The asset and wealth management (AWM) industry’s revolution is well under way. Assets under management (AuM) are increasing, as are costs and revenues. But even though costs have gone up, they have not risen as quickly as revenues for multiple reasons, including economies of scale and the slow adoption of new technologies. However, as investor and regulator pressures build and companies invest in infrastructure and talent, costs are likely to begin creeping up.

Executive Summary

Against this backdrop, asset and wealth managers are experiencing significant pressure on profitability in certain regions of the world, with other regions expected to feel the impact in the years ahead. Managers are also dealing with unparalleled challenges and developing opportunities presented by intense fee pressure, product innovation, the continuing realignment of existing distribution channels, and the development of new ones. This paper outlines our predictions for management and performance fees from now until 2025 and identifies how managers should react.

Consistently high-performing markets and managers, new wealth from emerging markets, and positive net flows have driven the increase in AuM, which has, in turn, helped fuel revenue growth. However, firms haven’t been able to consistently boost profits. Although AuM is set to grow through 2025, pressure on profitability will intensify, too. Managers who haven’t yet made drastic changes to their operating models will need to do so in order to win, or even to survive.

According to the analysis we performed on the annual reports of 64 asset managers covering more than US$40tn in AuM, the overall ratio of revenues to AuM declined by 9.81% between 2012 and 2017. At the same time, the average ratio of costs to AuM decreased by 15.36%, largely as volumeper-unit costs decreased because of growing AuM. This has resulted in an increase of 15.91% in average operating margins. However, it’s important to note that not all managers have experienced this rate of increase. The gains have been limited to certain large managers and a broader number of niche managers. This is proof that in the coming years, only those that truly embrace a transformation agenda and create value for investors will be successful.

We estimate that fees are likely to continue declining through 2025. This trend will be influenced by the continued rise of passives and newer low-fee products like smart beta, increased investor and regulatory scrutiny of the value for money that managers provide, and new fee models in the active space that focus on performance.

In line with the trends we identified in our recent paper Asset & Wealth Management Revolution: Embracing Exponential Change (“Embracing Exponential Change”), we outline here four foundations on which managers can build a target operating model to protect or even improve profitability:

- 1. Articulating value for money:

- 2. Strategic positioning – what’s the plan?

- 3. Transform through technology – or be eliminated:

- 4. AWM – fight the battle for talent:

1. Articulating value for money:

Investors are looking to the AWM industry to provide value for their money. The constant introduction of new regulations amid competitive developments in the market will push managers to be even more efficient and to lower pricing. Outcome-based fee structures have also begun to transform the active landscape. Passive players have begun to feel the sustained pressure of low-margin products and move into new areas, such as smart beta. Many are also expanding into alternatives, providing the barbell investment exposures a lot of investors now seek. Fees for alternatives have been more resilient, but market pressure is leading to more innovation, as seen with outcome-based fees. Managers need to focus on articulating their value proposition.

2. Strategic positioning – what’s the plan?

Regulatory and compliance burdens are driving up costs at the same time that investor and regulatory scrutiny is forcing fees lower. Managers need to ensure that investment products and related services are continuously updated to align with investors’ wants and needs, which forces firms to refocus on strategic positioning. Managers must decide whether they’ll operate as scale or niche players. Either choice means changing certain things about the business – by determining the product range, target markets and distribution channels – and striving for operational excellence. Many firms will struggle in the coming low-fee environment, and those without a clear strategic positioning plan will be more likely to fail.

3. Transform through technology – or be eliminated:

Advances such as artificial intelligence, machine learning, data harvesting and processing, and robotic process automation have begun to drive the quantum leap we spoke of in Embracing Exponential Change. There is potential for these technologies to create efficiencies and cut costs, particularly in the front office and in sales and service. Managers that have yet to double down on technologies and analytics that enhance the investment process and the distribution function will fall behind.

4. AWM – fight the battle for talent:

Firms need techsavvy talent in a broadening array of positions, and younger workers increasingly seek companies that reflect their values, challenge them, and offer both work and life opportunities. The AWM industry will need to fundamentally change its culture to entice new talent to join and help upskill current talent. Also, managers will need to replace siloed working groups with integrated, multiskilled teams. These changes will come with costs but also will produce value in the long run.

AWM revolution: four transforming trends

In Embracing Exponential Change, we identified four trends that are revolutionising the AWM industry. We believe managers must understand, analyse and act on these interlinked trends.

- 1. Buyers’ market

- 2. Digital technologies: Do or die

- 3. Funding the future

- 4. Outcomes matter

1. Buyers’ market

As low-cost products continue to gain market share and large players keep outdistancing the majority of the industry with innovative products, technological capability and geographic reach, firms need to be creative and disciplined. They can develop products that fill market voids, as long as their other capabilities are, at a minimum, competitive

2. Digital technologies: Do or die

The AWM industry is a digital laggard. Firms should tap technology to create a single state-of-the-art platform to help them from front to back. Companies with siloed teams, limited automated advice capabilities and an insufficient understanding of the broadening role of technology will fall behind.

3. Funding the future

The AWM industry continues to play a vital role in filling financing gaps. Managers are becoming more involved in various new, and in some instances more available, asset classes, including peer-to-peer lending, trade finance and infrastructure financing. As a decline in defined benefit plans drives growth in defined contribution plans, the pursuit of alternative products is creating significant market demand.

4. Outcomes matter

Actives, passives, smart beta and alternatives are becoming building blocks for multi-asset, outcome-driven strategies. Large firms are creating multi-asset strategies, while small and midsized firms are acting as suppliers of the building blocks. The multifaceted nature of this changing marketplace creates opportunities for firms of all sizes and investment styles – as long as the focus is on delivering consistent, superior investment returns.

1. Landscape

Price competition exists in every mature industry, and others have long made use of tactics like early-bird discounts, volume discounts, loyalty discounts and reduced pricing on certain products to facilitate cross-selling of others. The asset and wealth management (AWM) industry is beginning to catch up. As pricing concerns become a reality, a renewed focus on investment performance will become the key selling point. At the same time, technology in the form of automated advice and client service will become a necessity. In our view, as this occurs, the industry will undergo significant consolidation in certain developed markets, with up to 20% of the firms currently in existence either being acquired or eliminated.

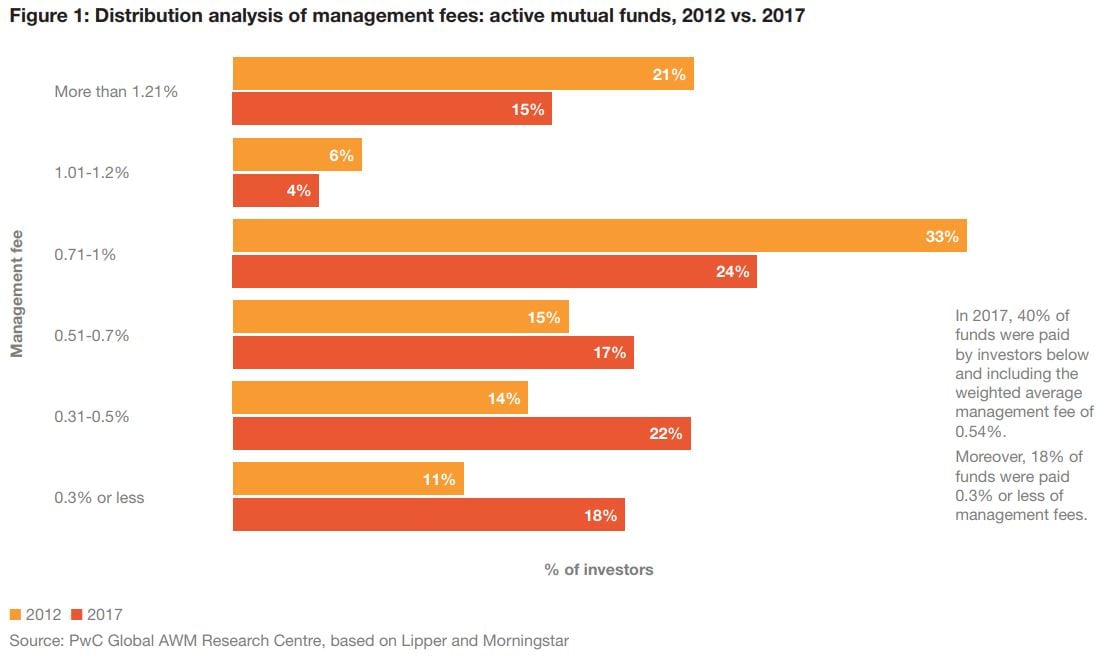

As detailed in our recent paper Asset & Wealth Management Revolution: Embracing Exponential Change (“Embracing Exponential Change”), we expect AuM, current conditions prevailing, to increase to US$145.4tn by 2025. But mounting fee pressure (see Figure 1), a shrinking number of distribution channels and a focus on investment performance will continue to disrupt business models. Challenges lie ahead, but there are also extraordinary opportunities for talented, focused strategic managers to thrive.

The amount of assets under management (AuM) has increased faster than revenues, and managers have been feeling sustained pressure on their fees. Passives are dominating the price war with actives, but active managers are striking back by charging less and creating new fee models.

- Traditional fund fees to fall by close to 20%

- Active mutual fund fees in Europe and Asia to drop most

- Passive fees: race to the bottom

- Alternatives: move to outcome-based fees

- Total expense ratios will continue to fall faster than management fees

- Traditional revenue-to-AuM ratio to decline by 22.4% as assets soar

Traditional fund fees to fall by close to 20%

The year 2017 set another record for the industry. Global AuM reached US$98.1tn, an increase of 53.7% from 2012. However, the overall revenue pool grew by only 38.5% in the same period, indicating the decoupling of AuM growth from revenue growth. We anticipate that revenues per AuM for traditional long-only managers are set to fall from 0.40% in 2017 to 0.31% by 2025.

This decrease in revenue to AuM will result from declining mutual fund fees. Mutual funds’ average asset-weighted global management fees will decline by almost 20% by 2025, reaching 0.36% globally. We estimate that the fee drop will be steepest before 2021 but then will flatten as investors and managers align on interests and value for money. Investors’ search for diversification and increased yields will sustain the popularity of alternatives, but we estimate that average management fees will also decline – between 13.1% and 16.4%, depending on the asset class, according to the PwC Global AWM Research Centre.

While many managers have needed to enhance their target operating model to keep their current margins, focusing even more on cost-effective operations, including producing alpha and managing risk, not all have done so.

Active mutual fund fees in Europe and Asia to drop most

Active players’ management fees will decline by 19.3%, reaching 0.44% in 2025. However, the pace will differ vastly across regions. The drop will be slowest in the US – where fees are already at the lowest levels globally – and fastest in Europe, with prices for active mutual funds expected to fall by 26.0% between 2017 and 2025. This steep decline is anticipated as the Markets in Financial Instruments Directive II (MiFID II) becomes more entrenched, investor scrutiny grows, and the shift to low-fee products continues. We’ve already seen the effect of regulation on prices in the UK, where the introduction of the Retail Distribution Review (RDR) caused active management fees to fall by 25% between 2012 and 2017.

It is important that investors understand headline fee rates and where this fee is earned. New transparency has revealed that a significant proportion of current management fees is paid to intermediaries that have a direct relationship with end clients. This is particularly prevalent in Europe and Asia. The introduction of MiFID II and the move towards more direct-toclient channels will probably cause fees for intermediaries to decline.

In the US, high cost structure and inadequate technology, along with shifting product preferences, are confronting the traditional broker model. Independent brokers with low-cost operating models, open-architecture investment platforms and up-to-date technology are seeing strong growth, as are registered investment advisers that are technologically enabled and more focused on model portfolios than on single products.

We believe Asia-Pacific will also see a steep fee drop, with average asset-weighted management fees decreasing by 24.6% between 2017 and 2025, to reach 0.43%. Asia-Pacific is dominated by price-sensitive institutional investors and high-net-worth individuals, whose demand for more from their asset managers at lower cost will drive this decline. Lower prices are also one of the leading drivers of the consolidation that the Asia-Pacific market is experiencing. Additionally, the prevalence of low-fee products such as money market funds and exchange-traded funds (ETFs) in retail-driven markets, such as China and Japan, is driving fees lower.

Passive fees: race to the bottom

Passive funds continue to see strong inflows, buoyed by record equity market performance. Institutional investors are surging to passives, in part because these products offer transparency and low fees. In recent years, North American and Western European retail investors have begun to increase allocation to the passive market, particularly in the rapidly growing area of defined contribution. We anticipate this trend will continue around the globe. Rising demand for passives has intensified competition among all players, including active, alternative and traditional long-only.

Amid intense competition and minimal differentiation capabilities, we believe that by 2025 management fees on all passive asset classes will decline by 20% or more from their already low level. Our forecasts show that between 2017 and 2025, average global asset-weighted passive fees will drop by 20.7%, to reach 0.12%. Given low margins in passives, scale is key and large players will find it far easier to operate profitably. Price remains the key differentiating factor among traditional passive products.

The passive ‘race to zero’ has long been a topic of discussion in the AWM industry. But the finish line has never been closer. One mega-manager’s recent launch of two index-tracking funds with zero fees shocked the industry. Some public firms’ shares fell within hours of the announcement, even though this wasn’t the first time that passive managers have dropped fees to zero. Leaders of the pack have previously used the strategy to attract assets and scare away competition. We believe that this development will reshape the entire passive landscape, as more competitors will need to follow suit or risk losing investors.

Other large passive asset managers have already started to take action: some have slashed prices multiple times this year, and others launched ETF platforms with no transaction fees. But it’s unlikely we’ll see all passive funds move to zero. Instead, managers may use zero fees on select funds to cross-sell other alpha-focused products and ancillary services. We have already seen more recent entrants into the passive industry focus on smart beta or active strategies in an ETF wrapper to differentiate their offering and protect fees.

Alternatives: move to outcome-based fees

Global alternatives AuM grew 67.3% between 2012 and 2017 and is set to reach US$21.1tn by 2025 because of continued institutional investor interest and increasing retail investor interest in this segment. The often-talked-about alternatives fee model of 2/20 has become more elusive since the global financial crisis ten years ago. Within hedge funds, for example, 40% of all funds set up in 2017 had management fees of 1% or less, and more than half of funds launched in 2017 had average management fees below 1.36%. Although averages may be deceiving because asset classes often have different fee rates, including lower fees for so-called founders’ shares, we foresee average hedge fund management fees falling 15% by 2025, to 1.16%. For stronger, consistent performers that have pedigree, fees may not fall.

The same trend can be observed in real estate funds, where more than 75% of funds launched in 2018 had management fees of 1.5% or less. Average management fees for all real estate funds were at 1.44% in 2017. We forecast that these management fees will slide a further 13.1% by 2025, to 1.25%. Private equity (PE) funds have been very resilient. Average fees stood at 1.86% in 2017, with 68% of funds launched at 2% or higher. In 2018, 59% of all PE funds launched stood at 2% or above. However, an in-depth analysis tells a different story. Large PE funds charge about 1.7%, because scale allows them to be more competitive, and small ones charge 2%. This is in line with the latest MJ Hudson analysis, which showed that although only 19% of funds in the 2018 sample were charging a management fee of 1.5%, the aggregate amount of capital targeted by these funds represented 59% of the capital targeted by the entire sample. We expect average fees on PE funds to fall 16.4% by 2025, to 1.55%.

The increased availability of alternative assets is also going to play a significant role in the decline in fees. Fee pressure will grow as active and passive mega-managers realise that AuM growth doesn’t necessarily translate into strong revenue growth and increased investor demand. Because of this realisation, managers will continue to turn to higher-margin products such as alternatives, increasing competitiveness in this space. And as the segment becomes more competitive, these mega-managers could try to leverage their scale and cost advantage by offering innovative and/or lower fees. This will result in the decline of overall fees in alternatives.

The alternatives segment has also been trying new models since the financial crisis. We are seeing a clear move towards outcome-based fees, such as higher performance fees for alpha-generating funds. Early-bird investors are also getting lower fees, and investors in multiple funds at the same company or with a large commitment often enjoy a volume discount. PE funds are offering a step-down in management fees after the initial investment period, and we’re also observing negotiations between limited partners and general partners affecting transaction fees. Clawback and similar clauses have remained a standard within alternatives.

Performance fees differ across asset classes. For hedge funds, they have, on average, drifted down from 20% closer to 15% for new funds being launched. The 20% performance fee or carried interest is still the norm in PE and real estate. We believe we’ll see lower management and performance fees or carried interest paid only for generation of alpha. Investors continue to appreciate both the funds’ alignment with their wants and needs and the crystallisation of carried interest on a distribution/cash basis, which has helped protect these fee levels.

Alternative asset managers still have to rethink their business models, adjusting their products, services and operations to ensure they not only survive, but thrive, as the industry changes. If alternative managers continue to provide alpha and differentiate themselves, we believe they’ll be able to keep fees steady, but will still be subject to business model pressures that require significant change.

Total expense ratios will continue to fall faster than management fees

Since the global financial crisis, regulators continue to introduce rules demanding that managers adhere to their fiduciary duty and provide value-for-money services to their clients. These regulations, along with industry pressures and increased transparency, have resulted in global total expense ratios (TERs)1 falling by 15.2% over the past five years – a faster decline than for management fees in the same period. We anticipate that as management fees continue their downward march and investors continue to move towards low-cost products, TERs will fall by more than 22%, to reach 0.53% by 2025.

Traditional revenue-to-AuM ratio to decline by 22.4% as assets soar

Pressure on management fees has led to a decline in traditional managers’ ratio of revenue to AuM, and we project it will fall further, to reach 0.31% by 2025 – a decrease of 22.4% from 2017.

Despite this steep drop, the revenue pool of the traditional asset management industry will keep growing until 2025, reaching US$385.4bn, as traditional AuM soars to US$124.3tn.

Although the ratio of revenue to AuM already fell by 10.4% between 2012 and 2017, traditional managers did, on average, successfully decrease the ratio of costs to AuM by 14.2% in the same period, resulting in their operating margins increasing by 10.5%.2

Of the 64 managers whose annual reports we analysed, large and small traditional asset managers saw their operating margins rise by 10.5% and 15.6%, respectively. But midsized asset managers could only increase their margins by 3.5% between 2012 and 2017.3 The ratio of revenue to AuM declined most dramatically among midsized managers, dropping 23.6%, followed by large managers, at 10.1%. However, it’s important to note that managers with superior investment products fared much better, allowing them to make improvements in firm operations.

Managers have been able to compensate for the disparity between AuM growth and the decrease in contribution margin per AuM by streamlining operations and becoming more efficient. Those managers with scale have used their size to ensure they’ll continue to grow and keep their costs low. However, the question that looms is this: What will happen if there is a downturn?

Managers should use the current period of growth to ensure they are prepared for a decrease in both AuM and revenues. The following section outlines how PwC believes managers can ensure they are reaching investors’ objectives while remaining agile and keeping costs low.

2. Four foundations for a future-fit operating model.

In today’s environment, it is increasingly common for leading AWM players to focus on the use of emerging technologies in solidifying the current customer base while simultaneously broadening their reach. To truly provide value to their clients, PwC’s Customer Insights Platform (CIP) can equip managers with indepth analytics to help drive customer acquisition and retention, facilitate engagement, sustain growth and support a customer-centric business transformation.

To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.

- Articulating value for money

- Strategic positioning — what’s the plan?

- Transform through technology – or be eliminated

- AWM – fight the battle for talent

Articulating value for money

As calls intensify for the AWM industry to provide value for money, managers have no place to hide, and so they have begun to align themselves with investors’ interests. While some of this is accomplished by tying fees to performance, managers must work to understand more comprehensively what investors truly want. Outcome-based solutions will become more important as managers strive to provide holistic investment solutions to both retail and institutional investors and to offer investment advice that helps clients achieve their long-term goals.

The AWM industry needs to lower costs and manage fee pressure to deliver more for less. It is remarkable that standard fee models have survived for so long, without evolving or changing significantly over time. As transparency increases so, too, does investors’ knowledge. By 2025, investors will know where every dollar of management fees has been spent and what value it is providing to them.

Fees are, however, only one part of the equation. Investors and regulators are increasingly aligned on the fact that the AWM industry should provide value for money. MiFID II in Europe and RDR in the UK are evidence of this trend, with RDR now bolstered by the Value for Money regulatory framework, under which, beginning in 2019, managers might need to complete an annual report on the wider value their firms provide. The US, despite shelving the Department of Labor’s fiduciary rule, also has made great strides in this space. The Securities and Exchange Commission has introduced consultation on Regulation Best Interest, a rule that would require broker–dealers and registered investment advisers to act in the best interest of retail clients, for both retirement and other investments. In the coming years, as these types of regulations become more prevalent, it’ll be imperative that managers articulate their value proposition. We believe that managers that fail to align themselves with investors’ interests will become easy prey for acquisitions or simply be left behind.

Strategic positioning — what’s the plan?

Costs are increasing due to regulatory and reporting demands, while at the same time, pressures are forcing managers to prepare their future position. They’ll need to determine whether they’ll be niche or scale, which products are underperforming and should be reconsidered, and how they contribute to society overall.

In order to be fit for the future and able to adapt operations in a low revenue-to-AuM environment, we believe managers must focus on their current strategic position and plan for a future in which the majority of costs are variable and therefore easier to manage. It’s also important to evaluate how to scale through sourcing strategies.

Transform through technology – or be eliminated

Digital technology investments are helping managers innovate and serve investors by transforming many business functions. As managers look to integrate their front, middle and back offices onto one platform, the lines between these functions will blur. Data is becoming a core competency and strategy for managers, and those who are able to convert it into actionable insights will lead the industry.

As we’ve said, investing in digital technologies is critical to cutting costs and improving operations, and therefore margins. Managers with legacy systems need to become state-of-the-art and focus on implementing resources such as artificial intelligence (AI) and machine learning in the front office. Uncompetitive firms that haven’t invested in technology and have survived despite poor investment performance will find themselves orphaned with few, if any, strategic options.

AWM – fight the battle for talent

Without good talent, you can’t transform or build for the future. New technologies are changing the skills that workers need, the way jobs and tasks are completed, and the very definition of talent. Managers are competing with each other, startups and established technology companies to attract talent and build the workforce of the future.

Building an AWM business with new talent requires a different way of hiring. Additionally, as a fresh generation of investors brings new expectations into the market, technical knowledge and financial experience will change. We have already seen this, as ESG investing has become more prominent and managers scramble to attract the best talent. New manager profiles are needed too, as alternatives, quantitative investing and smart beta increasingly become part of the investment landscape. And as firms turn to new technologies to mine data, people who are able to work with both the technologies and the analytics will become more important.

In 2025, we expect that humans will remain the dominant workforce, but technology will play a much stronger enhancement role than it does today, allowing the workforce to focus energy on core duties. According to the World Economic Forum’s Future of Jobs 2018 report, 56% of financial services companies surveyed are expecting to reduce their workforce due to automation. Given the advanced level of education in the industry, these displaced individuals could be redeployed to higher-value roles. As the competition for talent intensifies, redeployment or retraining of existing talent become viable options.

The AWM industry has long been considered traditional and hierarchical. As managers look to attract, train and develop talent, they will need to change both the public perception of the industry and their way of doing business. Managers need to think about themselves as technology companies, and not as in opposition to technology, to build a culture that will resonate with and attract the future workforce. This is increasingly important as managers are now missing out on a new wave of digital talent being lured by technology companies. New generations are no longer simply looking for a paycheck; they are searching for a company that reflects their values, rewards hard workers – not just vocal ones – and promotes a more even work–life balance.

Managers need to be thinking about upskilling current talent too. Transforming a business can be deeply unsettling for its people, and firms need to ensure they take their workforce on the journey with them. Business areas likely to be most affected include the following:

- Traditional analyst and research roles, which will be transformed by technology and data science

- Client relationship and engagement, due to increased digitisation of distribution channels

- Back- and middle-office functions, some of which can be automated for efficiency

According to PwC’s CEO survey, 29% of AWM CEOs are implementing continuous learning and development programmes, in part to attract and develop digital talent. This is lower than the global average of 42%. The AWM industry is behind the global average in all other aspects of workforce planning too, except for “implementing new, flexible ways of working” and “outsourcing to external providers.” This could be cause for concern, because it shows the industry’s lack of willingness to change and adapt. One example of a learning programme is PwC’s digital fitness tool, which allows firms to assess their employees’ capabilities and analyse and leverage the results to build a comprehensive digital talent strategy, with ongoing training to improve their digital acumen.

Conclusion

According to our analysis of the annual reports of 64 managers, operating margins have returned to the levels they were at before the global financial crisis and assets continue to show strong growth. Despite this, fees are falling quickly, and although managers have lowered costs, the real challenge will be protecting or improving profitability in the future. The AWM industry will need to continue pushing efficiencies while balancing costs as it adapts to changes ushering in a new era. The future will look very different, but just as bright