Tax Alert - October 2023

The MRA releases e-invoicing legislation

In the Finance Act 2022, the Mauritius Revenue Authority (“MRA”) amended Section 20 of the VAT Act to provide for the e-invoicing system. The regulations in relation to the e-invoicing system have recently been released and the MRA has confirmed that the project will go live in early 2024.

What is the e-invoicing system?

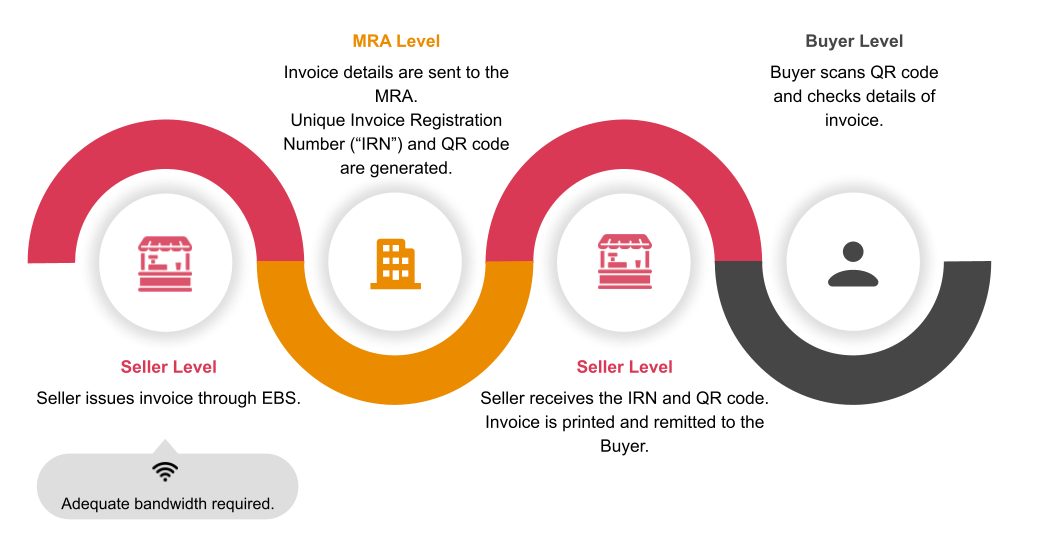

The e-invoicing system allows the transfer of billing information electronically between the buyer, seller and the MRA in real time.

With the e-invoicing system, all businesses/ economic operators will be required to generate invoices, debit notes and credit notes in electronic format through a compliant Electronic Billing System (“EBS”). Invoices generated will then be sent to the MRA’s Invoice Fiscalisation Platform (“IFP”) for fiscalisation of the transactions.

How does it work?

The below illustrates the mechanism of the e-invoicing system:

Role of EBS solution providers

Only authorised EBS solution providers can sell, rent or make available an EBS to taxpayers. EBS solution providers must thoroughly test their EBS brand and model on the MRA e-invoicing developer portal before registering themselves as authorised EBS solution providers. The list of authorised EBS solution providers is expected to be published on the MRA’s website.

Role of economic operators

Economic operators must either acquire a certified EBS from a registered EBS solution provider or upgrade their current EBS. All EBS must be registered with the MRA, to which a unique ID will be assigned.

Taxpayers will be expected to operate the e-invoicing system and issue fiscal invoices to buyers. They must also ensure that they have internet connectivity with adequate bandwidth to connect to the MRA’s IFP.

Timeline

The below depicts the different stages under Phase 3:

Our view

E-invoicing has been adopted by most continents. To date, Africa is the continent that is still lagging behind. The introduction of the e-invoicing system in Mauritius will benefit a range of stakeholders, including taxpayers, the MRA, the government and the public at large. Some of the stakeholder advantages are as follows:

- Enhanced and automated processing of invoices

- Fast tracking of VAT refunds and reduced time for tax audits

- Pre-filled VAT returns allowing for adjustments

- Elimination of VAT annexes and Statement for purchases of goods and services

- Live data collection allowing economic analysis and predictions

- Paperless storage of invoices (environment friendly)

The adoption of e-invoicing may result in initial additional costs for economic operators in terms of software acquisition/ upgrade and we look forward to tax incentives such as accelerated annual allowances or double deductions.

We welcome the introduction of the e-invoicing system as it will not only increase compliance, minimise fraud and increase tax revenue but also bring about a level playing field between businesses.