Special Forum by PwC Mauritius and MRA to discuss the latest tax amendments brought by the Budget and Finance Act 2018

19/07/18

Ebène, 27 August 2018 – On Monday 27 August 2018, PwC Mauritius hosted a Special Forum at the Labourdonnais Waterfront Hotel, Port Louis, to discuss the tax amendments brought by the Finance Act 2018. Mr. Sudhamo Lal, Director-General of the Mauritius Revenue Authority (‘MRA’) and Mr. Mario Hannelas, Director, Large Taxpayer Department of the MRA, were our guest speakers. The debate was moderated by Mr. Anthony Leung Shing, Country Senior Partner & Tax Leader, and Mr. Dheerend Puholoo, Tax Partner, both from PwC Mauritius.

Around 100 high-profile business leaders operating in diverse industry sectors in Mauritius were in attendance for this event, where Mr. Sudhamo Lal and Mr. Mario Hannelas from the MRA discussed the various amendments recently brought by the Government of Mauritius in the Finance Act 2018. The Special Forum was in a twofold format that lasted 1.5 hours. The first part was dedicated to a panel discussion moderated by PwC, and this allowed the MRA to shed light on various key topics. In the second part of the event, the floor was opened for questions from the audience, whereby specific concerns from the business community were addressed.

The Global Business sector

- As an introductory remark, the MRA highlighted the need to eliminate harmful tax practices and the fact that the tax reforms were necessary in order to comply with the latest international standards, specifically the requirements of the OECD.

- A company will need to satisfy the conditions relating to the substance of its activities as prescribed by the Financial Services Commission (‘FSC’) in order to benefit from the new partial exemption regime. Whilst the detailed guidelines for substance are in the process of being finalised, we understand that these conditions will be in line with the provision of the Base Erosion Profit Shifting (‘BEPS’) Action Plan and may vary depending on the nature of the activities being undertaken.

- A new concept of the place of effectivement management (‘POEM’) has been introduced in determining the tax residency status of a company in Mauritius. A guideline on POEM will be issued by the MRA in due course and this will be in line with international norms.

- The partial exemption regime is restricted to certain types of income. Royalties, management fees, brokerage fees, commissions, etc do not qualify for the partial exemption regime. We understand that discussions are ongoing in order to assess the eligibility of such income streams to benefit from the partial exemption regime and the wider impact on the domestic economy.

- As a non-resident of entity, any dividend paid by an Authorised Company will be considered as foreign dividend and shall be taxable in Mauritius. Although an Authorised Company will be required to submit a return of income in Mauritius, it will not be subject to any PAYE or withholding tax (‘WHT’) obligations. An Authorised Company may be subject to audits from the MRA.

The Banking sector

- Following the Finance Act 2018, the Special Levy on banks with leviable income of less than Rs1.2bn is calculated at a rate of 5% and, for leviable income of more than Rs1.2bn, the rate is 4%. The MRA clarified that it is the first Rs1.2bn of leviable income which shall be taxed at 5% and thereafter at 4%.

- Under the current Special Levy regime, transactions by banks with global business companies are considered as foreign income and therefore qualify for the 80% deemed foreign tax credit. However, under the Finance Act 2018, such transactions shall henceforth be considered as income from residents and subject to the standard rate. As a result, the Special Levy on banks is likely to be higher than under the previous method. We understand that the MRA will undertake further consultation on this issue.

Other

- The MRA explained the introduction of electronic fiscal devices to combat tax evasion. Those electronic fiscal devices will be installed and integrated with a 3 of 4 company’s point of sales system, where a unique reference will be replicated on the VAT invoice.

- Companies engaged in the export of goods are taxable at 3%, and exports will henceforth include the sale of goods from overseas, without going through the custom control in Mauritius. The MRA further elaborated on the definition of goods and whether such items as software or data could fall within this provision. However, in view of the evolving practices in an age of digitalisation, further consultation would need to be undertaken.

At PwC, we aim to engage with both our clients and the authorities to create a platform for the exchange of ideas and perspectives. I believe this event has been successful in promoting dialogue between taxpayers and the MRA on the various tax amendments”.

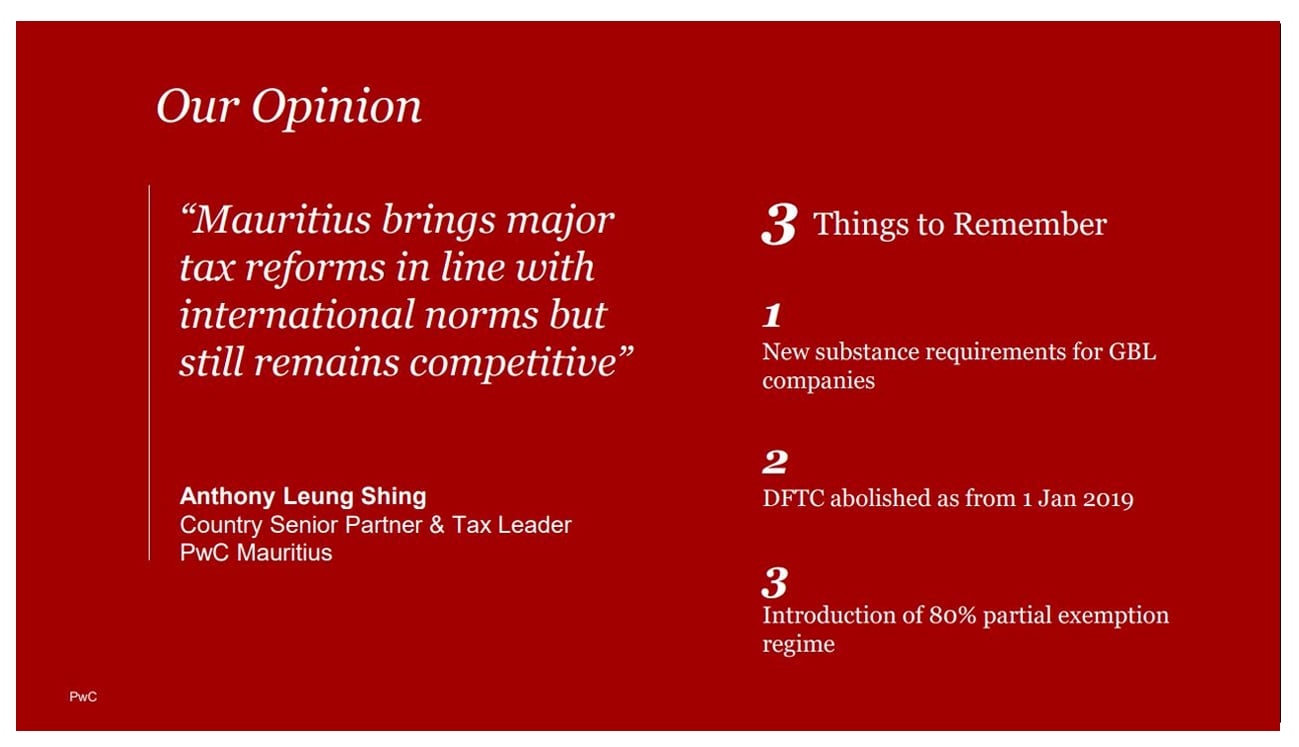

Anthony Leung Shing, who moderated the debate alongside Dheerend Puholoo, further added that “Mauritius has been under the radar of the OECD in recent years, and the Finance Act 2018 has brought about fundamental changes to our tax system. As we transition from one system of taxation to another, a lot of questions are being asked and there is a mood of uncertainty among operators. We are happy that this special forum has enabled our clients and taxpayers, at large, to raise their concerns, better understand the position of the MRA as well as obtain clarity on the amendments”.

Live Webex: Tax reforms in the Global Business Sector in Mauritius

Click here to download the presentation (PDF) used during the Live Webex on Tax reform in the Global Business Sector in Mauritius on Friday 27 July 2018

Download the presentation