The Finance Act 2025 brings a new wave of reforms aimed at strengthening public finances.

While the intent is clear, the impact is more complex. Some measures, like the Fair Share Contribution or the early adoption of QDMTT, raise important questions about timing, design and long-term effect.

Other areas left untouched, point to missed opportunities for broader economic or legal reform. As Mauritius looks to strengthen its fiscal position, the challenge will be ensuring that new policies support long-term economic growth, without discouraging investment, innovation or talent.

Some of the key measures in The Finance Act 2025 are as follows:

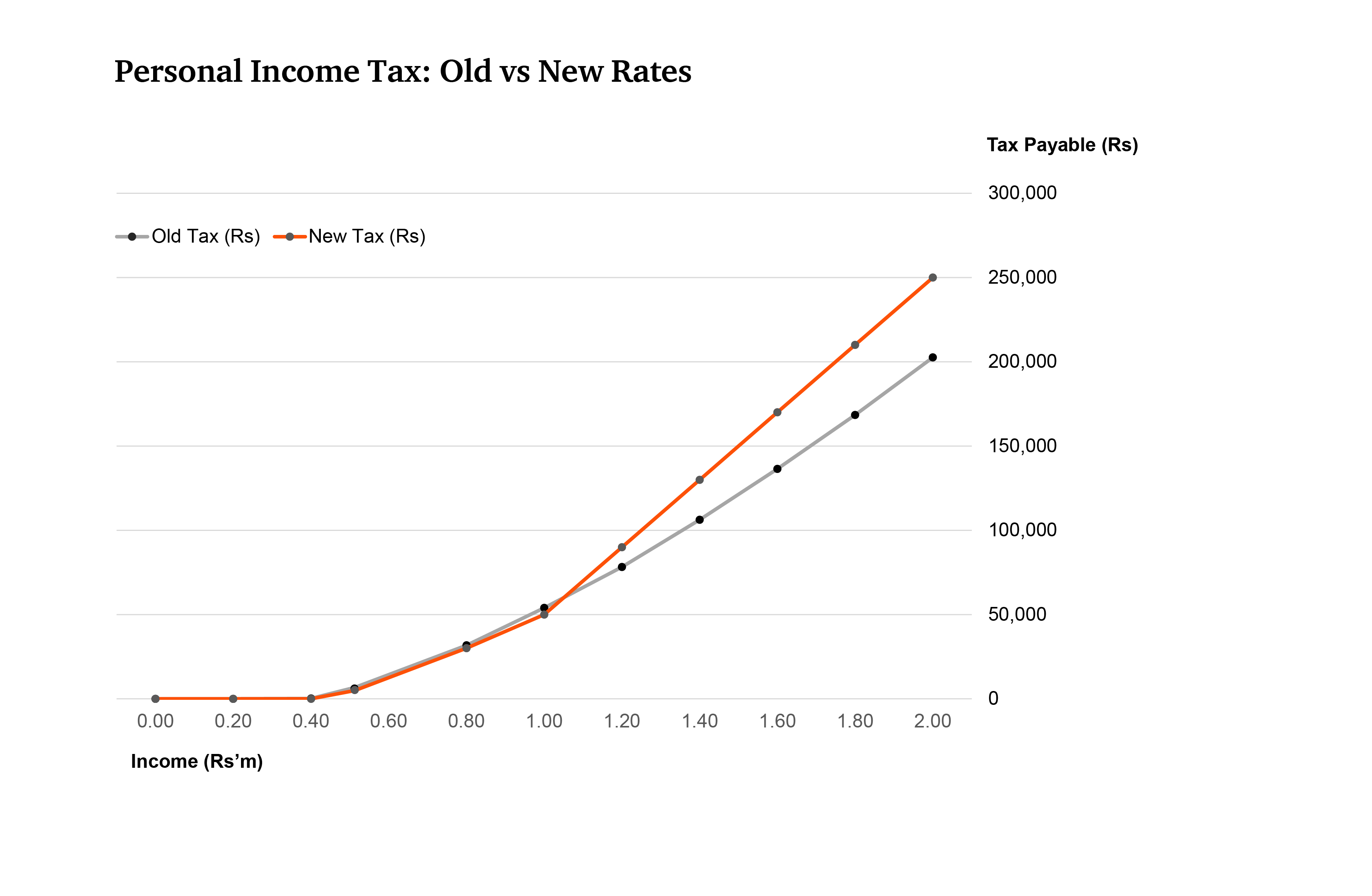

- Personal Tax - An individual whose net income exceeds Rs12m, inclusive of dividend income, will be required to pay a Fair-Share Contribution at the rate of 15% on the amount in excess of Rs12m.

- Corporate Tax - QDMTT is applicable to multinational enterprises with annual revenue of at least €750m.

- VAT - Corporates earning over Rs 24m will be subject to an additional 2% (if export-oriented) or 5% tax in other cases. Banks will be required to pay an additional 2.5% tax on their domestic transactions.

- Smart City Scheme - Smart City incentives have been grandfathered for existing players.

- Other Taxes - The Home Ownership scheme and Home Loan Payment Scheme have been abolished.

- Tax Administration - The MRA now limits tax assessments to 2 years and caps penalties and interest at 100% of the tax due.

The Finance Act 2025

Download our Summary of Tax and Legal measures

Contact us