Unlocking the power of insights to move you forward

Change in the asset & wealth management industry is now accelerating at an exponential rate. Although the industry is set for growth over the next ten years, asset and wealth managers must become business revolutionaries, even disruptors, if they’re to survive and prosper. Now is the time for action.

In a follow up to our report called Asset Management 2020 – A Brave New World (link in related content at bottom of page), the

Time to act

Since the 2008-2009 Global Financial Crisis, the forces of regulation, technology and fierce competition have begun to usher in transformational change.

This period of reinvention will accelerate rapidly in the years ahead, forcing the industry to re-imagine itself. In five to ten years, fewer firms will manage far more assets significantly more cheaply. Technology will be vital across the business. And, the industry will have found some new opportunities to create alpha, and restore margins. It’s time to act.

Key projections

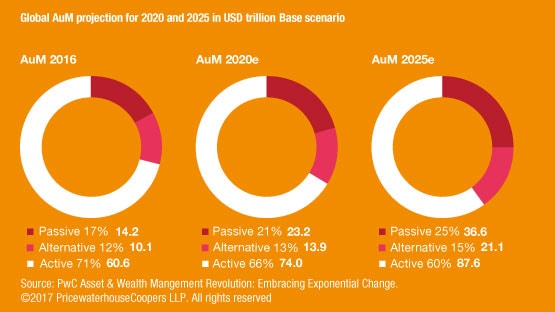

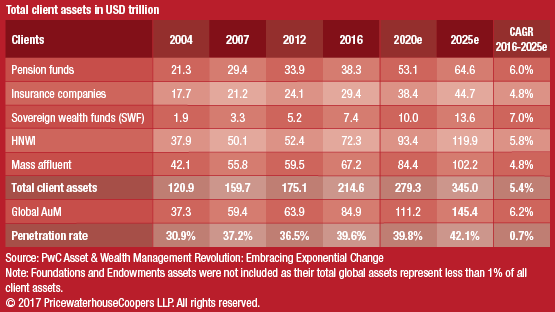

If interest rates remain relatively low globally and economic growth is sustained, our projections foresee AuM growing from US$84.9 trillion in 2016 to US$111.2 trillion by 2020, and then again to US$145.4 trillion by 2025. Growth will be uneven; on a percentage basis, it’s slowest in developed markets and fastest in developing markets.

Passives will gain huge market share, rising from 17% of AuM in 2016 to 25%, while alternatives go from 12% to 15%. However active management will still represent 60% of global AuM.

If current growth is sustained, the industry’s penetration rate (managed assets, as a proportion of total client assets) will expand from 39.6% in 2016 to 42.1% by 2025.

Asset managers need to act now as their industry moves to a new paradigm

With change accelerating, all firms must decide how they will compete in tomorrow’s world.

Will they be scale or niche players? How will they become more productive?

Whatever they decide, they need to act now.

Strategy

Asset and wealth managers must be more efficient and entrepreneurial, being prepared for success in some areas and failure in others. All firms must have a view of the landscape of tomorrow, a clear strategy and know their differentiating capabilities. They should reorganise their business structure to support the differentiating capabilities and cut costs elsewhere. As befits a time of great change, they must have a long view, take radical steps and invest in building their businesses strategically.

Technology

Every firm must become a technology business. Artificial intelligence, robotics, big data and blockchain are transforming the industry. Technology will determine which firms are the winners in a fast-changing landscape.

People

Old ways of hiring and nurturing people are changing. New skills are needed and new employment models must be embraced. Hiring and retaining the best will depend more than ever on diversity and inclusion, and meeting the needs of the whole person. Talent is a global challenge and excellent people with leadership skills will be absolutely vital as firms reinvent themselves – moving into new countries, new technologies, different distribution channels and leading-edge products.

Contact us