Paying Taxes 2018

The 12th edition of Paying Taxes pays particular attention to how the digital revolution is transforming many aspects of tax administration. It considers this in the context of the methods companies use to pay their taxes, how tax administrations communicate with taxpayers, how they select companies for audits and the ways in which they conduct those audits, to name a few.

Marked improvement in Mauritius

You will be pleased to note that Mauritius has shown a marked improvement in its overall ranking from 45th in 2016 to 10th in 2017 (out of 190 economies).

This improvement has been driven by the measures put in place by the Mauritius Revenue Authority to ease the compliance requirements, provide clearer guidance as well as introduce good governance principles. On 05 December 2017, the ECOFIN Council, composed of EU Economic and Finance Ministers, published a list of 47 countries committed to good tax governance principles, and Mauritius featured in it.

Evolution in Paying Taxes ranking for Mauritius

In-depth analysis on tax systems in 190 economies

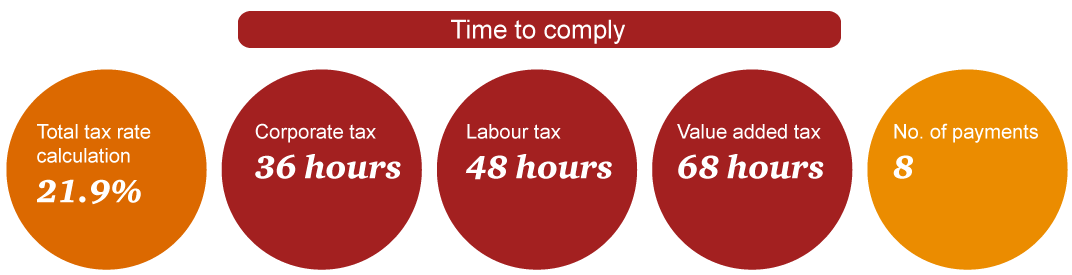

The study measures the ease of paying taxes across 190 economies and assesses the time required for a company to prepare, file and pay its taxes, the number of taxes that it has to pay, the method of payment and the total tax liability as a percentage of its commercial profits.

Want to know how our economy compares to others around the world? Try out our updated online data explorer tool. Create your own peer groups from all the economies and regions in the study, including historical data from all years of the study.