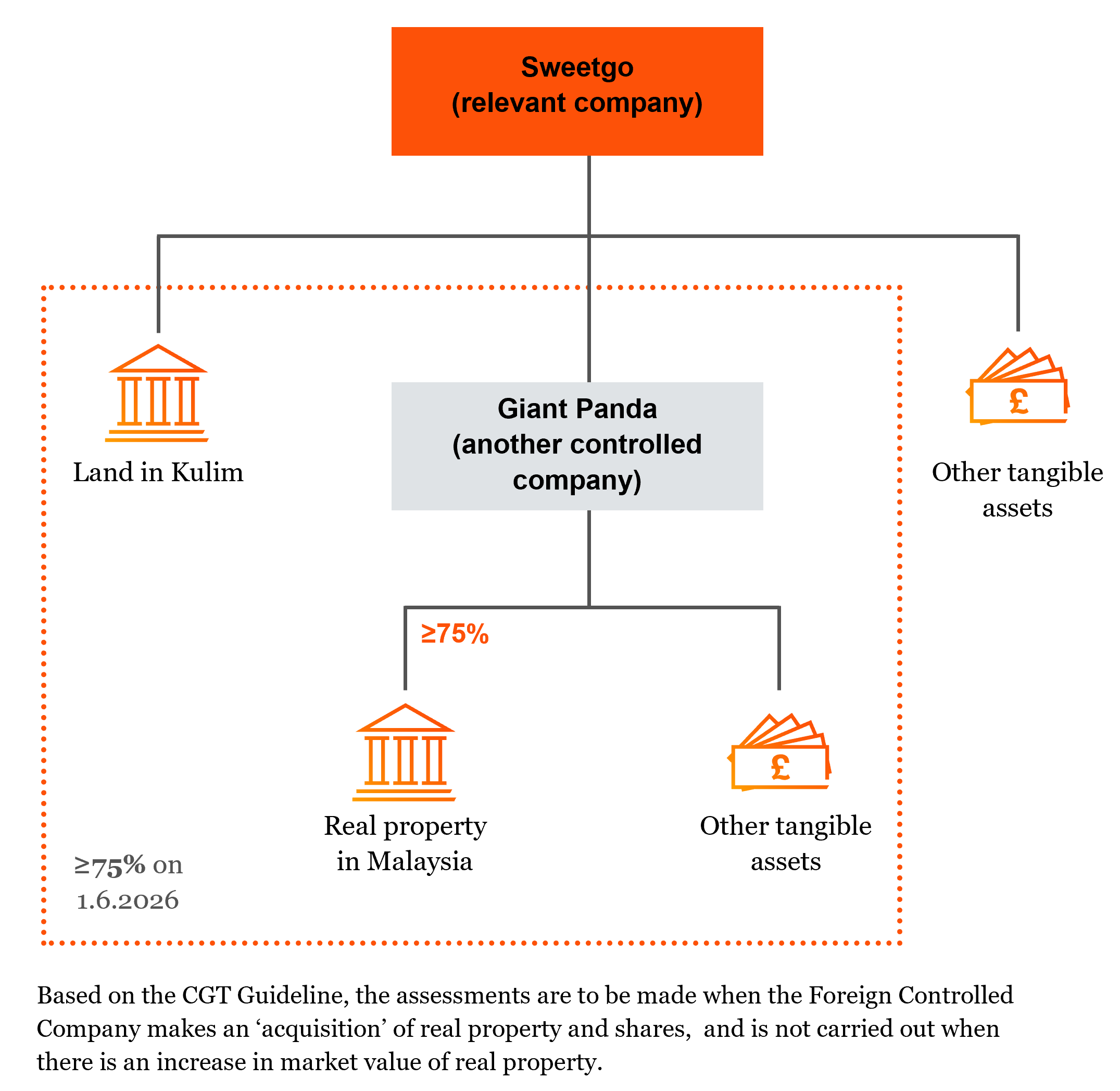

The example below illustrates the timing to perform the 75% threshold test based on the CGT Guideline issued by the Inland Revenue Board of Malaysia. Here are the scenario and key facts around the disposer, Sweetgo.

| Acquisition of real property or shares in another controlled company by Sweetgo (relevant company) | Date of acquisition / revaluation | Market value of asset acquired / revalued (RM) |

TTA (RM) |

| Land in Kulim | 1.4.2024 | 4.3 million |

4.5 million |

Revalued in 2025 |

6.1 million |

8 million | |

1.6.2026 |

7 million |

13 million | |

Shares of Giant Panda* |

1.6.2026 | 4.5 million |

* At the date of acquisition of shares of Giant Panda by Sweetgo, the defined value (i.e. market value) of real property situated in Malaysia owned by Giant Panda exceeded 75% of the Giant Panda’s TTA.

Determination of section 15C shares status of Sweetgo

| On 1.4.2024 (Acquisition of land) |

|

| 2025 (Revaluation of land) |

|

| On 1.6.2026 (Acquisition of shares) |

|

CGT returns are to be filed as follows:

| Taxable assets | Unlisted shares and section 15C shares |

Foreign capital assets |

Disposed between 1 January 2024 to 29 February 2024 |

CGT return is not required | Foreign capital gains are to be declared in the annual income tax return form of the respective chargeable person. For companies, this will be the Form e-C |

Disposed on 1 March 2024 or later |

CGT return (e-CKM Form) is to be filed electronically and CGT is to be paid within 60 days from the date of each disposal |

Gains arising from disposal of foreign capital assets received into Malaysia are eligible for exemption if economic substance requirements (ESR) are met.

Economic substance requirements

Key conditions

The key conditions to be met by the disposer to qualify for exemption are:

What if the prescribed adequacy thresholds are not met?

In the absence of prescribed adequacy thresholds, the IRB has stated in the Guideline for CGT on Foreign Capital Assets that factors which will be considered for each taxpayer are:

Outsourcing impact on ESR

Specified economic activities of a taxpayer which are outsourced will be taken into account for ESR adequacy purposes. Key conditions to observe include:

Examples:

A manufacturing company in Malaysia which the IRB considers to have adequate ESR is one which hires 150 employees and incurs operating expenditure of RM1 million

A resident investment holding company, which does not employ any employee, could meet the ESR adequacy tests when it outsources its investment and asset management activities.

Businesses which require certainty especially in a self-assessment environment can consider approaching the IRB for a confirmation on its compliance with the ESR conditions prior to filing their tax return.

Use our interactive calculator to estimate your CGT for year of assessment (YA) 2024

Professional fees for services of any valuer, accountant, agent or legal adviser

Stamp duty

Cost of advertising to find a buyer

Subtotal (incidental costs for disposal)

Professional fees for services of any valuer, accountant, agent or legal adviser

Stamp duty

Cost of advertising to find a seller

Subtotal (incidental costs for acquisition)

Expenditure incurred for enhancing / preserving the value of assets

Expenditure incurred for defending the title or rights over the assets

Disposal price

Less: Acquisition price

Estimated gain / (loss)

Gain received in Malaysia The amount would form part of the chargeable income

Prevailing tax rate for YA 2024 Refer here for information

CGT payable

Disposal price

Tax rate

CGT payable

Consideration value for disposal

Less: Expenditure incurred for enhancing / preserving the value of defending the title or rights over the assets

Less: Incidental costs on disposal

Disposal price

Consideration value for acquisition

Add: Incidental costs on acquisition

Acquisition price

Estimated chargeable gain / (capital loss)

Tax rate

CGT payable

Disclaimer:

This CGT calculator does not constitute legal, accounting or other professional advice. It is intended only as a general illustrative guide and is neither a definitive nor exhaustive analysis / discussion of the law nor a substitute for professional advice.

Users should discuss with professional advisers how the information may apply to their specific situations.

PwC does not collect or store any information entered into the CGT calculator. All of the entered data appears only on the user's end and is automatically deleted once the calculator is closed. Unauthorised reproduction is expressly prohibited.

As the pace and complexity of tax laws continue to increase, professional advice is essential. Let our experienced professionals manage your compliance matters while you grow your business.

Technical updates and insights relevant to you

{{item.text}}

{{item.text}}