Download our publication

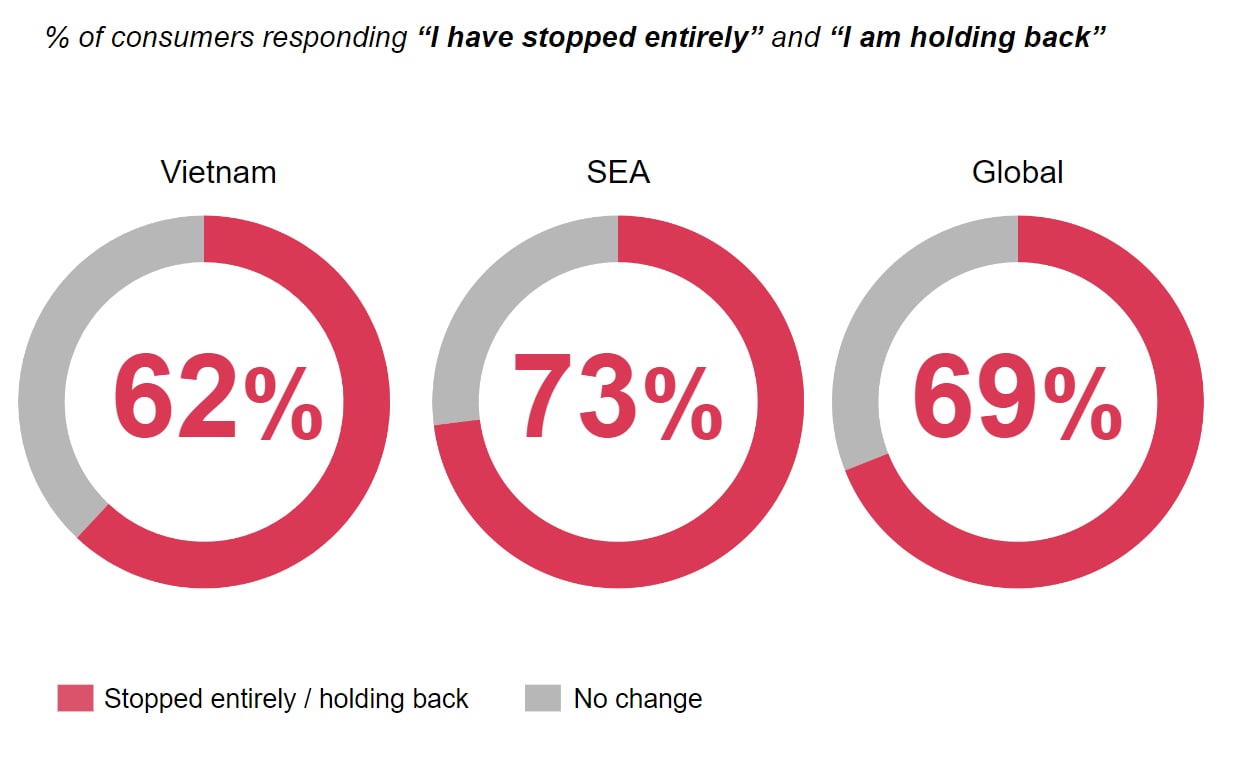

Less consumers in Vietnam are restraining their non-essential spending compared to SEA and Global.

In addition, while a modest number of global and SEA consumers responded “not concerned about personal financial situation” (14% and 13% respectively), over 25% of Vietnamese consumers are “not concerned”.

Q. Considering the current economic climate, which of the following best describes your situation regarding non-essential spending?

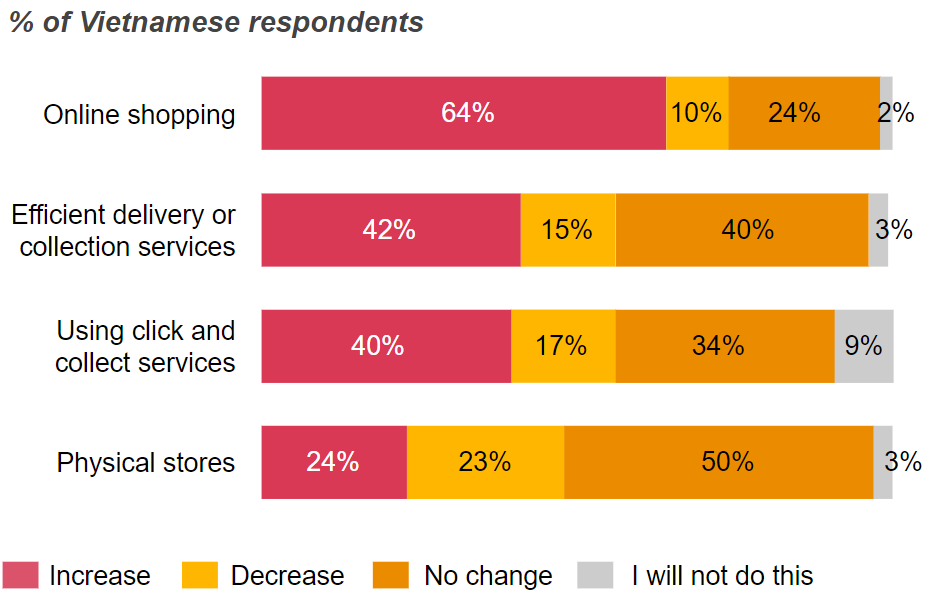

Q. Thinking about your spending over the next 6 months, to the best of your ability, please describe your expectations on spend across the following categories

Q. Looking ahead to the next 6 months, how do you think consumer behaviour will change?

Q. Thinking about what your employer requires at this time, which of the following statements best reflect a typical working week for you?

Q. Considering the current economic climate, to what extent would you be willing to pay a higher than average price for a product that is…?

Q. To what extent are you concerned about the privacy of your personal data when interacting with the following types of companies?

Six priorities to address - that help pave the way for greater impact

Rakesh Mani

Partner, Asia Pacific Consumer Markets Co-Leader, PwC Malaysia

Tel: +60 3-2173 1188

Johnathan Ooi Siew Loke

Partner, Deals and Consulting Services Leader, PwC Vietnam

Tel: +84 28 3823 0796

Mohammad Mudasser

Director, Deals - Transformation, PwC Vietnam

Tel: +84 28 3823 0796, Ext. 3322