{{item.title}}

{{item.text}}

{{item.text}}

The market and industrial structure are undergoing major changes due to globalization, the declining birthrate and aging population. New technologies are bringing a paradigm shift to the business world at an unprecedented speed. The changes in governance in recent years have been accompanied by a gradual increase in shareholder activism, making it increasingly difficult for corporate management. In order to achieve further growth by turning the wave of disruptive changes into opportunity of creating new value, companies need to enhance their management even more than ever before in order to achieve further growth.

PwC supports our clients in maximizing their corporate value through various approaches, including providing useful information and analysis support to help CxO’s issue solving, formulate management strategies, optimize their business portfolios, restructure their businesses, and improve governance through the use of PwC’s professional capabilities.

The development of business strategies is not the goal; it must be implemented to increase corporate value. As changes in the business environment have become more rapid and discontinuous, the formulation of strategies has become more difficult than ever. In order to respond quickly to changes in the business environment, we support the formulation of strategies effectively by utilizing M&A.

Strategies alone do not improve corporate value. The key to increase corporate value lies in the ability to execute management operations that steadily implement strategies. We support the acquisition of management operations capabilities to enhance corporate value by making effective use of M&A based on judgments on the pros and cons of using M&A.

As there is a growing demand from both domestic and foreign investors to improve the return on their investments, enhancing corporate governance over individual businesses and/or group entities and also accelerating business turnover in pursuit of growth are essential. Moreover, the magnitude of uncertainty and the pace of change in the future, which are not currently visible, are doubtless increasing, leading to increased complexity in corporate management.

In such a business environment, it is essential for top management to hold multiple scenarios in view using a medium- to long-term perspective, with a clear understanding of the company's vision, such that they can prioritize investments in each business/group entity and make the right management decisions.

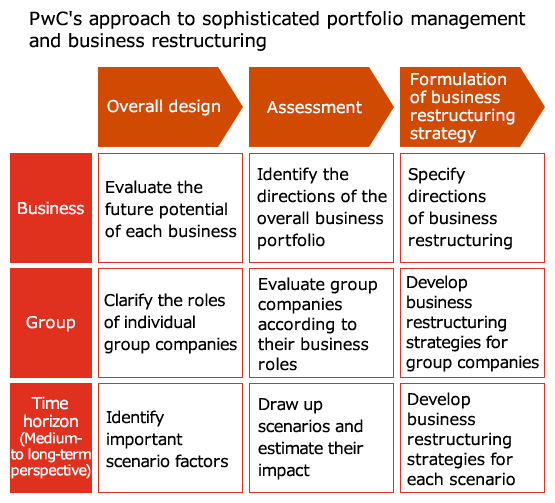

PwC assists clients in resolving their challenges by objectively evaluating target businesses and companies based on aspects of “Business”, “Group”, and “Time horizon”, according to the specific circumstances of each company, and by drafting potential directions and specific measures that can be taken.

As a corporation with many businesses and organizations that aims to achieve growth with its existing businesses or M&A, the group reorganization such as consolidation, carve-out, spin-off, spin-out and creating hold-co structure or regional headquarters is one of the effective and efficient solutions for the business management of the Group.

Under the leadership of a professional teams for the group reorganization support, we assign specialists in each operations or utilize a global network to cover a wide range of issues to be solved and provide consistent support from planning to implementation.

Amid increasingly complex and uncertain business environments, which are affected by globalization, the maturation of the domestic market, and changes in the industrial structure, among many other factors, management needs to take appropriate and timely improvement measures to address various management issues.

PwC provides highly effective support for management reforms to deal with all aspects of potential management issues, including hands-on support by stationed PwC professionals with various fields of expertise, temporary staffing of support personnel and the use of the overseas PwC network.

Low-interest rates continue to be an issue globally and uncertainty surrounding the world economy is growing. Some global corporations exposed to foreign currency risks and turbulent emerging markets have prioritized improving their financial position. On the other hand, the market continues to require growth strategies and higher returns on shareholders’ equity. In such circumstances, it is increasingly critical for the management of globally operating companies to maintain working capital at a proper level to ensure they have self-funding options and to manage the generated cash efficiently.

For survival and constant growth, transformation in fund-raising methods and financing activities is unavoidable. For many companies, an increasingly critical part of the management agenda is analyzing and optimizing working capital and managing the available cash using sophisticated methodologies.

Recent advanced analytics technologies provide opportunities for a wide range of organizations to improve their competitiveness through the use of big data from both inside and outside the company. PwC supports the performance improvement of corporates and PE funds in M&A, turnaround or restructuring situations by leveraging data analytics.

Advanced data analytics capabilities are enablers in achieving the following: (1) enhancement of subsidiaries / operations governance; (2) high-resolution business analysis and a shift to data-driven management; and, (3) business model and operational restructurings.

{{item.text}}

{{item.text}}

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC

Chief Executive Officer and President, PwC Advisory LLC