Taxation

Corporate Tax

- Global Business

- Reduced Corporate Tax Rate

- Taxation of banks

- Investment Tax Credit

- Solidarity Levy on telephony service providers

- Taxation of artworks

- Tax Holiday on Africa Project

- Freeport Regime

- Sheltered Farming Scheme

- Corporate Social Responsibility (“CSR”)

- Work@Home Scheme

- National Regeneration Scheme (“NRS”)

Global Business

Abolition of Deemed Foreign Tax Credit (“FTC”) regime available to companies holding a Category 1 Global Business Licence (“GBC1) as from 31 December 2018

Partial exemption regime for companies (except banks) whereby 80% on specified income such as foreign source dividends, interests, royalties and other income from specified financial services will be exempted from income tax

Partial exemption regime available upon satisfaction of pre-defined substance requirements of the Financial Services Commission (“FSC”)

Category 2 Global Business Licence (“GBC2”) will be abolished as from January 2019

Grandfathering of companies holding GBC2 issued before 16 October 2017 until 30 June 2021

Reduced Corporate Tax Rate

Corporate tax rate of 3% to companies engaged in export of goods will be extended to companies involved in global trading activities

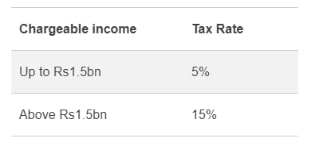

Taxation of banks

Abolition of deemed FTC regime available to banks as from 1 July 2019

- Introduction of new regime whereby no distinction between Segment A and Segment B income. Banks will be taxed as follows:

Banks with chargeable income in excess of Rs1.5bn will be taxed at 5% if pre-defined conditions are satisfied

Special levy on banks is maintained up to June 2019

Investment Tax Credit

Companies importing goods in semi knocked down form to benefit from an investment tax credit of 5% over 3 years (up to 30 June 2020) on acquisition of new plant and machinery excluding motor cars, subject to a local value add of at least 20%

Tax credit will be available on investments up to 30 June 2020

Solidarity Levy on telephony service providers

Solidarity levy on telephony service providers is extended up to June 2020

Removal of conditions for solidarity levy apply to companies having a book profit exceeding 5% of their turnover

Taxation of artworks

Companies not engaged in the artworks business will be allowed to deduct cost of artworks bought from a local artist up to maximum of Rs500,000, provided the artwork is displayed in the place of business, can be seen by the public and the artworks are kept for at least 3 years

Tax Holiday on Africa Project

- 5 year income tax holiday for project developers and project financing institutions collaborating with the Mauritius Africa Fund for the development of infrastructure in Special Economic Zones

Freeport Regime

- Corporate tax exemption granted to Freeport operators and Freeport developers on export of goods will be removed

Sheltered Farming Scheme

- 8 year tax exemption on farming related projects

Corporate Social Responsibility (“CSR”)

For CSR funds set up on or after January 2019, companies are allowed to retain an additional 25% of the fund, upon approval of the National CSR Foundation for programmes that started prior to January 2019

Unused foreign tax credit will not be allowed to be offset against CSR payable

Companies on tax holidays will be required to contribute to CSR

Work@Home Scheme

Double deduction for wages and salary costs of employees under the Work@Home Scheme for the first 2 years

Annual tax credit of 5% to employers for the first 3 years on investments in required IT system under the scheme

National Regeneration Scheme (“NRS”)

NRS is introduced under the Smart City Regulation

Property developer will be eligible to investment income tax credit of 5% over 3 years on qualifying capital expenditure on substantial work in relation to existing buildings if completed within 2 years from date of approval

5 year tax holiday on income derived from smart parking solutions and other green initiatives

2 year tax exemption on newly rented space for cultural purposes or to artists as from date plan is approved

Expenditure made by private companies on renovation, embellishment or cleaning of public infrastructure will be tax deductible

Personal Tax

- Tax band of 10%

- Exempt Income

- Taxation of artists

- Exemptions and Reliefs

- Negative Income Tax

Tax band of 10%

Tax rate reduced from 15% to 10% on annual net income derived by an individual of up to Rs650,000

Exempt Income

Lump sum exemption threshold on severance allowance, pension or retiring allowance increased from Rs2m to Rs2.5m

Exemption on Insurance Industry Compensation Fund

Taxation of artists

Mauritius artist earning less than Rs300,000 can get deduction of 50% from his artistic work earnings without the need of supporting documentation for expenses

Exemptions and Reliefs

Additional deduction for tertiary education

Additional deduction for pursing tertiary education increased –

From Rs135,000 to Rs200,000 for dependent child studying abroad

From Rs135,000 to tuition fees in excess of Rs135,000 up to Rs170,000 for dependent child studying in Mauritius

Income Exemption Threshold for Retired Person

- Income Exemption Threshold is now available to retired person deriving emoluments not exceeding Rs50,000

Rain Harvesting Investment Allowance

- Individuals investing in rainwater harvesting system (including consultancy and design, earthworks, gutters and specialised water tanks) for their house can deduct amount invested from their taxable income

Interest Relief

- Interest relief is now allowed on secured property in respect of profit charge payable under Islamic Financing Arrangement for house construction

Negative Income Tax

Conditions for financial support granted to low income employees earning Rs9,900 or less monthly changed as follows –

Allowance computed on monthly basic salary instead of total earnings, limited to monthly total earnings up to Rs20,000

Condition to be in full-time employment changed to a minimum of 24 hours over at least 3 days on a week

No requirement for an employee to be in continuous employment for the past 6 months

Aggregate monthly income of employee and spouse not exceeding Rs30,000 changed to monthly income not exceeding Rs9,900 and Rs30,000 for employee and spouse respectively

Compliance with NPF and NSF contribution will be for the month Negative Income Tax is claimed instead of all prior NPF and NSF contributions made to date

No requirement for full time employee to compulsorily register for Negative Income Tax as information will be provided by employer in monthly PAYE, NPF and NSF returns.

MRA will pay allowance to employee within 1 month from the date employer files PAYE, NPF and NSF returns.

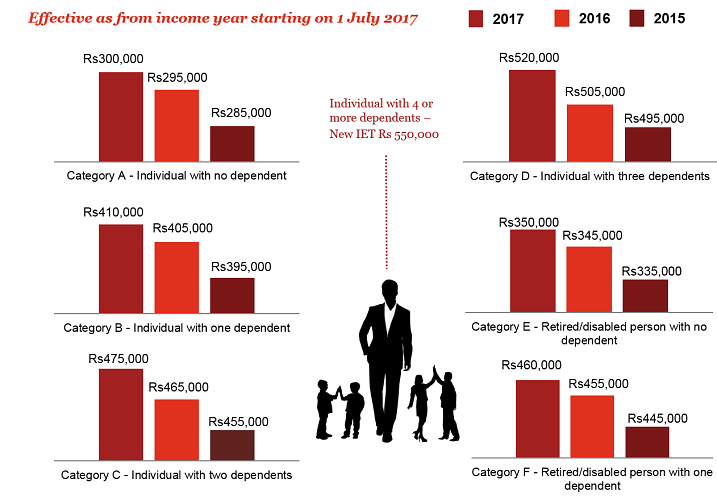

Income Exemption Threshold

Effective as from income year starting on 01 July 2018

| Category | From (Rs) | To (Rs) |

A. Individual with no dependent |

300,000 |

305,000 |

B. Individual with one dependent |

410,000 |

415,000 |

C. Individual with two dependents |

475,000 |

480,000 |

D. Individual with three dependents |

520,000 |

525,000 |

E. Individual with four or more dependents |

550,000 |

555,000 |

F. Retired/Disabled person with no dependent |

350,000 |

355,000 |

G. Retired/ Disabled person with dependents |

460,000 |

465,000 |

Value Added Tax

- VAT Refund Scheme

- Supply of manual labour in agricultural or construction Sector

- Burglar alarm systems

- Public buses

- Examination of vehicles (Fitness)

- Photovoltaic system

- Recovery of VAT in Hospitality Sector

- Watch straps

- Anti-Smoking tablets

- Special Levy on banks

- Claw Back of VAT on Capital Goods

- National Regeneration Scheme

VAT Refund Scheme

- VAT refund to planters extended to the following:

- Branch chopper

- Earth auger

- Fogging machine

- Handy blower

- Irrigation hose

- Mini tiller, including blade

- Land preparation works; and

- Rental of land leased for agricultural purposes

- Registered local artists will benefit from VAT refund on musical instruments including guitar, drum set, dhol, flute and violin

Supply of manual labour in agricultural or construction Sector

Supply of manual labour to VAT registered person in construction or agricultural sector will be exempt from VAT

Burglar alarm systems

Services relating to upgrading, repairs and maintenance, patrol and monitoring or rental of burglar alarm system will be zero rated supplies

Public buses

VAT exemption extended to cover bus bodies built on chassis for all buses meant for public transport

Examination of vehicles (Fitness)

- Fees payable for fitness of vehicles will remain zero rated for another two years up to 30 June 2020

Photovoltaic system

All components forming an integral part of photovoltaic system will be zero rated

Recovery of VAT in Hospitality Sector

VAT paid by registered person involved in accommodation, catering, entertainment or rental/lease of motor vehicles businesses can be recovered

Watch straps

- VAT will be abolished on watch straps except those made of precious or base metal

Anti-Smoking tablets

- VAT exemption extended to anti-smoking tablets

Special Levy on banks

Special levy on net operating income derived by banks from domestic operations

Claw Back of VAT on Capital Goods

- MRA will be empowered to claw back refund made on capital goods (excluding building) exceeding Rs100,000 in case of abuse

National Regeneration Scheme

- Property developer qualified under the above scheme will be eligible to VAT refund on renovation work on existing buildings including capital goods, professional fees and fit-out works on completed work within 2 years from date of approval

Other Taxes

- Freeport Regime

- Income Tax Winnings

- National Regeneration Scheme (“NRS”)

- Customs Duty

- Excise Duty

Freeport Regime

Freeport operators and private operators will no longer be exempted from corporate tax on export of goods

Companies with a Freeport certificate issued before 14 June 2018 will continue to be exempted until 30 June 2021

Manufacturing activities will not be allowed in the Freeport

Income Tax Winnings

- Introduction of withholding tax of 10% on winning amount exceeding Rs100,000 obtained from Mauritius National Lottery – ‘Lotto’ and Government Lotteries – ‘Loterie Verte’, casinos and gaming houses

National Regeneration Scheme (“NRS”)

Under NRS:

- Property developers will benefit from customs duty on import of:

- machinery,

- equipment and other inputs in semi knocked down form

on the condition that at least 20% local value add on substantial work on existing buildings if it is completed within 2 years from date of approval

Customs Duty

Goods imported in Semi-Down condition will be exempted from customs duty, provided there is at least 20% value addition domestically

15% customs duty on acoustic doors and 10% customs duty on iron bars will be abolished

10% customs duty on imported blended oil

Increase of custom duty from 15% to 80% on import of sugar

Foreign retirees will be exempted from custom duties on import of personal effect up to a value of Rs2m

Excise Duty

100% duty exemption on motorcar up to 1,600cc for disabled persons

100% duty exemption on purchase of single/double space cabin vehicle for planters in hydroponic activities

Excise duty of Rs2 per unit on non-biodegradable disposable plastic containers as from 1 February 2019

Excise duty on buggies adjusted to 10%

- Road tax of Rs4,000 will be extended to include farmers engaged in sheltered farming, poultry breeders and growers of fine herbs on commercial sale

Tax Administration

- General

- Personal Taxation

- Corporate Tax

- Value Added Tax (“VAT”)

General

5% Payment on Objection

- An additional 5% of tax payable when appealing before Assessment Review Committee

Return of Information

- Casinos, Gaming Houses and bookmakers/totalisators will be required to submit a return of information to the MRA on wins exceeding Rs100,000

Expeditious Dispute Resolution of Tax Scheme (“EDRTS”)

- EDRTS will be extended to assessments raised from 1July 2015 to 30 June 2016

Alternative Tax Dispute Resolution (“ATDR”)

Time limit for determination in cases of disagreement with the ATDR Panel starts from the date a case is referred back to the Objection Directorate and not the date that the objection was initially lodged

This principle will apply to assessments raised by the MRA under the Gambling Regulatory Authority Act

Efficient Recovery of Arrears of Revenue

- Mauritius Revenue Authority Act will provide for enforcement actions regarding arrears of revenue to expedite recovery of debts

Refund of Training Costs

Refund of training costs will be increased from 60% to 70%

For Small and Medium Enterprises (“SMEs”), the refund will increase from 60% to 75%

Personal Taxation

Statement of Assets and Liabilities by High Net Worth Individuals

Individuals who derive income exceeding Rs15m or own assets costing more than Rs50m must submit a statement of assets and liabilities with his income tax return for the income year starting 1 July 2017

An individual who has submitted his income tax returns in the last five years will not be required to submit such a statement

Corporate Tax

Tax Deduction at Source (“TDS”)

TDS will be applied on ‘commission payment’ at the rate of 3%

TDS on rent paid to non-residents increased from 5% to 10%

No TDS on director fees

Exchange of information with other countries

- Penalties will be imposed on a person who fails to furnish information needed for automatic exchange of information with other countries

Additional assessment

Provisions regarding amended assessments will be reviewed

Objection and appeal procedure will be set out for any additional assessment raised by the MRA

Value Added Tax (“VAT”)

No VAT on the importation of capital goods exceeding Rs150,000 will be paid by VAT-registered persons but they will be required to declare the imports on their VAT returns

Consolidated list of the taxable supplies submitted electronically will now be submitted invoice-wise instead of taxpayer-wise

Penalties will be introduced to deter misuse of or tampering with an Electronic Fiscal Device

Immigration

- Occupation permit (OP) Applications

- Work permit (WP) Applications

- Mauritian Citizenship and Passport

Occupation permit (OP) Applications

5% Payment on Objection

Applicants will pay the processing fees upon the approval of their permit instead of paying at the time of submission of the application

OP applications falling under the Foreign Manpower Scheme will be processed within 5 days and the employer will pay a contribution equivalent to 1 month salary

Work permit (WP) Applications

Incomplete applications will not be entertained and will be treated as ‘missing documents cases’

The ratio of local workers to expats will be reviewed for some sections

Companies employing less than 20 individuals will not be required to advertise jobs in the press. The Employment Information Center will facilitate the process

Penalties will be applicable for late applications of WP/renewal

Payment for WP fees will be extended to 30 days

Mauritian Citizenship and Passport

The Economic Development Board (EDB) will provide two schemes to attract high net worth foreigners through contribution made to a Mauritius Sovereign Fund

Mauritian Citizenship against a non-refundable contribution of USD1m for the main applicant and an additional USD100,000 for each dependent

Mauritian passport against a non-refundable contribution of USD500,000 for the main applicant and an additional USD50,000 per passport for each dependent