Is your current tax operating model designed to handle the escalating pressure of today’s management?

Somsak Anakkasela

Tax & Legal Partner, PwC Thailand

An effective approach to managing and improving tax efficiency is to follow a well-structured tax operating model. A defined tax operating model will successfully improve a company’s ability to tackle risks, reduce costs, improve efficiency and lead to sustainability.

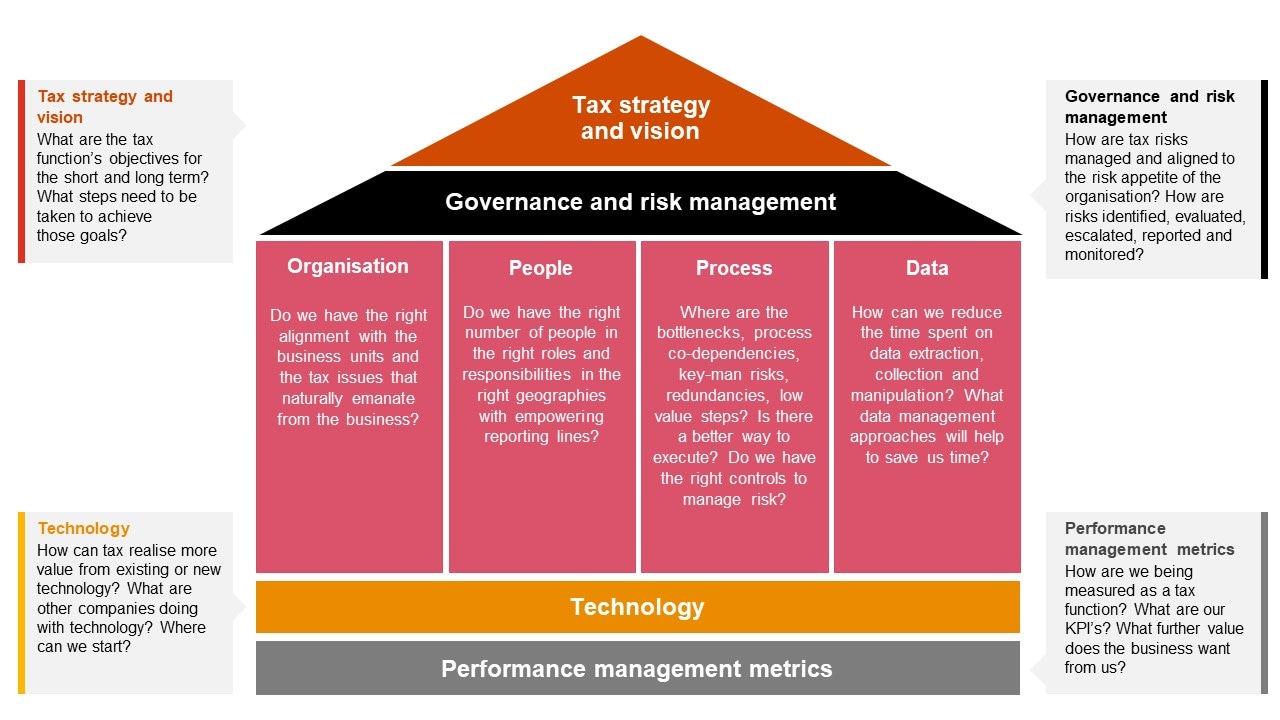

As a metaphor, the best practice for tax management is like building a house where the tax operating model is a blueprint. Let us now imagine that your organisation is a house where tax strategy and vision serve as your roof. Management should see things and set things first from a high-level approach. Tax strategy and vision will define your objectives and navigate your direction. They define the high-level strategic goals and the aim of your organisation.

Tax strategy and vision can be strengthened by good governance and risk management. Good governance is the process by which companies are directed and managed. It’s about building credibility and ensuring transparency. With respect to risk management, companies should be sure that they have a process to identify, evaluate and monitor risks. Above all, it’s essential that tax risks are managed and aligned to the risk appetite of the company.

Transforming the tax function can be successfully implemented through an operating model consisting of four pillars: organisation, people, process, and data.

Organisation: Management should focus on the key characteristics of the organisation and define what it will look like in the future.

People: Management should set the right people in the right roles. They should ensure that employees have a clear set of roles and responsibilities. Companies should anticipate that, in the future, employees will be required to work alongside automation and artificial intelligence technologies.

Process: Management should pinpoint the bottlenecks, redundancies and relevant problems. They should solve problems by implementing the right controls to manage risks. They should then define the organisation’s main tax processes relating to both the filing of returns and compliance with tax obligations. Companies should ensure that they have processes that are designed to make up the end-to-end compliance cycle. Technology and data can be used to manage and achieve this goal.

Data: Management should focus on data integrity, efficient data management and extraction. They should ensure that the company has a reliable process for harvesting data. The efficient process and data will then be used to support the decision-making process and reduce the time spent.

For a company to run smoothly in this digital era, technology definitely plays a vital role. It serves as the foundation of the house, without which the house can no longer stand. We are all aware that technology has permeated our daily lives and has become an indispensable tool in business, including tax decision-making, especially for large-scale businesses.

The same applies to tax authorities, which have adopted sophisticated technology and data-driven systems to target tax audits. Companies are therefore gradually being required to provide more and more digital filings and electronic documents. Is this a crisis or an opportunity? The answer will depend on how the company responds. Companies should overcome this challenge by implementing effective technology solutions to improve their internal performance of tax management. To this end, management should focus on the state-of-the-art technologies that offer a cost-effective and non-invasive way to maximise value for the company.

Companies need to apply performance management metrics that will measure the proficiency of their internal process of tax function. Appropriate KPIs should be used to measure, track and reward the performance of the internal tax function. This will, in turn, fulfil the goal of the tax strategy and vision set forth from the beginning.

Tax operating model

Source: PwC's Tax Report & Strategy

As the challenges in the business environment continue to grow, businesses must remain proactive in keeping up with the changes that can have a substantial adverse impact on the operations. Good tax risk management starts from correctly identifying the level of its maturity. Transformation can never be achieved without designing a proper tax operating model. Regardless of how well you design the tax operating model, the most suitable one will be the one that aligns with the objectives and nature of your company.

//ENDS//

Contact us

Marketing and Communications

Bangkok, PwC Thailand

Tel: +66 (0) 2844 1000, Ext. 4713-15, 18, 22-24, 26, 28 and 29