Due diligence

Our due diligence team analyses the financial risks and opportunities of the target firms for our clients, including corporates and private equity firms. We investigate revenue and cost drivers of the target and estimate sustainable cash flows. We analyse the financial position of the target and comment on prospective financial information. We also work alongside our clients to facilitate their strategic vision across the entire deal spectrum, identify issues and points of negotiation, value and implement change to deliver synergies and improvements.

Identifying key risks and deal-breakers

Financial due diligence provides peace of mind to both corporate and financial buyers, by analysing and validating all the financial, commercial, operational and strategic assumptions being made. It uses past trading experience to form a view of the future and confirms that there are no 'black holes’

The due diligence process is executed during the deal evaluation phase, however, we regularly provide support during the SPA negotiations and closing.

Diligent approach, tailored to your needs

Our approach

We carry out the due diligence as follows.

- Our key goals during the analysis is to identify key value drivers, the sustainable level of earnings (e.g. one-off items in historical financials that can distort historical performance) potential debt-like items and other issues that may affect the value of the Target company after closing the transaction.

- The DD phase depends largely on the size and complexity of the Target Company as well as the extensiveness of the scope.

- Beside the core diligence services (financial, tax), we regularly involve other experts if it is needed (IT, HR and legal due diligence, commercial due diligence, etc.).

Usual procedures / deliverables

- Our procedures are focused on the key items that are relevant for the Client (it is always tailored during the process – based on our preliminary considerations).

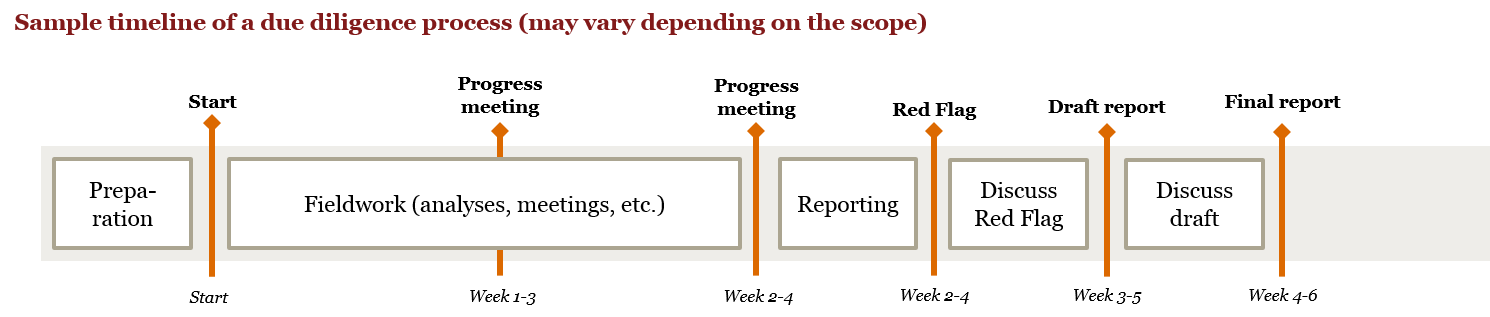

- Our fieldwork usually varies between 2-4 weeks.

- We normally provide a Red Flag report with the key findings earlier in the process, and a concise ‘issues-based’ Final report following the comments to our Red Flag and draft reports.

- We set-up weekly progress meetings/ calls with the Client to discuss our preliminary findings.

We have diverse sector experience and expertise

Our dedicated industry specialists across all industries deliver unparalleled knowledge to our Clients.

We are experts and have substantial experience in the following industry sectors:

- Automotive

- Energy and Utilities

- Financial services

- Transportation and Logistics

- Industrial products

- Pharmaceutical

- Retail and Consumer

- Technology, Information,

- Communications and Entertainment

The depth of our industry expertise, like our international perspective, is an attribute that our Clients value highly. We invest significant resources in building and sharing such expertise.

Our services

- Buy side due diligence

- Vendor due diligence

- Business plan review

- Closing account review

- SPA negotiation support

Buy side due diligence

Buy-side Due Diligence is executed by a potential buyer of a business. It can therefore take place at different stages of the deal cycle, e.g. during the beginning of an auction process or to complement other due diligence work (‘top-up DD’). In case of a transaction process with multiple round buy side Due Diligence can be phased.

Vendor due diligence

Vendor Due Diligence (VDD) typically consists of a comprehensive analysis and validation of a business to be sold, executed by the vendor at the early phase of a sale process.

It provides a detailed understanding of the business’s historical performance and track record, generally combined with an independent view on the sustainability of the business’s future plans and projections..

Business plan review

Beside analysing the historical performance and sustainability of historical earnings of a Target Company, it is essential to understand the business plan of the acquiree and its coherence with performance it showed in the historical period. During the business plan review we perform in-depth analysis of the key value drivers behind the prospective business plan as well as its consistency with the historical business KPIs and analyse the currently available pipeline information via supporting documentation (contracts, orderbooks etc.)

Closing account review

Most of the deals we work on use a Completion Accounts mechanism to adjust the purchase price at completion. Although the principles behind completion accounts may seem simple, they are often a source of conflict as parties differ in their interpretation of the SPA or have opposing views about accounting treatment, which affects value.

We help clients to anticipate and address issues arising from Completion Accounts and achieve a favorable outcome.

SPA negotiation support

In any transaction, the Sale and Purchase Agreement (SPA) represents the outcome of key commercial and pricing negotiations. Purchasers and Sellers are becoming increasingly sophisticated in seeking to exploit the potential value to be gained through the negotiation and execution of the SPA.

Our team provides expert support at all stages of a transaction from pre-deal work through to post-completion support. Pre-deal, the team assists in the identification and articulation of value issues related to pricing and deal completion mechanics, to assist clients in their SPA negotiations; Post-deal the team assists clients in protecting or generating value through the execution of any SPA completion mechanism.

Valuation

During any transaction - an acquisition, disposal, merger or a stock exchange listing - the following questions often arise: What is the fair value? What maximum price should be paid? What should the reserve price be?

At the beginning of a transaction, negotiating parties very seldom share the same views on prices. When setting the price, it is crucial to be clear on which factors actually impact on value and the degree to which they influence it.

Alongside the financial indicators and positioning within the competitive environment, identifying potential synergies can play a very significant role. As every value-related factor is immediately visible, our specialists have the right valuation methods for assets that don't appear on the balance sheet.

Today’s most innovative organizations are seeking to unlock greater value from existing assets and ongoing capital expenditures—as well as new acquisitions, investments and complex corporate arrangements. At the same time, regulators are demanding greater transparency through fair value reporting, putting more emphasis on the importance of valuation and value analysis.

By bringing together professionals with project feasibility analysis, extensive valuation, accounting (GAAP and IFRS), financial reporting, tax and deal structuring, asset management and industry expertise, we can offer our clients an integrated valuation, accounting, tax and business advisory model.

PwC helps its clients with:

- Feasibility study preparation and reviews

- Business & equity valuations

- Property, plant & equipment values and impairment tests

- Business planning including value driver identification & forecast analysis

- Financial modelling and model reviews

- Portfolio reviews & capital management

- Option valuation & financial instruments

- Purchase price allocation

Contact us