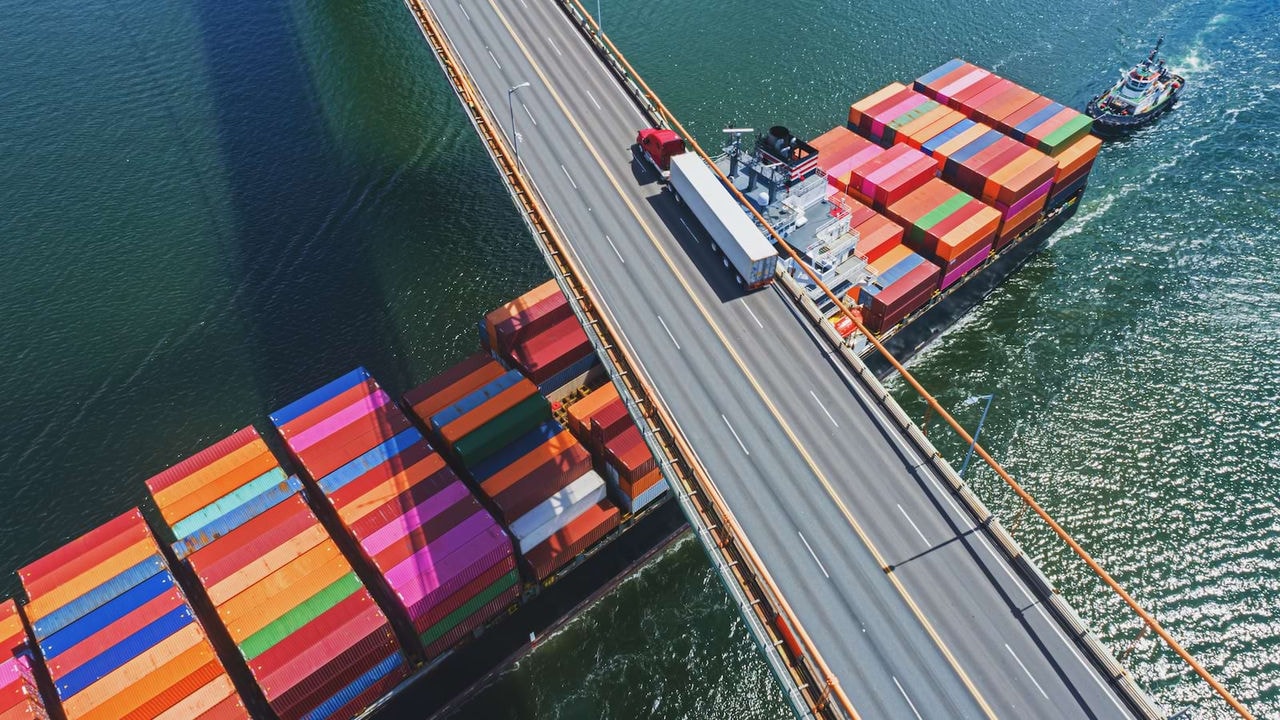

Your trusted partner in global trade

Worldtrade Management Services (WMS)

Our Worldtrade Management Services (WMS) team brings together both Asian and international experts.

Our people have backgrounds spanning senior government roles, customs, law, accountancy and logistics. Get a blend of deep knowledge and fresh perspectives. We can help you navigate the complex world of international trade—and deliver clear results for your business.

Our services—an overview

We help you manage risks with robust defence procedures and documentation to resolve customs challenges, audits and investigations.

Concerned about compliance? We’ve got you covered. We’ll help you conduct proactive self-assessments, implement standard operating procedures and training, and secure advance rulings.

Our Asia Pacific network coverage includes: Australia, Cambodia, China, Hong Kong SAR, India, Indonesia, Japan, (South) Korea, Laos, Malaysia, Myanmar, New Zealand, Philippines, Singapore, Taiwan, Thailand and Vietnam.

Based in Thailand since 1992, and part of the specialists regional practice, we are staffed by local and expatriate customs professionals, who are focused on delivering custom-made solutions designed to better inform our clients on all areas of customs compliance and best practices.

WMS Thailand can assist firms to understand their roles and responsibilities in their conduct towards Thai customs. The regulations and processes in Thailand can be confusing, complex and difficult to implement. WMS Thailand provides assistance and guidance on the best practices on all aspects of customs duty management.

- Our services – an overview

- Managing risks by having robust defence procedures and documentation to revolve customs challenges, audits and investigations

- Ensuring compliance through conductive proactive self-assessments, implementing standard operating procedures, training and securing advance rulings.

Our services – an overview

Creating value through structuring and implementing smart import / export planning strategies that are aligned to the direction of the business.

- Use of Free Trade Agreements (FTAs)

- Duty savings through unbundling of transaction value

- Customs supply chain business modelling

- Tariff engineering (reviewing the optimum way to import)

- Optimising use of customs incentive schemes (e.g. free zones, bonded warehouses, Board of Investment (BOI) promotion, duty drawback for re-exported goods, duty and tax reimbursement for exports, etc.)

- Customs operational improvement

- Excise tax planning

Managing risks by having robust defence procedures and documentation to revolve customs challenges, audits and investigations

- Audit and investigation support

- Assisting in applying for advance and post-importation customs rulings

- On-site customs training

Ensuring compliance through conductive proactive self-assessments, implementing standard operating procedures, training and securing advance rulings.

- Customs and excise compliance review

- Managing customs valuation and transfer pricing documentation

- Review compliance and managing export of dual use goods (e.g. assisting in drafting Internal Compliance Programmes (ICP) on Export Controls, assisting in applying for export licenses etc.)

- Voluntary disclosure

- Review compliance and managing import and export of restricted goods (e.g. hazardous substances) and non-core importations (e.g. business and technical documents and computer software)

Contact us