View this page in : 日本語

Service Overview

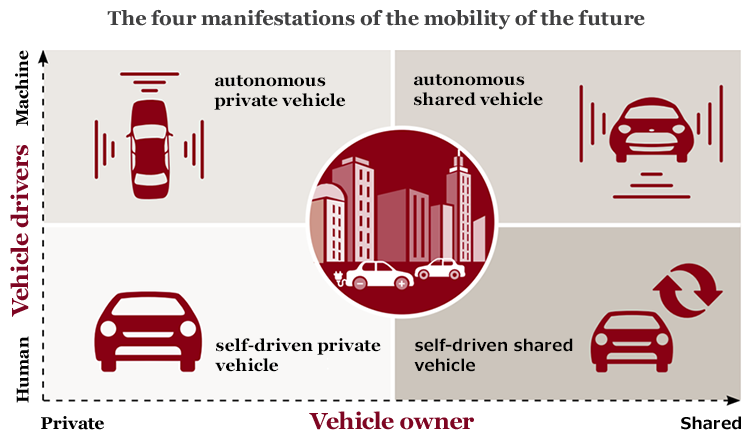

With advances in CASE (Connected, Autonomous, Shared & Services, Electric) technology, the automotive industry is entering a once-in-a-century transformational period. With this, financial institutions that provide automotive loans and leases are also facing the need to re-examine their business models in order to survive as a business.

Situation

Auto manufacturers, IT companies, and governments are already moving towards the realization of a “mobility society”.

Many auto manufacturers have already announced their next-generation vehicle strategies with 2025 on the horizon. Research & development and alliances are accelerating, with laws also being drafted to accommodate a mobility society. As we move from an era of selling cars to an era of providing mobility services using cars, financial institutions are facing the need to search for new business opportunities.

Complication

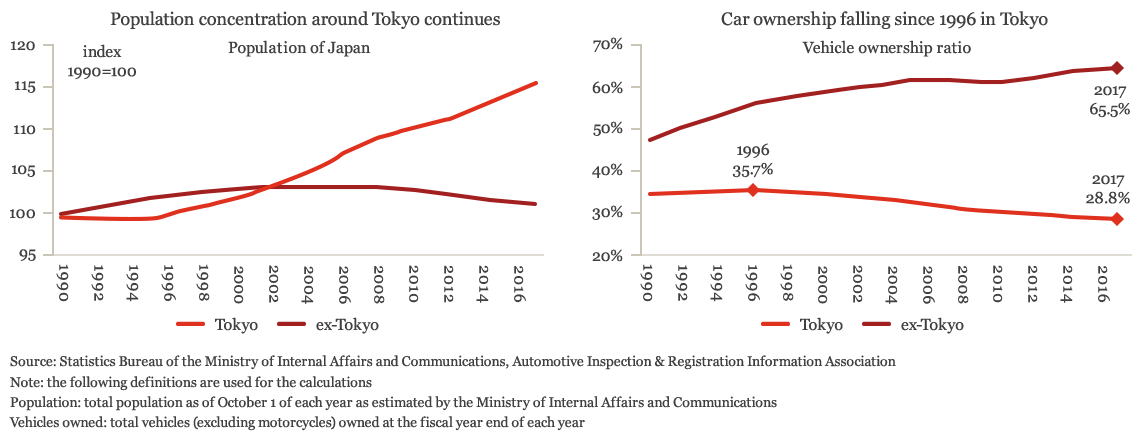

With a fall in both population and domestic car sales, current businesses are facing the risk of revenue decline. New services need to be created to offset this risk.

An aging population and decreasing birth rate is causing the population of Japan to fall. The population is also increasingly becoming concentrated around Tokyo, which has a lower ratio of car ownership. Automotive sales and the supporting sales finance market are therefore expected to shrink in size. With prolonged negative interest policies, commission revenues are also falling. On the other hand, with financial deregulation and the acceleration of digitalization, consumer needs are diversifying.

Under such conditions, the current sales finance business based on leases and loans may become unviable in the future for financial institutions. What new services can financial institutions offer in a future where mobility and Fintech services become commonplace? This is likely to become the key.

It is important that companies understand their strengths, envision the role they want to play in a future mobility society, and determine what new segments they want to enter.

Resolution

There is a need to envision a future society where mobility services and ID related businesses become the norm, and create a new business model that accommodates such a future

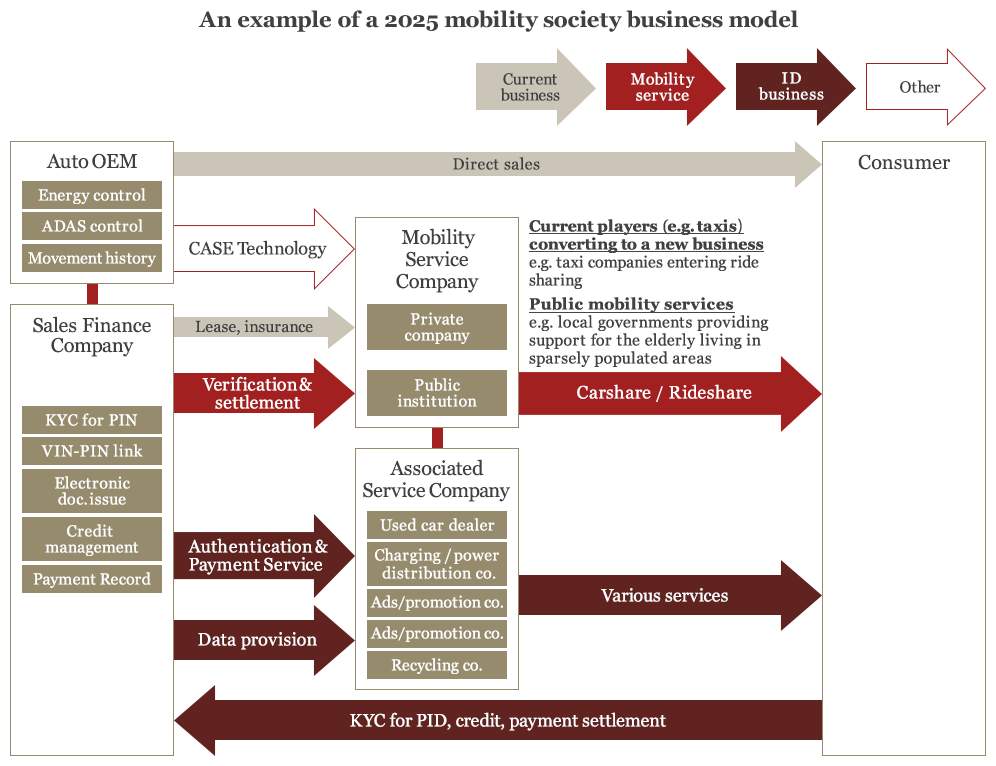

Proposing new services with mobility service companies as the customer

While private car ownership is expected to decline, car demand from mobility service companies is expected to expand. Customers are likely to include not only taxi and rental car companies that convert to ride sharing and car sharing, but also public institutions that aim to provide public mobility services such as aiding the elderly in sparsely populated areas or boosting tourism. It is therefore important to be able to propose financial services for a diverse group of mobility service companies.

Creating a new business model based on the expected linkage of IDs

In a mobility society based on connected and autonomous driving technology, we expect ID businesses (associated services arising from the linkage of the vehicle (VIN) and the individual (PIN)) to expand. By linking the movement & maintenance history of the vehicle with an individual’s ID, credit, verification & settlement data, financial institutions can using datalakes and AI to analyse the data, establish a new business model (targeted advertising, promotions, services, advance settlements) and secure a new source of revenue.

Clarifying alliance strategy and optimizing investment

With the automotive industry entering a transformational period, there are numerous new areas where one can invest in. To fully utilize the resources of the company, however, one must be selective and concentrate their investments. Companies must consider investments that play to their strengths, and alliances to augment their weaknesses. Many auto manufactures, IT/technology companies, and start-ups are competing to find new business opportunities in the mobility services and associated services arena. An alliance strategy that crosses industries is therefore important.

Anticipated new businesses and services in the future mobility society

Businesses where changes are expected

- Auto finance companies

- Auto manufacturers

- Mobility service companies

- Local government institutions

- Advertising & promotion companies

Services where changes are expected

- Mobility services such as car sharing

- Infrastructure support services for ID verification and payments

- Data utilization services such as those using datalakes

- Marketing and promotion services based on user data

Our Approach

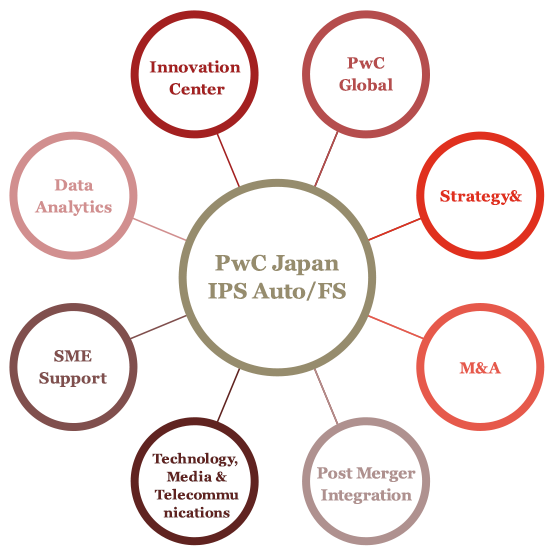

We provide a wide range of support services, from developing strategies to determine areas of focus to designing and executing specific plans

We provide many services including: a) conducting catalyst sessions to creatively imagine the future, b) developing business models, c) identifying new entry areas for financial institutions, d) identifying potential alliance partners and assisting in negotiations, e) developing operational models and processes needed to enable execution of plans, and f) goal setting and designing corporate governance structures.

Why PwC?

We are able to provide a highly effective services based on our deep understanding of the leasing, credit, and automotive businesses based on our rich experience supporting both financial institutions and auto manufacturers. Through our PwC global network, we are also highly knowledgeable in areas like operations reform and M&A support.

Contact us

Our Team

Partner, PwC Consulting LLC

Director, PwC Consulting LLC

Director, PwC Consulting LLC