The Finance (Miscellanous Provisions) Act 2023

Towards a more equitable tax system

Share this page:

The abolition of the solidarity levy for individuals is no doubt the flagship amendment of the Finance (Miscellanous Provisions) Act 2023 (the “Act”). This means that local dividend is fully exempt.

Subscribe and download the full PDF for our opinion, the key measures and an infographic depicting the impact of the newly introduced tax system.

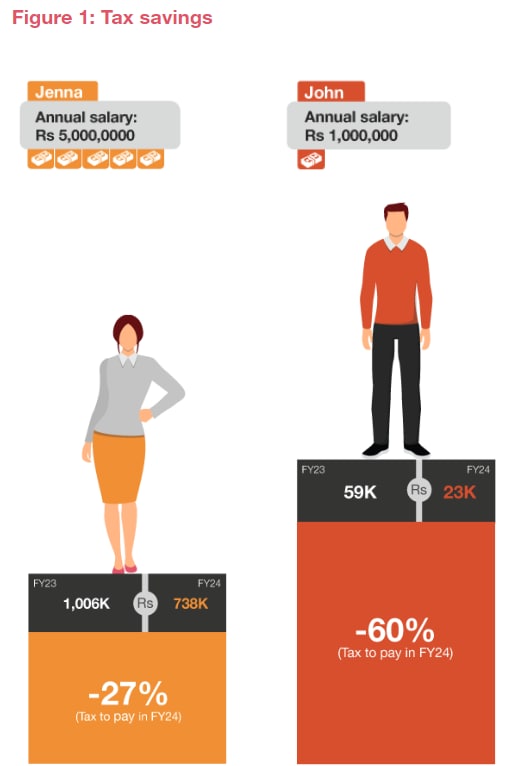

The document explains how the re-introduction of a progressive rate, coupled with an increase in deduction for dependents will result in significant tax savings for everyone.

Some of the key measures in The Finance (Miscellaneous Provisions) Act 2023 are as follows:

Personal tax - Introduction of 11 tax bands ranging from 0% to 20%

Corporate Tax - Abolishment of the incentive tax rate of 5% for Banks

VAT - Special Levy rate harmonised to 5.5% of leviable income of banks.

Other Taxes - Home Ownership Scheme - Refund of 5% of the cost of the property up to a maximum of Rs 500,000 available up to 30 June 2024.

Tax Administration - Payment to management companies exempted from TDS

Immigration - Introduction of Sustainable City scheme

We invite you to register and download our summary of Tax and Regulatory measures.

Contact us

.jpg.pwcimage.370.208.jpg)