{{item.title}}

{{item.text}}

{{item.text}}

Public Finance

Successfully resetting the course of the economy, more than just the deployment of financial resources, will require thoughtful decision making underpinned by a real desire for long-term sustainability.

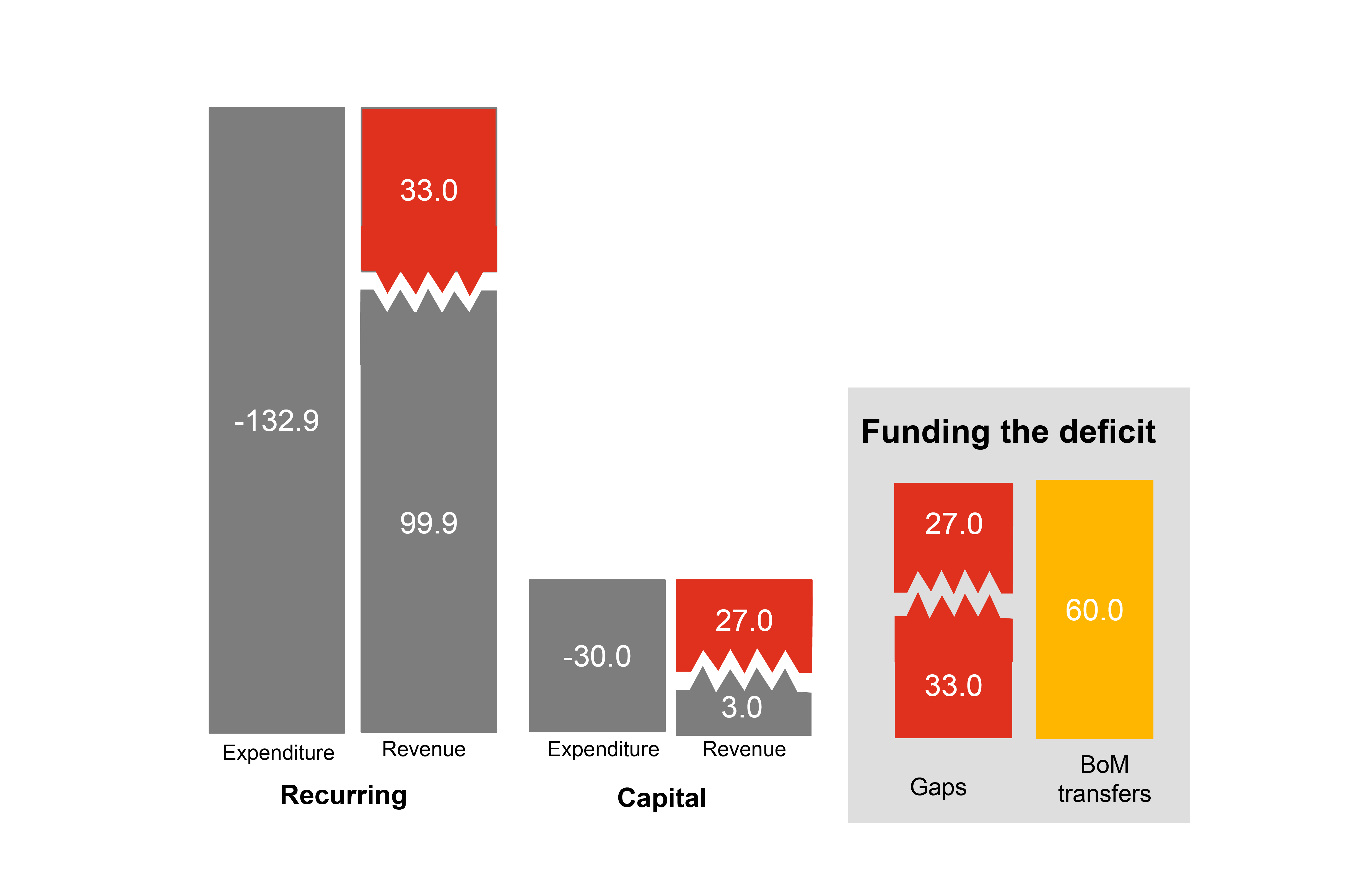

Announced as balanced, the previous budget included a silent exceptional Rs60bn contribution from the Bank of Mauritius packaged as 2 transfers of Rs33bn and Rs27bn to even out the current and capital balances respectively.

A second lockdown later coupled with a prolonged closure of our borders that brought the tourism sector to its knees, the Minister of Finance today disclosed the budget deficit for 2020/21, consolidated with special transfers, stood at Rs24.6bn, representing about 5% of GDP.

Expected to be contained at -7% off the application of the stimulus package, GDP dropped by 14.9% in 2020, making Mauritius the country with the largest Covid-related GDP loss in Africa, according to the IMF.

The conservative easing of border restrictions and the lack of visibility on the government’s agenda for managing the sustainability of public finances do not bode well for the country’s economic recovery in the near term.

Unemployment rate for 2020 has been estimated at 9.2% off a labour force totalling 570,000. This effectively implied an increase of some 12,500 Mauritians being newly out of a job during the year.

Whilst subdued, this can be primarily attributed to the government’s sought objective of preserving jobs through the implementation of the wage assistance scheme specially earmarked for the tertiary sector, without which the unemployment rate would have stood at 20% i.e 100,000 unemployed.

In the wake of a Committee on Sustainability of Public Finances being set up by the government with the objective of addressing deficit financing and public sector debt in the short to long term, all eyes are set on the government’s planned expenditure for the upcoming financial year.

Surprisingly, the current budget plans for higher employee compensation of 10% in 2022 or equivalently Rs3.3bn more than the prior year spend.

Excluding the Rs60bn special transfers, the budget 2021/22 projects a 44.2% increase in revenue from last year. The bulk contribution is attributable to VAT at 28.7%, accounting for Rs39.5bn (+Rs11.5bn).

An additional Rs9.6bn is expected to be collected from property income; Rs4.8bn from corporates (+39.3%); Rs 2.8bn from CSG; Rs1.6bn from individuals (+14.0%); Rs1.6bn from airport taxes; Rs1.6bn from external grants; and Rs1.0bn from betting and gambling (casinos and sports).

Contribution to Government Revenue: 2019/20, 2020/21 and 2021/22E

Computed under the old definition, the Debt-to-GDP ratio for 2021/22 is projected at 91.4%.

Public debt increased by 22% from fiscal year 2019 to 2020 and is projected to rise by 8% subsequently. The proportion of external debt is however, expected to increase from around 15% to above 20%.

{{item.text}}

{{item.text}}

Anthony Leung Shing, ACA, CTA

EMA Deputy Regional Senior Partner, Country Senior Partner, PwC Mauritius

Tel: +230 404 5071