Pricing financial transaction #2: Getting intra-group loan transfer pricing arrangements right

Our series of deep dives into transfer pricing for financial transactions has already explored cash pooling pricing controversies and the arm’s length principle, which is the cornerstone of intra-group transactions, including intra-group loans. But what factors do you need to consider, in addition to the comparability of loan terms and credit rating, to prove that the transfer price is set at arm’s length? This blog post will help you navigate the issues involved.

Realistically available alternatives

A quick recap: the arm’s length principle is the heart of transfer pricing (TP). The conditions of a related party transaction should be imposed in a comparable manner as if the transaction was made between independent parties under comparable circumstances.[1]

To ensure the transaction is at arm’s length, a benchmarking study is generally needed to examine uncontrolled comparable transactions to identify the range of market interest rates that matches the functions, assets and risk profile. But before jumping head-first into benchmarking, you should keep in mind: is the arrangement the best realistically available alternative?

The arm’s length principle is based on the idea that independent parties would only enter into a potential transaction – after evaluating its terms and conditions – if there are clearly no other possible alternatives that would make them better off in achieving their commercial objectives. Independent parties should holistically consider all options realistically available to them by examining all the economically relevant differences of these options – differences in the level of risk they will assume for pursuing each, for one.[2] Simply put, independent parties won’t enter into an arrangement if it makes them worse off than the next best option. The best ‘realistically available alternative’ is the option that should be chosen.

Chevron Australia: a landmark case for arm’s length pricing

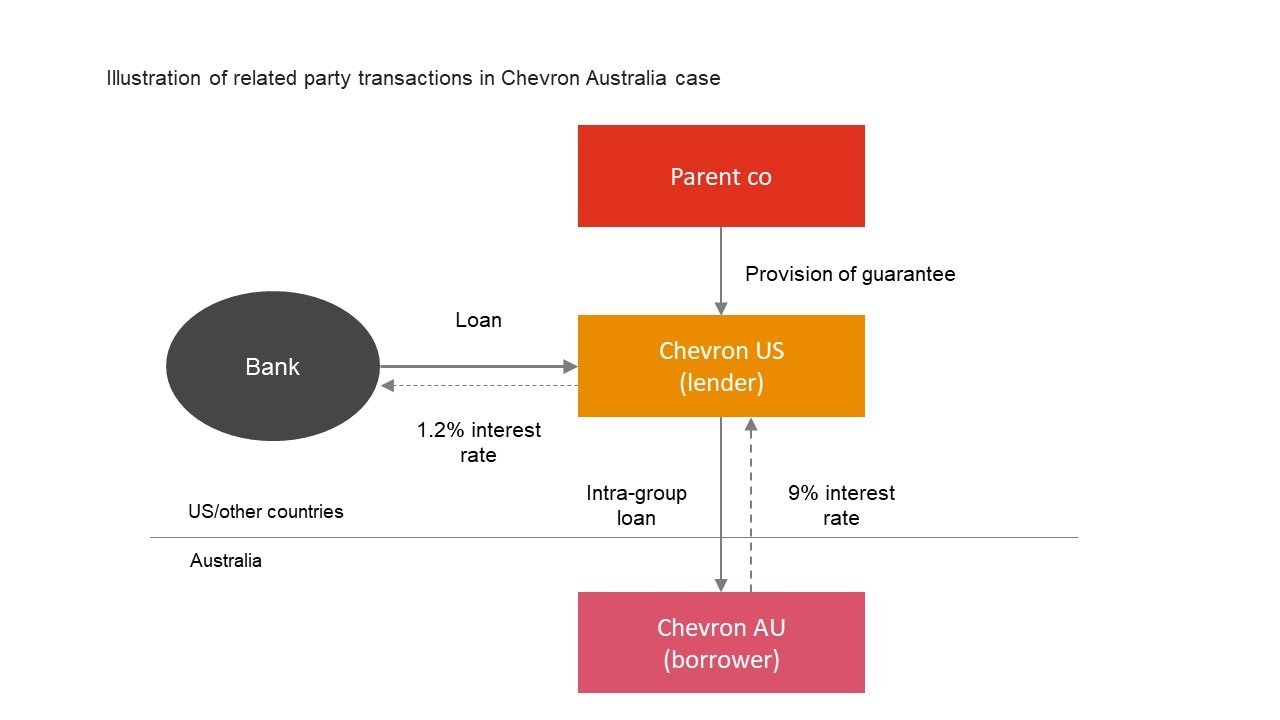

A pivotal court case for intercompany loan transactions, which shows the importance of exploring all realistically available alternatives when setting the arm’s length interest rate, is the Chevron Australia Holdings Pty Ltd vs Commissioner of Taxation from 2017.

In this case, a Chevron subsidiary in the US sourced funds in the form of a loan from a third-party bank, with the ultimate parent company’s guarantee, at a 1.2% interest rate. Then, without security or a specific loan covenant, Chevron Australia borrowed USD2.5bn from the US subsidiary at a 9% interest rate. Chevron claimed the 9% rate was appropriate as it was supported by their benchmarking study and Chevron Australia's standalone credit rating.

This prompted the Australian Taxation Office (ATO) to question whether this claimed-to-be-arm’s-length 9% interest rate would be imposed between independent parties

Chevron Australia explained that had it borrowed USD2.5bn from a third-party bank without security or covenant, the interest rate would have been higher than 9%. So, in Chevron Australia’s view, the 9% was at arm’s length.

But this defence failed to convince the ATO. The ATO argued that merely whether a borrower was backed with security or not was insufficient to prove the arm's length nature of the interest rate. Intra-group funding arrangements, by the virtue of the arm’s length principle, need to be analysed from both perspectives: the lender's and the borrower's. The degree of risks assumed by the lender and the costs to the borrower in obtaining these funds mustn’t be overlooked.

Also, it wasn’t clear to the ATO that Chevron Australia had sought any other operational and/or financial covenants that could have lowered the interest rate. Had Chevron Australia sought this loan from a third party, it would have gone all out to explore all approaches realistically available to secure the loan at a lower interest rate. For instance, Chevron's ultimate parent could have backed Chevron Australia with a guarantee.

The court finally ruled that this arrangement wasn’t the best ‘realistically available alternative’ to Chevron Australia as it could have taken out the loan at a lower cost from a third party (e.g. when security or convent is put in place). Hence, the arrangement didn’t satisfy the arm's length principle. The ATO’s win marked the case as one of the most noteworthy transfer pricing cases to date, clarifying that both the interest rate and the loan’s terms and conditions must be arranged and agreed at arm’s length.

Paving the way forward

Following Thailand’s signing of the BEPS Inclusive Framework, it’s certain that Thailand’s transfer pricing laws and guidance will continue to align with those of the OECD. One recent trend we’ve observed in recent years is that the Thai Revenue Department (RD) has largely translated the OECD TP Guidelines into many of its concrete transfer pricing laws. This means that the RD can use notable international cases in OECD countries as precedent when making arm’s length reviews and assessments on Thai taxpayers’ intercompany financial transactions.

Amidst this constantly evolving transfer pricing landscape, taxpayers should monitor developments and trends to ensure that their intercompany arrangements are managed properly and balance potential costs and tax risks. Consider other realistically available options before jumping into benchmarking to prove the arm’s length nature of intercompany financial transactions.

In a nutshell, no one should be worse off in an intercompany transaction when compared with other options.

Our next article (and the last one is this series) will focus on guarantees for related parties. Don’t miss it to stay in the know!

Authors:

- Nopajaree Wattananukit

Associate Partner, Tax and Legal

- Satida Chotayakrit

Senior Manager, Tax and Legal

- Chanidapha Orachorn

Associate, Tax and Legal

[1] OECD Transfer Pricing Guidelines, chapter 1, paragraph 1.33

[2] OECD Transfer Pricing Guidelines, chapter 1, paragraph 1.38

Contact us

Marketing and Communications

Bangkok, PwC Thailand

Tel: +66 (0) 2844 1000, Ext. 4713-15, 18, 22-24, 26, 28 and 29