The European Securities and Markets Authority (ESMA) has issued rules for the European Single Electronic Format (ESEF). The new regulation was published in the Official Journal of the European Union 29 May 2019. EU-regulated listed companies must produce their annual reports in the eXtensible HyperText Markup Language (XHTML) for reporting periods beginning on or after 1 January 2020 and International Financial Reporting Standards (IFRS) reporters must use Inline XBRL (iXBRL) to make the consolidated data in the primary financial statements machine-readable.

Companies will need to create tags if they have entity-specific disclosures, for which tags are not available in the ESEF taxonomy. New technical functionality called ‘anchoring’ has been devised to make it easier to understand such XBRL extensions. You can learn more by watching our anchoring webcast. ESEF is already a hot topic for preparers of annual reports and may disrupt the supplier landscape and your current processes.

Further resources can be found on XBRL Europe's ESEF hub

Anchoring demystified

PwC UK | Duration 06:25

What’s on your mind?

- What does ESEF mean for EU-listed companies?

- Where should a company start?

- Will auditors be checking the ESEF-compliant reports?

- What are other companies doing?

What does ESEF mean for EU-listed companies?

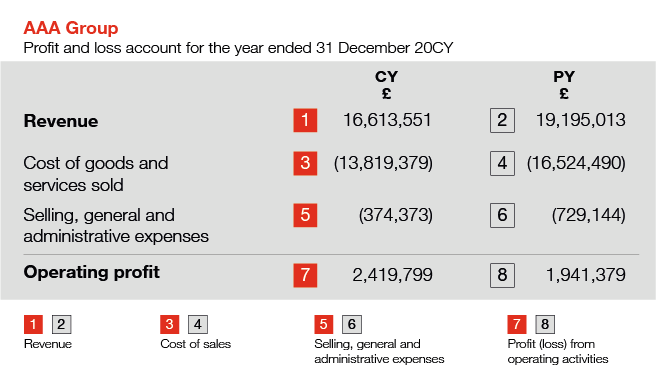

ESEF is a new format. For the first time, the consolidated financial statements of EU-listed companies will be freely available in the public domain in a machine-readable format. That means investors and other stakeholders will be able to search IFRS consolidated financial statements using computers, as well as the human eye.

Where should a company start?

Before making any updates, improvements or changes to current annual report preparation arrangements, the first step is to understand the requirements and consider how ESEF may affect your company. Become familiar with the ESEF rules and taxonomy. Review your current annual report preparation process. Get ready to select and deploy new software. Plan to update processes and controls.

Will auditors be checking the ESEF-compliant reports?

The European Commission's staff have suggested that the independent auditor should assure the new digital tagging. The Commission has asked the Committee of European Auditing Oversight Bodies (CEAOB) to explore how the audit of ESEF could be carried out in practice. There may be a mandatory requirement, which is for the regulators to decide. If not, it is possible that some listed companies will ask their auditors to check the ESEF tagging.

What are other companies doing?

ESEF is a catalyst to review the annual report preparation process. Some companies are already speaking with service providers and advisers. Changes to shorten and simplify the annual report in readiness for the new requirement may be on the agenda. Software vendors recognise the scale of the change and are speaking with current and prospective clients about how new systems and processes can be implemented to support ESEF.

How we can help

The ESEF services we offer include: eLearning and blended training, a tailored ESEF blueprint mapping report and a controls assurance review. Services offered may vary by region; please speak with your local PwC team to find out more.

Our point of view

Having freely-available, machine-readable access to the consolidated financial statements of every EU-regulated listed company will allow companies to manipulate the data and compare across a peer group - giving users of the information new possibilities.

ESEF is a technical format. It doesn’t prompt new information to be produced, it’s about making existing information available in both human-readable and machine-readable forms. So, it seems reasonable to view this as, primarily, a regulatory compliance exercise.

The preparation of annual reports can be costly and time-consuming. Some will use ESEF as a springboard to cost-savings and better processes, whilst others will delay engaging with the new requirement, take differing paths and achieve a range of cost outcomes.

What are the next steps?

Right now, this will mean getting to grips with the emerging regulation - tasking someone in the organisation to assess the requirement, present the options and devise a plan. Doing it well can involve training on the requirements, understanding how existing processes work, knowing where judgements will be involved and entering into discussions with current and potential service providers.

Further ahead, this will lead to more cost-effective, high-quality, digital information for users of your consolidated financial statements.