PwC’s Global Economic Crime and Fraud Survey 2022 - Thailand Report

Protecting the perimeter: The rise of external fraud

The COVID-19 pandemic has drastically changed the business landscape. Fraudsters are becoming more sophisticated than ever. The risk of cybercrime is on the rise, as well as emerging threats such as Environmental, Social and Governance (ESG) reporting fraud, supply chain fraud and anti-embargo fraud.

Thailand’s Fraud Landscape

Nearly one in four (22%) of Thai companies that responded to PwC’s Thailand Economic Crime and Fraud Survey 2022 experienced fraud, corruption, or other economic/financial crime within the last 24 months.

Only 37% of Thai respondents have a designated risk management/compliance function for responding to fraud risks (compared to 43% globally). Moreover, in the past 24 months, less than 30% of Thai respondents have increased the size of enterprise risk management/compliance functions (compared to 53% globally). Thailand is falling behind in this aspect compared with global standards.

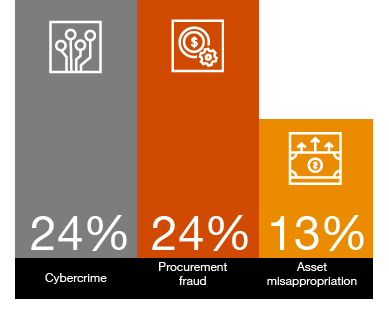

As a result of the disruption caused by the COVID-19 pandemic, Thai companies experienced the highest increased risk in cybercrime (24%), procurement fraud (24%) and asset misappropriation (13%).

Increased fraud risks as a result of COVID-19 pandemic

“The survey shows that Thai businesses’ perimeters are vulnerable to fraudsters who are adopting new methods and technologies to breach defences undetected. Adding to the risk is that companies in Thailand are falling behind in terms of investment in risk management and compliance. As fraudsters become more complex in their attacks, it’s critical that businesses focus on investments to better protect themselves from economic crime.”

Phansak Sethsathira

Risk Consulting Partner

PwC Thailand