Opportunity and Compliance Assessment Tool (OCAT)

- Do you know how much duties you’ve paid in the past five years or what your top five duty spend products are?

- Do you know whether you’re overpaying duty or losing out on available customs privileges?

- Have you recently carried out an internal customs compliance review?

- Have you been audited by Customs in the past two years?

- Do you know what the penalties are in case of customs non-compliance?

Don’t get caught out

If you answered 'no' to any of these questions, there’s a big chance you have customs risks related to your import/export operations in Thailand. Either that or you’re missing out on opportunities to save money and privileges.

The regulatory Customs environment in Thailand is complex and continually evolving. In our experience, companies find themselves on the back foot when dealing with Thai Customs, especially during a customs audit or investigation.

Equipping yourself with information on your customs operations and assessing your compliance level could help mitigate customs risks and assist your company in identifying possible customs opportunities.

So how can we help you?

We’ve developed OCAT (Opportunity & Compliance Assessment Tool) to quickly obtain information on your company’s customs operations and to provide you with a report on possible key compliance issues on past imports and identify opportunities to minimise duties payable on future imports.

The good thing for you is that the analysis can be conducted from our offices, so it won’t tie up your resources.

As part of the service, we will:

- prepare a letter to obtain your company’s accurate import and export data from Thai Customs for the past 5 years, and

- analyse the data and identify key potential compliance issues and savings opportunities.

What will you get out of it?

- Accurate customs data for your company for the past 5 years.

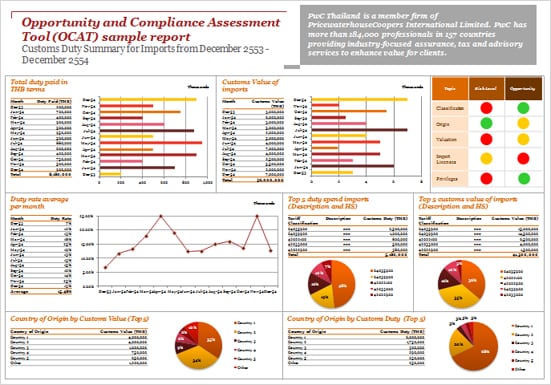

- A Dashboard Report that summarises your company’s customs operations and activities, total duties paid and any key areas of potential compliance issues and savings opportunities.

- A meeting with us to discuss our findings. We’ll discuss with you implementing strategies to minimise identified risks or discuss ways to benefit from the identified savings opportunities.

Opportunity and Compliance Assessment Tool (OCAT) sample report

Customs Duty Summary for Imports from December 2553 - December 2554