{{item.title}}

{{item.text}}

{{item.text}}

Share this page:

On 01 July 2022, the Mauritius Revenue Authority (“MRA”) issued a Communiqué1 clarifying that the income which is distributed by a foreign fiscally transparent entity to a Mauritius entity shall retain its initial character in the hands of the Mauritius entity. The MRA also confirmed that capital gains distributed by a foreign fiscally transparent entity to a Mauritian resident shall be treated as capital gains and shall not be subject to income tax in Mauritius.

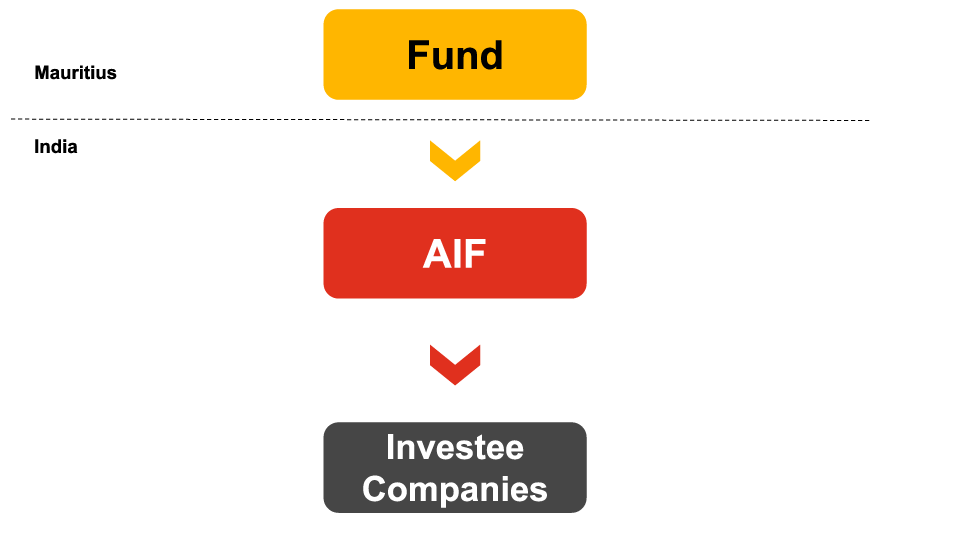

It is customary for a fund to be set up in Mauritius to invest in an Alternative Investment Fund (“AIF”) in India. The AIF would in turn invest in shares and securities of Indian portfolio companies and would derive income in the form of:

Where the AIF is registered with the Securities and Exchange Board of India (“SEBI”) as either a Category I or Category II AIF, it is fiscally transparent and has a tax pass-through status under the domestic tax laws of India. As stated in the Communiqué, any dividend income and capital gains accrued by the AIF and distributed to the fund would retain their characteristics.

Tax Ruling ("TR") 2352 deals with a Mauritius resident entity which holds a Collective Investment Scheme licence and pools funds from various investors and invests in India through AIFs Category II and Category III. The MRA disregarded the tax transparent nature of the Category II AIF trusts and ruled that income received by the AIF trusts in the form of dividend, interest and capital gains would be treated as dividend income upon distribution to unit holders. It is expected that TR 235 will soon be revoked and a new ruling issued in line with the Communiqué published by the MRA.

Under the Mauritius Income Tax Act, any distribution made by a trust is to be regarded as dividend income in the hands of the beneficiary. TR 235 initially confirmed this principle and ruled that a trust is to be regarded as a non-transparent entity. Although the domestic law is silent in this regard, the Communiqué now clarifies that a foreign trust may be regarded as tax transparent where the foreign entity has been treated as such in the foreign jurisdiction.

PwC welcomes the clarification provided by the MRA, especially as it is in line with TR 383 which confirms that there should be no transformation of income at the level of the tax transparent entity.

For more information, contact Yamini Rangasamy, Associate Director, Tax below:

Yamini Rangasamy

{{item.text}}

{{item.text}}