PwC's insights on FinTech

The majority of global financial services companies plan to increase FinTech partnerships as 88% express concern they will lose revenue to innovators, according to a new PwC global report.

A large majority of global banks, insurers and investment managers intend to increase their partnerships with FinTech companies over the next 3 - 5 years and expect an average return on investment of 20% on their innovation projects.

Given the leading role that financial services play in the Channel Islands, this report is thought-provoking in its assessment of the role of FinTech and how the global finance industry is responding to its growth and the competitive threat it poses. The Channel Islands has also invested in the digital sector and considering the strength and depth of the finance industry offering, it is highly likely that we will witness increasing partnerships between finance and tech companies, with the opportunity for further innovation, a quality that firms in both jurisdictions have demonstrated time and again.

FinTech is all about innovation, disruption and transformation, and will undoubtedly impact and shape the way financial institutions around the world operate. Explore the key themes of our report, as well as in our Executive Summary, and download the Global report to find out how senior financial services and FinTech executives around the world prepare their organisations for the impact of FinTech.

Key Themes

FinTech and Financial Services are coming together

The Financial Services industry continues to be fuelled by FinTech’s influence. The perception of business at risk is growing and along with it the concern of potentially lost revenues. The fact that consumers are increasingly doing business with these non-traditional players will do little to calm uncertainty. As incumbents react to this they are attempting to come together with FinTech; to leverage the ecosystem it creates, turn the innovation to their advantage and alleviate their concerns around their business being at risk.

Emerging technologies are enabling convergence

FinTech companies are driving market changes by focusing on emergent technologies that will provide a renewed experience for their customers. As incumbents adapt to the market and begin to concentrate on these technologies they will be able to move closer to FinTechs, make use of the technologies to swiftly adjust to the fast-changing environment, regulations, and ultimately provide a better consumer experience.

Managing expectations will be key

The opportunities surrounding FinTech innovation continue to grow and the Financial Services industry has allocated considerable amounts of money to new projects and initiatives that leverage the new technologies and innovative business models brought to the market. However, many of the institutions engaged in their FinTech journey are finding transformation difficult and are not necessarily seeing the 20% return they expect on FinTech and

Our analysis is based on a global survey of 1,308 financial executives and includes insights and proprietary data from PwC’s platform.

Hear from our leaders

Manoj Kashyap, PwC’s Global FinTech Leader and Steve Davies, PwC’s EMEA FinTech Leader share some insights from PwC’s latest report, Redrawing the lines: FinTech’s growing influence on Financial Services. This report follows up from our 2016 FinTech survey Blurred Lines, and is looking at the evolution of trends, innovations and emerging technologies such as blockchain and artificial intelligence are shaping the FS industry.

Explore the data

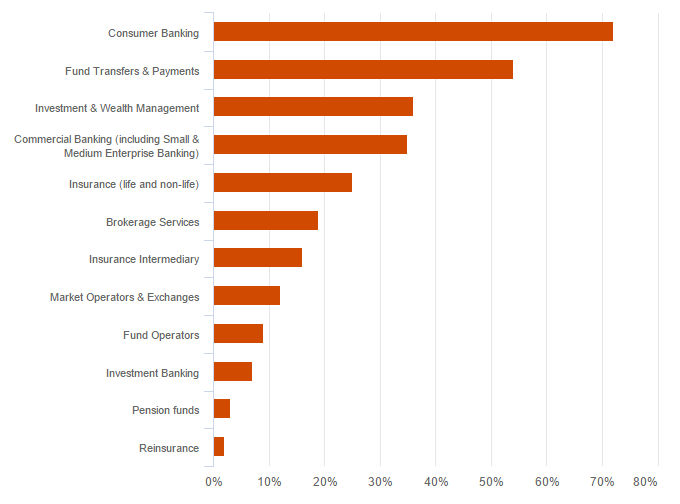

Find out what over 1,300 senior financial and FinTech executives told PwC about the impact of FinTech and emerging technologies on Financial services, and what it means for your organisation, your industry and your territory. Use our data explorer to find out more.

FinTech sector reports: Insurance

Insurance’s new normal: Driving innovation with InsurTech