{{item.title}}

{{item.text}}

{{item.text}}

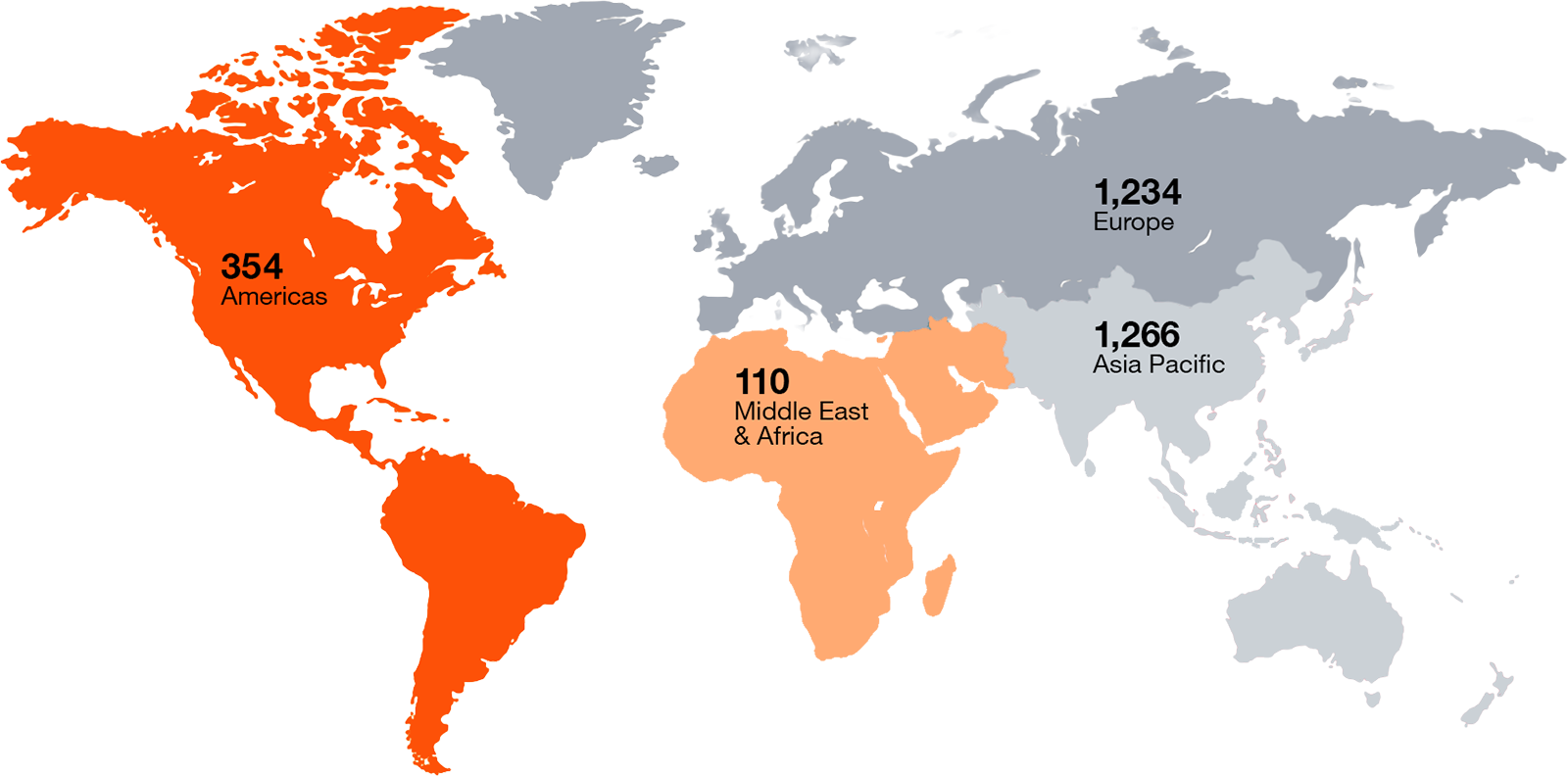

PwC Corporate Finance is the #1 Global M&A Advisor by volume of deals announced for H1 2022 to H1 2025 as recorded by Bloomberg, Mergermarket and LSEG. We deliver unmatched M&A expertise across Southeast Asia through a global network of 2,900+ specialists in 60+ territories.

Our team of experienced, execution-focused investment bankers work with your team throughout the deal lifecycle to create, preserve, and realise results that make an impact for all types of businesses–from global multinational corporations and regional mid-sized companies to fast growing early-stage startups.

With our extensive industry capabilities, global network reach, local market knowledge and proven track record in advising on domestic and cross-border deals, we will work with you and guide you through the complex deal issues you may encounter at every stage of the deal process.

The Corporate Finance team develops and fosters relationships with our clients at both shareholder and senior management levels, helping us gain a solid understanding of our client's strategic priorities.

We advise on optimal sale and fundraising structures, identify and approach potential buyers/investors, prepare the necessary marketing materials, manage the due diligence process, provide valuation advice and assist with negotiations through to the completion of the transaction.

Our services include:

Our services include:

We help clients identify and evaluate potential acquisition targets, provide valuation advice, assist with negotiations, manage the due diligence process and assist with the procurement of acquisition finance.

Our services include:

Our services include:

{{item.text}}

{{item.text}}

Gregory Bournet

Partner, Corporate Finance Leader, PwC Malaysia and Vietnam, PwC Malaysia

Tel: +84 902 583 336