{{item.title}}

{{item.text}}

{{item.text}}

Published in Mauritius Finance | April 2024 | Issue 7

Sharvin Ballah

Assurance Partner, PwC Mauritius

PwC's Sharvin Ballah spotlights Mauritius as a prime location for the booming Asset & Wealth Management sector. The island nation offers strong growth potential in Africa, a competitive edge with its infrastructure and workforce, and a commitment to regulation and innovation.

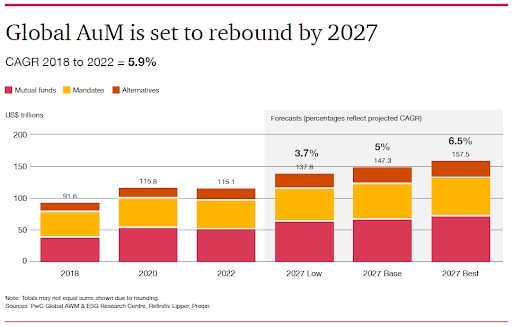

With a projected turnover rate twice the historical average by 2027, the Asset and Wealth Management (AWM) sector will thrive further by expanding in different jurisdictions. At its forefront, the sector is in need of maximising margins, prioritising people, driving differentiation and compliance to rising regulations, amongst others. Mauritius, as a prominent International Financial Centre (IFC), has demonstrated its capabilities to serve that purpose.

Expectations and hopes are higher than ever before with the Global assets under management (AuM) targeted to rebound by 2027, with expected revenues of up to US$622.1 billion, of which 50% is forecast to be generated from private markets. The increased growth in private markets is a result of increased allocations from pensions, institutional investors, and a growing interest from high-net-worth individuals.

At the same time, inflation, investments and regulatory requirements are driving up costs. It is crucial for investors to explore new frontiers from an investment perspective and Africa, in particular, appears to be an underinvested continent, presenting abundant opportunities. In absolute terms, the AWM expansion would be the fastest growing in the Middle East and Africa at a projected 6.9% CAGR.

Strategically positioned with an advantageous time zone between Africa and Asia, the Mauritian jurisdiction is highly regarded as a favourable business destination with a range of unique offerings for the AWM sector. Besides its location and strong network, Mauritius offers excellent connectivity to conduct and facilitate business with the emerging African market. The Island stands out for its political stability and low crime. In comparison to larger asset management jurisdictions, Mauritius' unique strength lies in its intimate knowledge of and proximity to the continent.

Mauritius offers excellent connectivity to conduct and facilitate business with the emerging African market.

Having transitioned from a British colony to gaining independence in 1968, Mauritius has showcased its resilience and development potential by consistently reinventing itself to adapt to economic changes. The country has diversified across sectors such as hospitality, manufacturing, and business services, currently emphasising high value financial services.

Leveraging from its historical ties with France and Britain, Mauritius boasts a bilingual and highly educated local workforce. The island’s positive economic growth stems from the exchange of knowledge, technology, and capital. Notably, Mauritius stands out as a unique jurisdiction that has navigated both French and English legal frameworks, allowing seamless operations of corporate vehicles and structures in both languages.

Mauritius’s financial services sector upholds corporate governance and international regulations through the overarching Financial Services Act (FSA) and oversight by the well-established Financial Services Commission (FSC). Globally, the island stands out as one of the very few countries which are compliant with all the 40 recommendations of the FATF, placing significant emphasis on anti-money laundering and counter-terrorist (AML/CFT) measures within a robust framework aligned with international norms and best practices.

This regulatory framework supports financial transparency and compliance making it conducive for large asset managers and high net worth individuals to enter the local market.

Drawing on over a century of banking experience, Mauritius’ financial services sector encompasses both local and international banks. These institutions offer a range of cost-effective services that have evolved from private banking to fund management and investment banking. The Mauritius IFC also hosts reputable legal firms, professional services firms and renowned management companies, which collaboratively service nearly 1000 global funds and facilitate operations for over 15,000 companies in the Global Business sector.

With a foundation of good governance practices, promising growth opportunities and a thriving financial services ecosystem, Mauritius is well positioned to attract more large international banks, asset managers and family offices and provide diverse, high-margin financial products and services that are aligned with the needs of investors.

Besides its great standing in the ‘ease of doing business’, Mauritius also ranks as one of the top African countries for quality of life. With both political and economic stability, the country provides a distinctive mix of comfort, luxury, career potential and rich diverse traditions. This makes it an ideal choice for accomplished and young professionals in the AWM sector and HNW individuals. In line with the global trend in AWM, Mauritius emphasises a people-centric approach that focuses on diversity, robust career development and work life integration. Additionally, the presence of prominent institutions such as the CFA, ICAEW and ACCA plays a significant role in nurturing professionals through continuous training and development.

The familiarity of the next generation with virtual assets can also translate into a unique mindset and appetite for investing in digital assets. Tokenisation can help to give access to private markets and for fractionalisation of ownership.

Mauritius holds significant prospects in developing its FinTech and virtual assets platform to meet the needs of these new investors. While digital banking is already prominent amongst Mauritians, a robust legal framework for virtual assets is in the pipeline. Clear definitions of virtual assets, identification of regulatory authorities and licensing requirements for service providers are crucial steps in shaping the landscape for virtual assets in Mauritius.

The jurisdiction is proactively incorporating antimoney laundering and consumer protection measures for these emerging digital assets. Simultaneously, the country is strengthening its tax legislation, supported by collaborative efforts in cross-border regulations, technology access, and regular reviews to adapt to evolving circumstances.

Among investors aged 21 to 42 in a 2022 Bank of America survey, 75% believe that traditional asset classes alone can no longer provide above average returns, whereas only a third of those above 43 hold the same view.

Leveraging on its long regulatory history and solid reputation, Mauritius stands out as a highly capable, strong, and reputable player in the industry, particularly with respect to private markets and access into Africa. Additionally, the country benefits from the strong commitments amongst all stakeholders to align their efforts and move in a unified direction. Mauritius aligns well with the preferences of international investors and is well positioned to capitalise on the opportunities within the AWM sector and further grow its financial services sector.

{{item.text}}

{{item.text}}