Tax Risk Management Maturity Model: knowing status of your company

Somsak Anakkasela

Tax & Legal Partner, PwC Thailand

Many factors have significantly increased the risks and complexity of business nowadays. These include the unprecedented volatility in international trade (and the trade war), the rise of e-commerce, the change in customer behaviour, the rapid change in technology and the COVID-19 pandemic, to name but a few.

Companies, regardless of their size, should be agile and able to adapt themselves in this changing and unpredictable environment. Often, companies will start to save their business by reducing their operating costs while neglecting the management of their tax cost. They may forget that the cost of paying tax is not restricted only to corporate income tax but, in the case of incomplete filing, a penalty and the monthly surcharge are imposed.

Therefore, non-compliance with tax filings may disrupt businesses more severely than other outside factors. This is why tax risk management, often overlooked by many companies, should also come to the top of management’s plan.

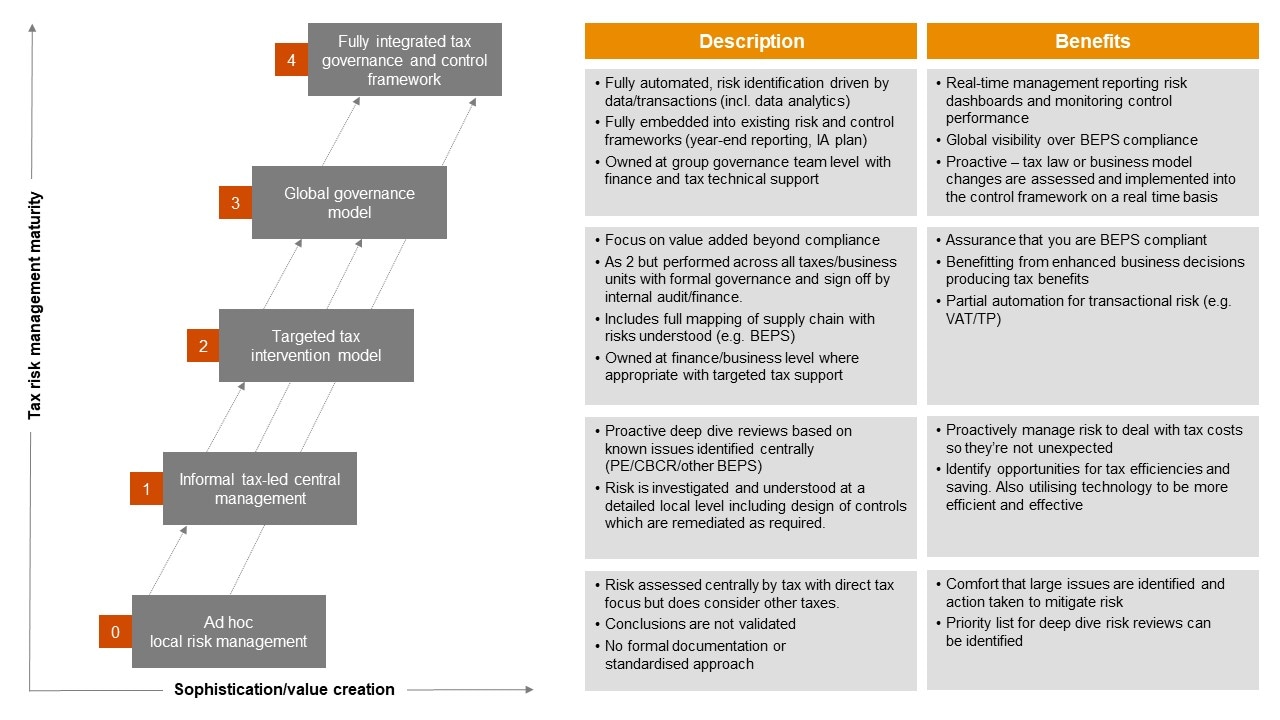

Tax Maturity Model: Moving up the tax risk management maturity model

Source: PwC's Tax Report & Strategy

In the light of this discussion, we encourage all kinds of business operators to identify their current level of tax risk management maturity so that they know their current status and can further develop an appropriate strategy to address their tax risks.

Accordingly, the concrete way to raise the level of tax risk management maturity is to develop an appropriate tax operating model. Companies should recognise that the factors underlying the current complexity of business are quite demanding and, as a result, are unlikely to be tackled successfully with an isolated strategy.

There is a tool for determining the situation of an organisation’s tax function, known as the “Tax Risk Management Maturity Model”. This model shows the level of sophistication in terms of tax risk management. Knowing the status of your tax risk management maturity, your organisation will be able to analyse the level of tax risk and provide the opportunity to develop your tax function to a desirable level.

To ensure that an organisation has a tax function fit for future challenges, it must consider the types of risks that it is exposed to and identify the solutions to solve those risks. The tax risk management maturity model is designed to facilitate an organisation’s review of its current state of tax management. It’s an important part of management in preventing problems from occurring and if they do really occur, there is protocol to manage them.

No matter what level of maturity your organisation is at now, it should be encouraged to enhance its level in order to prepare for future tax risks and gain the benefits available therefrom.

//ENDS//

Contact us

Marketing and Communications

Bangkok, PwC Thailand

Tel: +66 (0) 2844 1000, Ext. 4713-15, 18, 22-24, 26, 28 and 29