New Era Demands New Thinking

In complicated conditions, organizing principles matter. When a disparate array of circumstances present themselves, the advice frequently comes, “Connect the dots.” Many of us will recall puzzle books from childhood where “connect the dots” brought us to a solution that showed a line drawing that revealed the puzzle’s theme, the unifying concept that makes sense of an otherwise confusing array of facts.

Real estate as an asset class has matured. Market participants need to realize this and make the appropriate adjustments.

- 1. Intensifying Transformation

- 2. Easing into the Future

- 3. 18-Hour Cities 3.0: Suburbs and Stability

- 4. Amenities Gone Wild

- 5. Pivoting toward a New Horizon

- 6. Get Smart: PI + AI

- 7. The Myth of “Free Delivery”

- 8. Retail Transforming to a New Equilibrium

- 9. Unlock Capacity

- 10. We’re All in This Together

- Expected Best Bets for 2019

- Issues to Watch in 2019

- Record-Breaking Costs from Natural Disasters Help Catalyze a Focus on Building Resilience

1. Intensifying Transformation

The diversity of investor goals and choices is healthy—far healthier than the herd behavior that has sometimes characterized markets. As an international investment fund executive told us, “The differentiation of opportunities has—to a degree— expanded; niche product types like senior housing and selfstorage are being viewed as ways to ‘round out’ real estate holdings, taking advantage of specialized uses that are not ‘averaged out’ in major trends.” Many interviewees pointed to the

2. Easing into the Future

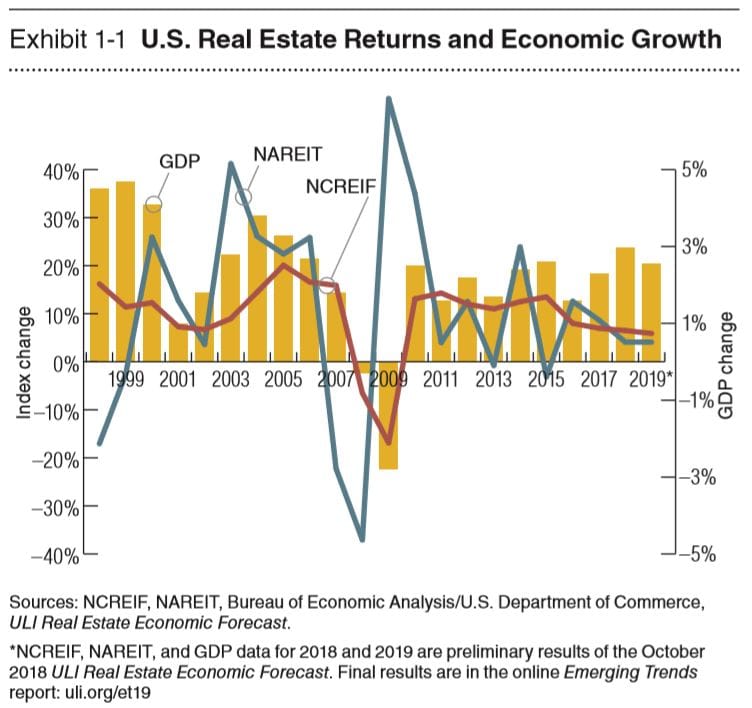

Mining the potential for productivity improvement is the missing link to sustained or enhanced economic growth in a labor-short era. The temporary bump provided by the tax stimulus in 2018 notwithstanding, growth since the global financial crisis has been moderate at best. The key reason appears to be disappointingly low productivity growth. Last year in Emerging Trends, we addressed this issue as “Working Harder, Smarter.” Despite the obvious need stemming from the “double whammy,” U.S. research and development (R&D) spending has dropped to 0.7 percent of gross domestic product (GDP), down from over 1.2 percent in 1976, according to the American Association for the Advancement of Science.

3. 18-Hour Cities 3.0: Suburbs and Stability

Economic growth also appears to be on the side of 18-hour cities. While the prior trend laid out a future where the economy could experience slower average growth in the future, those 17 markets at the top of this year’s survey appear to be clearly ahead of the national average when it comes to growth. The projected average annual population growth over the next five years in the 17 markets is 1.3 percent compared with 0.7 percent for the United States as a whole, while projected five-year annual employment growth is 1.2 percent compared with 0.6 percent for the United States.

4. Amenities Gone Wild

For decades, the term amenity creep has been current in the hospitality industry. In the Travel Industry Dictionary (yes, there is such a thing), it is defined as “the tendency of hotels to add new perks and features in an effort to attract more clients and respond to competition.” In an era when concierge service is being offered in apartment buildings, offices, and even retail establishments, real estate in general needs to think about this topic. We might need to think about the direction and staying power of real estate competition based upon amenities beyond those typically provided in the past.

5. Pivoting toward a New Horizon

A number of factors are combining to create this transitional pivot point. The first is the size of the U.S. real estate market, which is an enticingly large target: As of the end of 2017, the U.S. Bureau of Economic Analysis says that the real estate industry represents 13 percent of U.S. GDP. The second is that the target market is diverse, with most real estate companies operating within only a few segments of the overall industry. With this level of fragmentation, there is certainly no clear leader in the real estate technology business. This appears to play right into technology’s knack for fomenting consolidation. Third, opportunities for success appear to be unlimited. Real estate technology has the opportunity to touch virtually every aspect from fintech to proptech, from supply chain logistics to end user convenience, from manufactured building components to workplace productivity, from data analytics to tailored amenities, and more.

6. Get Smart: PI + AI

While it is difficult to predict exact job changes, the examples already discussed show that the potential for AI to influence how we work is significant. Forrester Research estimates that by 2027, AI could affect up to 25 percent of the daily tasks performed by every job category, ultimately enhancing the personalized intelligence (PI) of future workers. For example, although secretarial and administrative jobs, which have been steadily disappearing for years due to automation, are projected by the U.S. Bureau of Labor Statistics (BLS) to see a further 5 percent decline (192,000 jobs) by 2026, office-using occupations such as information clerks and customer service representatives, who will be users of AI in their daily tasks, are expected to increase of about 5.5 percent (270,000 jobs). Likewise, the BLS anticipates a 12 percent gain in computer and information services managers (44,200 jobs) and a 10 percent rise in the number of property and real estate managers (32,000) jobs by 2026, jobs that will be using proptech tools, including AI.

7. The Myth of “Free Delivery”

Although e-commerce growth has put B2C shipping in the limelight, B2B parcel delivery still accounts for twice the volume of goods traffic in the United States. Fleets of panel trucks arrive at business locations at the very times when streets and sidewalks are most crowded, adding to the costs of shippers and transportation companies. The total costs are enormous, affecting not only businesses directly but also all taxpayers as public budgets pay to fix problems. Some numbers: over five years, congestion costs to business are estimated at $240 billion; spending on maintaining America’s roadways is $68 billion annually, just 37 percent of what is needed to prevent further deterioration.

8. Retail Transforming to a New Equilibrium

In an important way, the shift from simply merchandizing goods to providing space for services and “experiences” is no fad: it reflects the distribution of consumption spending across the economy. Excluding items such as vehicles and gasoline, consumption spending on durable and nondurable goods totaled $2.8 trillion at midyear 2018. Services spending amounted to $4.6 trillion, once “nonstore” services like transportation, housing, utilities, and recreation are set aside. Clearly, the trend in retail leasing to accommodate urgent-care medical facilities, health and fitness providers, restaurants, financial services, and entertainment venues matches the way consumers are spending their dollars in ways that traditional malls and power centers did not.

9. Unlock Capacity

Nationally, though, rising levels of unaffordability are largely a function of underproduction at all price levels except for luxury housing, both ownership and rental. National Association of Realtors (NAR) data on affordability show that, since 2015, the combination of rising single-family home prices and upward pressure on mortgage rates has triggered a 15 percent decline in its affordability index. The National Association of Home Builders estimates 2018 single-family housing starts at 900,000, which is 400,000 units shy of sustained demand.

10. We’re All in This Together

Sensitivity to ESG issues has increased for U.S. real estate with the public decision of the current U.S. administration, in 2017, to withdraw from the Paris Agreement, although this decision cannot be formally implemented until 2020. Real estate has been proactive on sustainability issues for many years and, as a matter of self-interest as well as social responsibility, is moving ahead to advance its sustainability performance regardless of the direction of national policy.

Expected Best Bets for 2019

Industrial development.

The expansion of e-commerce is far from over, and the need for facilities to accommodate a denser distribution network is acute and will only increase over time. Warehouse/distribution vacancy is at a historic low, as one senior adviser noted in his interview. While ports and hub cities still play key roles, infill opportunities give “last mile” break-bulk sites—even multistory properties—a chance to join the party. Barring a trade war of serious proportions, industrials offer great risk-adjusted returns.

Garden apartments.

While the multifamily sector registered an overall NCREIF total return of 6.38 percent, the garden apartment component was near a double-digit total return at 9.33 percent. Appreciation in value accounted for the overperformance in the garden apartment group. Pricing for garden complexes reflects a higher-yield 5.7 percent cap rate, compared with 4.9 percent for mid-to-high-rise properties. The strong move toward secondary and tertiary markets, and the return of interest to suburban assets—especially by private equity—bode well for these multifamily assets.

Quick-flip value-add deals.

It’s all about timing, and interviewees from both the institutional and entrepreneurial realms see late-cycle opportunity. The window of opportunity is narrow— the ability to execute by 2020 is key. And the geographic focus needs to be in markets where assets have not yet been priced to perfection. These are mainly second-tier markets in the South and Intermountain states. Affordability to middle-market tenants—both commercial and residential—describes where underserved demand can be satisfied. This is not low-hanging fruit by any definition; but for yield-oriented investors with turnaround expertise, such deals are right in their wheelhouse.

Redeployment of obsolescent retail assets.

Many shopping center properties are just not going to come back as successful retail assets. But while few have been reduced in price to mere land value, many are well below replacement cost and have good locations for alternative uses. If a site is sufficiently large, mixed use is a great option for close-in suburbs looking to exploit maturing millennials’ desire to enter their next life-cycle phase. There also is an opportunity to turn the tables on the e-commerce trend that fostered the obsolescence by redevelopment into distribution facilities.

Issues to Watch in 2019

Insurance.

Last year, we presented data showing the increasing incidence of natural catastrophes, most due to climate change, since 1980. The evidence of floods, wildfires, and violent storms in 2018 indicates that the risk has been intensifying. That means that property/casualty insurers and reinsurers are experiencing massive payouts, and they will be pricing this into premiums going forward. Having adequate coverage and budgeting for increased operating expenses should definitely be high on the list of items that property owners need to watch in 2019.

Cybersecurity risk management.

Over the past several years, the vulnerabilities that come with interconnectedness have become more and more obvious. This has affected governments, retailers, and utility systems, and extends deeply into the property sector as the “internet of things” turns common building components and systems into gateways to cyberspace. REIT interviewee highlighted a need to establish industry norms and best practices for both primary defensive purposes and for evaluating risk/reward parameters stemming from technology.

Infrastructure.

As a public policy priority, the anticipated focus on America’s infrastructure needs has evidently been placed on the back burner. That does not mean that infrastructure is less of an issue, and its deficiencies are impactful for real estate. The American Society of Civil Engineers provides details not only on the multitrillion-dollar shortfall in investment in key assets, but also the costs that affect business. By 2025, the United States sacrifices $3.9 trillion in GDP and $7 trillion in reduced business sales. Failure to address the issue means 2.5 million fewer jobs created and a shortfall of household income of $3,400 annually. Congestion and delays along the supply chain add to greater costs of doing business, and there also is the added event risk that comes along with potential catastrophic failure in roads, bridges, dams, and transit systems.

Immigration.

The draconian approach to border security is a massive self-inflicted wound with immediate negative economic consequences and long-term weakening of our national growth potential. Emerging Trends has addressed the consequences for the labor markets in previous years. Now, the impacts on demand growth going forward, the reduction in the baseline for real potential GDP growth to less than 2 percent annually beginning in 2023 (according to the Congressional Budget Office’s forecast), and the implications for bringing the nation’s fertility rate below population replacement level should all give us pause. And, as a knock-on effect, these consequences reduce the U.S. comparative advantage as a place for inbound investment in real estate and could see other world cities become capital magnets, eclipsing key American markets

Complacency.

One key risk toward the end of economic cycles is the supposition that expansion will persist well into the future. It seems self-contradictory, but many take comfort in the adage that turning points are impossible to predict and that no trigger for a downturn is now apparent on the horizon. At present, however, it seems that rather than a single trigger, there is an accumulating number of risks that interact with each other (labor shortages, a flattening yield curve, a potential asset bubble on Wall Street, tariff and trade tensions, ongoing geopolitical risk) and argue for greater defensiveness. The decline in real estate transaction volume seems to say that investors as a group are pulling back in the face of such concerns. But even while that is happening, cap rates not only have trended low but also are convergent (with just a 30-basis-point differential between offices, retail, and industrials at midyear 2018). At current cap rates, risk premiums are so thin that is likely that many deals are pricing risk too cheaply. That mispricing becomes apparent once recession strikes—and that is not a question of if, but rather when.

Record-Breaking Costs from Natural Disasters Help Catalyze a Focus on Building Resilience

Natural disasters in 2017 cost an estimated $306 billion in the United States, shattering previous records because of hurricanes Harvey, Maria, and Irma. The high cost of U.S. events is reflected in the fact that insurers covered a record $135 billion globally in 2017, and the United States made up roughly 50 percent of the total payout in comparison to a typical 30 percent.

While it is impossible to ever be fully prepared for an extreme storm like Harvey, real estate developers, investors, and local governments are increasingly looking for strategies to reduce the likelihood of damage from major events. Concerns about potential increasing insurance costs, and reduced federal resources for disaster recovery, also are growing. As a result, interest in the concept of resilience—the ability to prepare and plan for, absorb, recover from, and more successfully adapt to adverse events—has broadened in both the private and public sectors. This growing focus on resilience is being driven by several factors:

Increasing risk:

Climate change is contributing to an increased frequency and intensity of storms, with trends indicating that 2017 is unlikely to be the most expensive year for long. Beyond storms, other climate change impacts also present risks: nearly 25 percent of the NCREIF’s Property Index value is in those cities among the 10 percent most exposed to sea-level rise. Extreme heat also is likely to affect the real estate industry. For example, Europe’s 2018 heat wave led to notable infrastructural impacts, such as the temporary shutdown of nuclear plants.

Potential for decreased property values:

While many high-risk areas still have relatively strong market values, regional studies have identified areas where property values have decreased due to flood risk. While many of these studies have focused on single-family residential, the lessons are still applicable. A 2018 Harvard study of Miami–Dade County determined that properties at lower elevations are gaining value at a slower rate than those at higher elevations. In 2018, the First Street Foundation reviewed 9.2 million real estate transactions, comparing coastal and flood-vulnerable properties to those at higher elevations, and determined that flood-vulnerable properties in New York, Connecticut, New Jersey, Florida, South Carolina, North Carolina, Virginia, and Georgia had lost $14.1 billion in value between 2005 and 2017. This includes $6.7 billion from the tri-state area alone.

Opportunities for market differentiation:

As investors, tenants, and homebuyers express increasing concern about exposure to extreme weather, some real estate developers have embraced resilient design as a market differentiator. Approaches can include the elevation of buildings or mechanical elements, incorporation of backup or passive power sources, building hardening and enhanced wind preparedness in hurricane-prone areas, and the incorporation of green infrastructure and landscape design to absorb water during routine and peak events.

Investments and incentives from the public sector:

Many cities are seeking to enhance resilience through requirements, incentives, and incorporation into zoning and building codes. For example, in spring 2018, Houston’s city council made the first changes to flood regulations in ten years, requiring new construction and retrofits to be two feet above the 500-year floodplain. Some cities are also seeking to set an example via investments in resilience for capital projects or public infrastructure. Miami Beach is currently investing $600 million to elevate roads and pumps to combat sunnyday flooding, and in 2018, New York City reissued Climate Resiliency Design Guidelines to inform the design of all city capital projects.

Expanding opportunities:

Resilience is a burgeoning field, but research on the impact of resilience investments is nascent. Still, some investors in resilience are projecting longterm gains in value and near-term reductions in operating expenses. For example, investments in resilience may make properties more attractive to Class A commercial tenants due to the better likelihood of business continuity. Shorter-term operational savings may include reductions on insurance premiums. Investing in resilience may also become an effective part of a community engagement strategy and help limit local opposition to a project. Numerous new tools are in development to both enhance building-scale resilience, and track and measure resilience. For example, GRESB’s Resilience Module, the U.S. Green Building Council’s RELi standard, and the nationally applicable Waterfront Edge Design Guidelines all launched in 2017 and 2018

Capital Markets

The world as presented in Economics 101 is clear and distinct, an ideal (and, indeed, idealized) construct. The world in which we live—including the capital markets—not so much. In the world of our daily activity, numbers count but, on their own power, do not determine decisions. That is a matter where judgment can—and should—influence action. Behavioral economists including pioneers Daniel Kahneman, Amos Tverski, and Richard Thaler have famously distinguished between “econs” (the wholly rational decision-makers and actors posited by classical economic theory) and “humans” (the rest of us).

The volume of capital is not constrained. The key is finding projects that can be executed using that capital.

- The Debt Sector

- The Equity Sector

- Summary

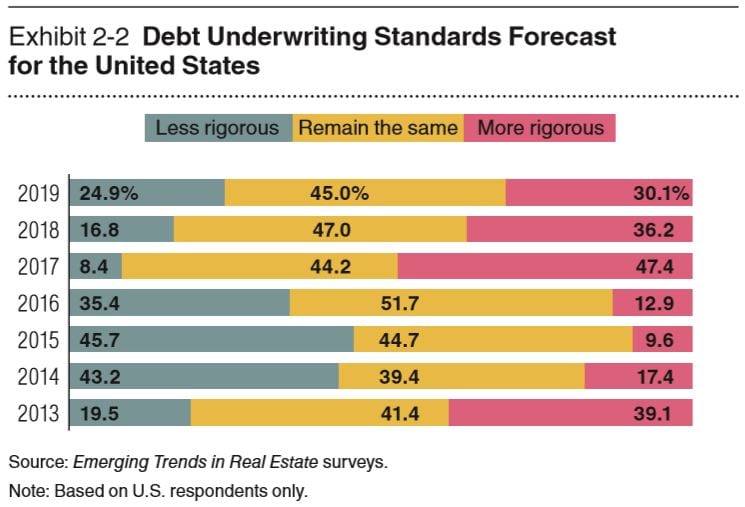

The Debt Sector

The long and gradual return of the real estate industry to a degree of vigor beyond the expectations at the start of this decade has come in large measure through lending discipline and prudence. This, it must be candidly acknowledged, is the fruit of the painful lessons of overly ebullient behavior in the early 2000s, behavior that mispriced risk in lenders’ spreads, the rigor of borrower credit analysis, and, most particularly, unachievable projections on the part of underwriters. Remember the push to “get the money out the door” and the term “the Niagara of Capital”?

Although we seem to be in little danger of a repeat of the global financial crisis, one of our Emerging Trends interviewees spoke for many when he ironically commented, “I seem to have heard once that real estate was a cyclical industry.

The Equity Sector

While a pattern of convergence can be discerned among lenders (as we noted last year, “everyone is getting into everyone else’s business”), equity capital providers are looking to identify their particular strengths and play to them. Thus, a pattern of selectivity, focus, and specialization paints a somewhat different picture from what we see in the debt space.

As discussed below, capital providers including the institutions and cross-border investors are becoming relatively less active. Core properties in major markets are scarcer to identify as acquisition targets and, when found, are breathtakingly priced. Low returns in such deals do nothing to help meet yield targets, especially for investors like pension funds and insurers’ equity portfolios that must produce earnings sufficient to meet long-term funding liabilities. International investors are becoming comfortable with some opportunities beyond the primary markets, but do not consider the large number of secondary markets as being equally desirable. One investment manager put it this way: “While gateway markets have grown more competitive and transparent, high-growth secondary MSAs create potentially less competitive conditions. Nashville, Atlanta, Seattle, and Dallas are benefiting from fundamental demographic and economic shifts.”

Summary

Real estate professionals would never denigrate quantitative analysis, and our industry’s access to and reliance on data have never been stronger. Yet, few experienced participants in real estate—on either the debt side or the equity side—would ever unthinkingly yield their ultimate investment choices to algorithms. We understand that the need for the Resolution Trust Corporation and for the massive interventions required in 2007–2010, and policies in place years thereafter, did not arise because “people didn’t know how to do math.” Indeed, those who sliced and diced the numbers were so impressed with their own wizardry, and dazzling in their “creative financing solutions,” that common sense and good judgment were washed away in the euphoria.

Fortunately, the complex trends in the capital markets, discussed in this chapter, give ample reason to think that judgment and independent thinking are more active this time around. The very patterns of convergence in the debt market being nuanced by patterns of divergence in the equity space constitute a sign that the vaunted herd instinct of markets is being held in check. With heavy volumes of capital at the ready, the pullback in transaction volume beginning in 2015 reflects investors’ collective determination not to repeat the mistakes of the recent past.

In times of conflicting signals, innovation is often the result of wrestling with vital issues. As is true in other contexts, it is the problem-solving environment that promotes creative solutions, not the problem-free environment. From contemporary problemsolving in the real estate capital markets, we can expect to discern some of the longer-term trends emerging for the next decade of property investment.

Markets to Watch

Growth appears to be in vogue for 2019. Emerging Trends in Real Estate® survey respondents favored markets with potential for more growth over the traditional gateway markets. An investment adviser mused, “At this point, I don’t expect any potential correction to be significant, so I’d rather be in markets that bounce back quickly.” As the economy and real estate expansion prepare to stretch into another year, the market does not feel the need to get overly defensive and move into markets that are often perceived as safe havens in a down market. In fact, the opposite is true to a certain extent. An institutional portfolio manager offered, “At this point in the cycle, I am willing to go out a little ways on the risk spectrum, but the turnaround needs to be relatively quick. My thought is these faster-growing markets may be the best place to find those opportunities.”

Maybe it is time to reevaluate how we think about markets. It may be time to move away from the old stereotypes. In this cycle, we have seen so-called supply-constrained markets overbuild and ‘boom/bust’ markets show great restraint.

- 2019 Market Rankings

- South: Central West

- South: Atlantic

- South: Florida

- South: Central East

- Northeast: Mid-Atlantic

- Northeast: New England

- West: Mountain Region

- West: Pacific

- Midwest: East

2019 Market Rankings

2019 Market Rankings Survey respondents continued the theme toward more 18-hour markets in the top 20:

- Dallas/Fort Worth returns to the number-one spot in the 2019 survey. The chief economist for an institutional investor remarked that Dallas/Fort Worth is an interesting market, one with the potential for strong future growth but also with the liquidity of a gateway market.

- Survey respondents appear to still be interested in markets adjacent to gateway locations, with Brooklyn moving all the way to number two. Also supporting Brooklyn’s rise in the survey is an increased interest in urban industrial.

- Florida is a noteworthy story in this year’s survey: Orlando is in the top five, Tampa Bay/St. Petersburg is in the top ten, and Miami and Fort Lauderdale are both ranked in the top 20.

- Raleigh/Durham and Nashville round out the list of this year’s top five.

- Texas again has three markets in the top 20, as Austin and San Antonio join Dallas/Fort Worth.

- Boston remains in the top ten and is the highest-ranked gateway market in the 2019 survey. The gateway market story has movement in both directions. Los Angeles slipped slightly from last year but remains in the top 20. The biggest movement of a gateway market is the return of Washington, D.C., to the top 20 list. D.C. regularly appeared at the top of the market list during the early years of the recovery, but concerns about overbuilding cooled interest in recent years.

South: Central West

The South’s Central West region markets are expected to have some of the strongest demographic and economic performance in 2019. Emerging Trends in Real Estate® survey respondents feel that this performance will offer good investment and development opportunities in the Texas markets and in Oklahoma City and fair opportunities in New Orleans.

The 2019 population growth rate in Austin is projected to be over three times the national rate while the rate is forecast to be over two times greater in Dallas/Fort Worth, Houston, and San Antonio. The rate of growth in population in Oklahoma City is expected to exceed the U.S. average, and is an area of growth that the market would like to see expand. While the rate of population growth in New Orleans is below the U.S. rate, the market has experienced positive net migration over the past five years. As one would expect, net migration has also been positive in the other markets in the region. Dallas/Fort Worth, Houston, and Austin all attribute in-migration as a key to their recent success.

South: Atlantic

“Carolina markets continue to see a population influx . . . a lower cost of living and employers see the quality of the labor force.”

The Emerging Trends in Real Estate® 2019 survey respondents like the opportunities in the South’s Atlantic region. All 11 markets that make up the region are ranked in the good potential for investment and development. Opportunities are expected to be readily available in Raleigh/Durham, Charlotte, and Atlanta. The region reflects several trends we have been following for the past several years: the continuing attractiveness of primary markets like Atlanta; the rising attractiveness of nonprimary markets such as Raleigh/ Durham, Charlotte, and Charleston; and the increased interest in markets adjacent to gateway cities such as northern Virginia. A new twist is that 2019 also marks the return of the District of Columbia into the group of top markets.

South: Florida

People are surprised when they discover the diversity that exists in a number of the larger markets in the state.”

The Emerging Trends in Real Estate® 2019 survey respondents clearly feel that the ten Florida markets have fully rebounded from the disruption caused by the global financial crisis. The outlook for real estate investment and development is good in nine of the markets, with excellent opportunities in four of the markets. Demographic growth, a friendly business climate, and an attractive cost structure are factors contributing to the positive outlook for Florida.

South: Central East

“Nashville continues to attract capital from all over the world. Outside money is willing to pay higher prices than local capital.”

The South’s Central East region is somewhat bifurcated, with Nashville, which has become a perennial top-ten Emerging Trends in Real Estate® survey market, and the other four markets that make up the region. While Nashville continues to outperform the national average in a number of demographic and economic measures, 2019 survey respondents also feel that opportunities exist in the other markets as well. The survey respondents see the investment and development potential for all markets in the region as good or fair.

Northeast: Mid-Atlantic

“Philadelphia and Pittsburgh are showing that they have unique attributes that deserve attention.”

The Emerging Trends in Real Estate® 2019 survey respondents feel that investment and development prospects are good in most of the markets in the Mid-Atlantic region. The region is seeing a continuation of a trend that we first mentioned last year. Markets adjacent to gateway markets are seeing increased interest as gateway markets as investors and developers look for returns in less competitive cities.

Northeast: New England

“Boston is at the center of a number of real estate trends like redevelopment, technology, and sustainability.”

The respondents to the 2019 survey continue to feel that Boston will be a good place in which to invest and develop in the coming year. In addition, the respondents feel like Boston will offer a number of opportunities. The survey results also reveal the idea that the same respondents like the potential for investment in Providence. The other markets in the region are considered fair locations for investment and development in 2019.

West: Mountain Region

“The quality of life offered in the Mountain region should continue to be attractive to millennials looking to start families.”

The markets that make up the Mountain region continue to exhibit strong demographic and economic growth. The comparatively low cost of living and of doing business is attractive to new residents and conducive to employment growth. The Emerging Trends in Real Estate® 2019 survey respondents see the good to excellent investment and development opportunities in most of the markets in the region.

West: Pacific

“We expect the economy of the coastal cities to continue to evolve but are confident the knowledge base will be a constant.”

The markets in the Pacific region are again popular with respondents to the Emerging Trends in Real Estate® survey. Respondents to the 2019 survey feel that investment opportunities are good in all 12 markets in the region and that development opportunities are good in 11. Local market respondents also feel that in 2019 investor demand will be particularly strong in eight of the 12 markets and good in the remaining four.

Midwest: East

“Investors who take the time to look continue to be surprised by the number of hidden gems they can find in the region.”

Emerging Trends online survey respondents ranked the 2019 investment and development opportunities as good for the eight markets located in the Midwest’s East region. Despite the region’s slower demographic and economic growth rates, survey respondents like the educated and productive workforce along with lower business and living costs. Local market respondents feel that the markets in the region offer significant investment and development opportunities that may actually exceed the current level of investor demand.

Property Type Outlook

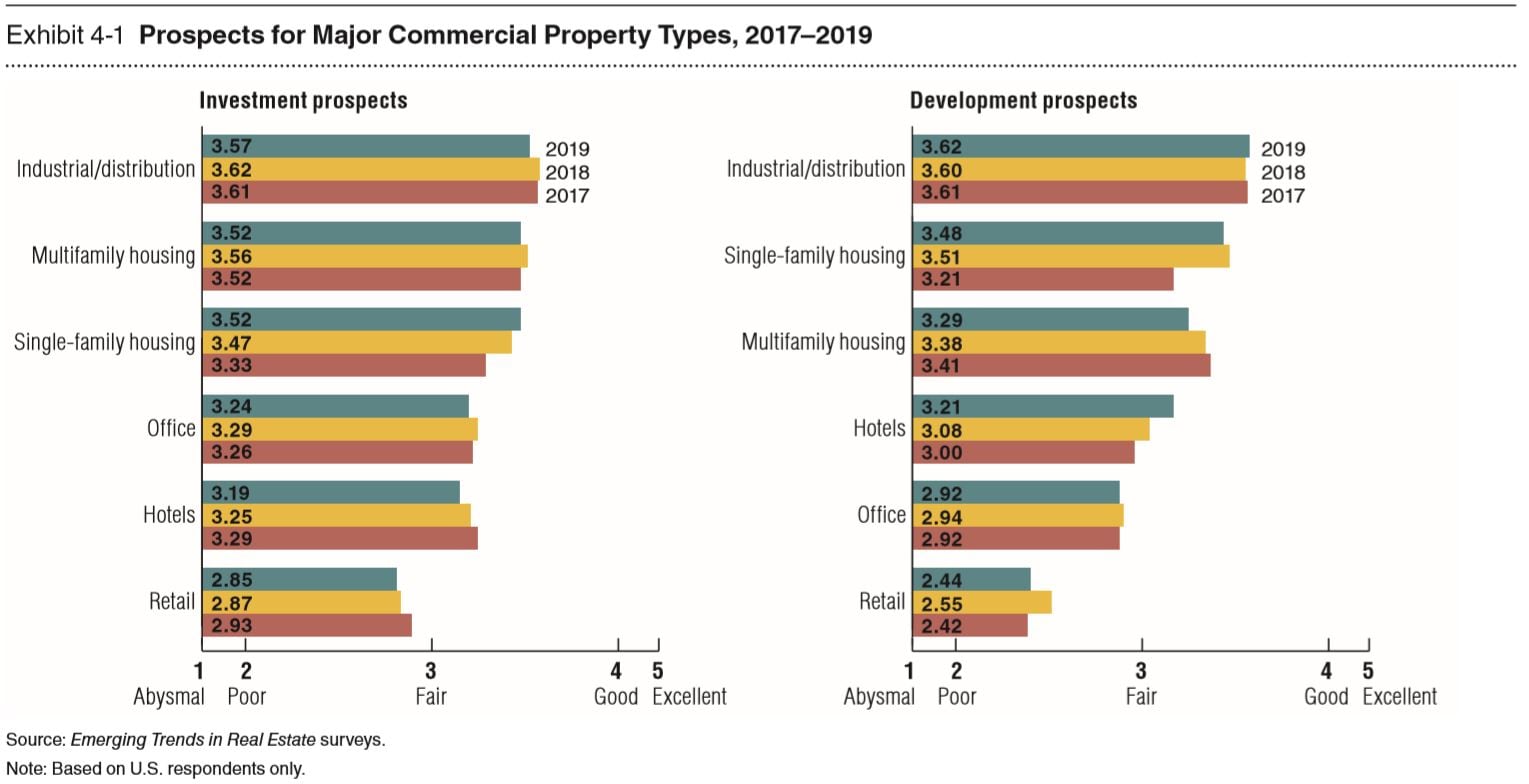

Given the differences in demand drivers among property types, and the variation in the supply cycle for each, the degree of agreement, or common perspectives among developers, investors, and managers, on the outlook for the coming year or two is extraordinary.

For the short term, the theme appears to be “happy days are here again.” At 2020 or beyond, the sense of an ebullient future rapidly evaporates. Perhaps this is not such a surprise, since our interviews and surveys were executed just as the nation’s gross domestic product (GDP) spurted to an annualized 4.1 percent growth rate and the unemployment rate dipped to 3.9 percent. The propensity to expect those measures to strengthen, however, was sharply arrested by the awareness of a long cycle nearing its end and by the awareness of structural shifts not only in the economy, but also in the real estate industry itself.

The pace of change in all property types makes investing more complicated today. There is more investment committee discussion about the future viability and/or adaptability of properties

- Industrial

- Single- and Multifamily Overview

- Apartments

- Single-Family Homes

- Office

- Hotels

- Retail

Industrial

Logistics real estate remains the consensus overweight among investors thanks to a compelling story of cyclical and structural factors that have united to deliver superior returns.

A long and broad-based economic expansion has generated demand from the makers, movers, and sellers of goods who need to get product to ever-discerning consumers around the world. The rapid growth of e-commerce, accompanied by technological advancements such as predictive analytics, has forged a mind-set shift among consumers and businesses for unprecedented levels of service. The gold standard is the trifecta of faster delivery, greater product variety, and consistently in-stock inventory. The result of this shift is a spike in demand for logistics space, especially at the consumption end of the supply chain.

Single- and Multifamily Overview

In 2018, housing’s $26.4 trillion business complex ecosystem of supply and demand forces answered—unequivocally—two big questions, and raised two more, probably as important.

The good news first: Young adults do and will value, work for, and attain the American dream of homeownership after all. More than one of every three homebuyers these days is 37 or younger. Questions as to millennials’ broad and deep embrace of owning—albeit almost ten years later in life than prior generations due to a number of mostly financial factors—seem to have been resolved. We can see it in recent data from the U.S. Census Bureau: millennials experienced the largest gains in homeownership rates among all age groups in 2017.

Apartments

Three matters of interest eclipse all others among decision makers who will shape the trends in multifamily rental investment, development, and construction over the next 18 to 36 months. One is a source of marvel and eager anticipation; one pitches most multifamily business stakeholders into deep fits of anxiety; and the third might well be a blend of the other two. Consider them separately, although in real life they connect, interweave like a triple helix of genetic information, and influence one another over time.

The place to begin is by acknowledging and appreciating an anticipated pivot point in the multifamily market. The eight-year post–Great Recession run-up in huge opportunity—with commensurately benign levels of risk—has, in large part, run its course. Multifamily business leaders have at last consumed— for the moment, anyway—the low-hanging fruit of a market that had been starved of development for more than a decade prior. With astonishing efficiency, design and engineering aplomb, effective marketing, and unprecedented margins, developers met a sudden and sustained surge of higher-end customer needs in America’s high-velocity urban markets. This has helped seed a now-flourishing trend of renters-by-choice of all ages, income and wealth levels, and geographical areas

Single-Family Homes

Ready or Not?

Housing’s business community of investors, developers, builders, and their partners obsesses today over two words that represent one year: twenty-twenty.

Add to these favorable forces the fact that the United States has thus far been building new homes at levels lower than any seen since the mid-1990s, when the population was 20 percent less than it is now. Evidence would suggest that housing’s recovery could yet have plenty of headroom for growth. Still, a premonitory uncertainty crops up in nearly every discussion about what lies just beyond the horizon of the next 24 or so months. The two words—twenty-twenty—conjure for every stakeholder the fullest appreciable sense of both where one’s firm is today and how the options stack up against one another near or beyond that bright horizon line.

Office

U.S. office investors continue to transact in a fairly balanced market. Office vacancy has remained near 13 percent for the past two years as new supply meets demand. With rents up by only 1.3 percent in the past year, the office sector is ranked fourth of six property types in the Emerging Trends survey for investment prospects in 2019, and fifth for development prospects—similar to its rankings in last year’s Emerging Trends.

However, significant variances exist by market as the tech industry continues to lead leasing trends. While the majority of markets continue to experience positive absorption, San Jose, San Francisco, Seattle, and Washington, D.C., accounted for 45 percent of total market absorption in 58 markets in the first half of 2018. Office supply is also concentrated in a few markets, with 41 percent of new office product under construction in just four markets—New York, San Francisco, D.C., and Seattle. With the exception of D.C., these markets have generally maintained high central business district (CBD) occupancy rates.

Hotels

As an asset class, hotels appear to be holding their own with investors, both from a return-on-investment perspective as well as a development perspective. While development cost and acquisition pricing concerns remain top-of-mind for a majority of the investors surveyed, strong operating fundamentals continue to balance the overall view on the sector. Comparisons to prior cycles remain a focal point of many conversations, albeit with investors tending to coalesce around the sustained strength of the current cycle. Other trends, including the changing lodging sector landscape and changing physical programming, have also become subjects of investor interest.

Retail

The so-called retail Armageddon might be grabbing headlines, but the retail industry is more robust and diversified, with consumers having more options readily at their fingertips than at any other time in memory. Consumer spending is growing, and consumers’ choices are expanding, often by pivoting to more efficient platforms that maximize price and convenience. A clearer picture of the complexities of the retail landscape is emerging. As a veteran retail executive said, “Retail is doing fine; bad retail and bad retail development are not!”

The CEO of a major West Coast shopping center developer and owner said, “The media always confuses malls with outdoor shopping centers . . . they lump these together and interchange them when they talk about the death of retail projects. They are perpetuating the myth of the death of all brick-and-mortar retail.”

Emerging Trends in Canadian Real Estate

There has been change before. But now the pace of change is too fast to comprehend.

- Industry Trends

- Property Type Outlook

- Markets to Watch in 2019

- Expected Best Bets for 2019

Industry Trends

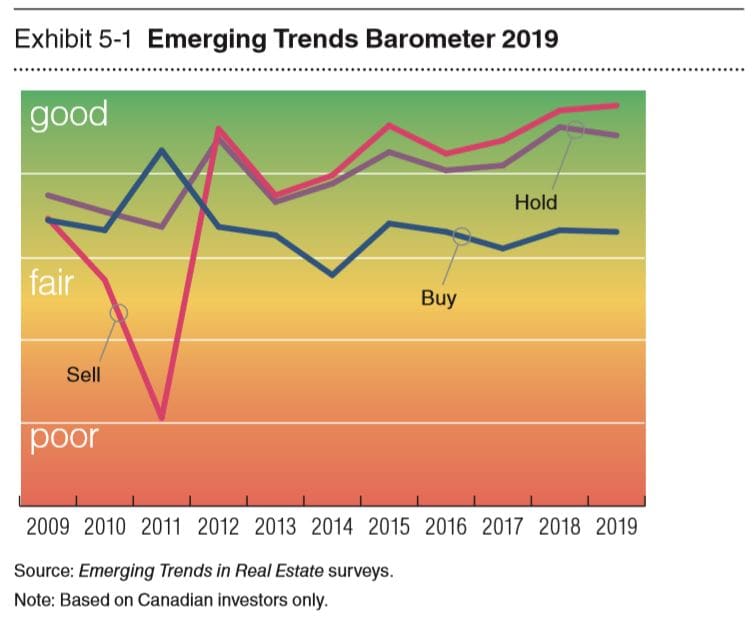

Rebalance: Redevelopment and Partnership Trends

"We’ll be more prudent with our acquisitions and our allocations for real estate because the valuations have reached their peak.”

Reassess, rebalance, and redevelop. For real estate investors, finding good deals has become a challenge. Capital is plentiful and pushing up prices on the best opportunities, so survey respondents plan to focus on improving, redeveloping, or selling assets rather than buying. Across the industry, investors are seeking to optimize portfolios to produce stronger yields. In this environment, success will come from being able to make decisions, pivot toward new opportunities, and act quickly. At this later stage in the cycle, investors want to “be more creative.” One interviewee said that a competitive market requires “agility

Property Type Outlook

“You will see a lot more experiential retail. You need to give people a reason to go to a retail location.”

Survey respondents have ranked retail real estate investment and development prospects relatively low, but stably, over the past three years. The popularity of e-commerce usually gets the blame for the softening retail market, but many forces are at play, including changes in consumer preferences, shifting demographics, and the maturity of the retail sector.

The suburban big-box segment of the market is feeling the biggest challenges, but malls have also been grappling with the closure of anchor stores. The disappearance of retail icons has created new opportunities for landlords, including backfilling with more resilient anchor tenants or using nonretail tenants to generate foot traffic. There also is a trend toward redeveloping urban malls by intensifying sites with mixed-use properties that combine retail with high-density residential, restaurants, community services, green space, and experiential attractions like gyms and movie theatres. It’s all about finding creative solutions to take advantage of opportunities in evolving markets. For example, one GTA-based shopping center is considering a long-term plan to convert some of its parking lots into mixed commercial and residential space.

Markets to Watch in 2019

Toronto

“The affordability issue is not going away.”

With net immigration into the GTA hitting a 15-year high and pent-up demand for housing, Toronto edged out Vancouver as the top market to watch this year. According to the CBoC, the local construction sector is on track to record its tenth straight year of growth in 2019, with gross domestic product (GDP) growth forecast to reach 2.4 percent in 2018 and 2.3 percent in 2019.

Vancouver

“Time to be cautious and opportunistic.”

Vancouver’s economy is forecast to grow 2.3 percent in 2019 after seeing 2.9 percent growth in 2018. Overall, the region’s real estate fundamentals look good, and even after years of price increases, interviewees said that “Vancouver continues to defy gravity” in terms of commercial investment prospects. But the market may yet come back to earth, with interviewees noting that they are being more cautious and selective when looking at new opportunities to invest or develop

Montreal

“The Quebec market has been a popular target for investors and developers after years of suppressed demand.”

Montreal’s economic growth is forecast to reach 2.2 percent in 2018 and 1.9 percent in 2019 after posting a 17-year high in 2017 of 3.7 percent, according to the CBoC. New construction continues to change the dynamic of Montreal’s central business districts and skyline.

Ottawa

“We need to dream a little bit bigger and be more ambitious.”

As its economy diversifies, Ottawa is contemplating a bigger future. Local survey respondents viewed their market positively, third only to Toronto and Vancouver. With a new light-rail transit system and a focus on intensification, construction activity can be found in every corner of the city.

Winnipeg

Winnipeg’s economy continues to perform well: GDP will grow 2.3 percent in 2018 and gain a further 2.1 percent in 2019, according to the CBoC. The city’s housing remains affordable by national standards, and inventory of all types of new homes has crept above the long-term averages, even as net migration inflows are strong by historical measures.

Construction will start this year on residences in a $400 million, four-tower downtown project, which will include office and retail space, a hotel, and underground parking. Both of the office and retail towers are already under construction. In the industrial sector, sales remain strong, with several large deals occurring in the northwest and east ends of the city. But the southwest continues to struggle with both limited sales and leasing prospects.

Quebec City

“Owners and managers alike are seeking a lot from their side to improve the customer experience.”

According to the CBoC, Quebec City’s economy is forecast to grow 2 percent in 2019, and interviewees remain confident. One noted that there was “a lot of competition” for assets compared with previous years, and another planned to make significant investments in the coming year to take advantage of increasing supply and opportunities.

Halifax

Halifax is set to deliver steady performance in the near term, with growth forecasts of 1.9 percent in 2018 and 1.8 percent in 2019, according to the CBoC. Halifax’s downtown has seen an unprecedented boom in recent years, and the city is working to redefine its core with a growth strategy that includes prioritizing people over cars.

Saskatoon

The Saskatoon market is on the upswing. According to the CBoC, after posting 2 percent GDP growth in 2018, the region is forecast to grow by 2.3 percent in 2019. At the moment, the city is taking advantage of relatively strong economic conditions as it seeks to spur development. Local councilors hope that by approving $120 million for a bus rapid-transit system that will cross the city, they will be able to foster the development of mixed-use “transit villages” along the new corridors. Construction of the system could commence in 2019 and be completed within three years.

Edmonton

According to the CBoC, the city’s economy was poised to grow 2.8 percent in 2018 and to expand 2.2 percent in 2019. Revitalization of the city’s downtown core continues with construction of the MacEwan Centre for the Arts, redevelopment of the old Molson brewery building, construction of Edmonton’s ICE District, and work on the new Valley Line LRT.

Calgary

The CBoC expects Calgary’s economy to grow 2.3 percent in 2019 after hitting 2.9 percent GDP growth in 2018. Now that the city is seeing increased confidence as the oil and gas market starts its recovery, the wheels are in motion in the real estate market in Calgary.

Expected Best Bets for 2019

Warehousing and Fulfillment

Warehousing and fulfillment represent the top development prospects among survey respondents. With the increased need for last-mile delivery and e-commerce facilities, logistics and fulfillment continue be a major opportunity for creating value. As tenants look for increasingly larger spaces, vacancy rates are tightening and rents are rising.

Senior Lifestyle Housing

Among the top development prospects with survey respondents is age-restricted housing, which one interviewee described as “a rising tide that can’t be denied.” With the number of Canadians over age 65 having surpassed those under age 15 for the first time in the 2016 census, several interviewees cited the development opportunities for senior lifestyle housing. While the development boom could lead to oversupply in certain markets, such as the GTA, interviewees across Canada predicted that demand would generally be strong.

Multifamily Market

As the cost of entering the housing market makes homeownership an increasing challenge, Canadians will continue to turn to multifamily options as an affordable alternative. Our survey results reflect that trend, with respondents citing it as a top development prospect. Statistics Canada has been reporting brisk activity for building permits for multifamily dwellings. It reported a record $3.1 billion in multifamily building permits for May 2018. Interviewees cited multifamily rental prospects as being particularly strong.