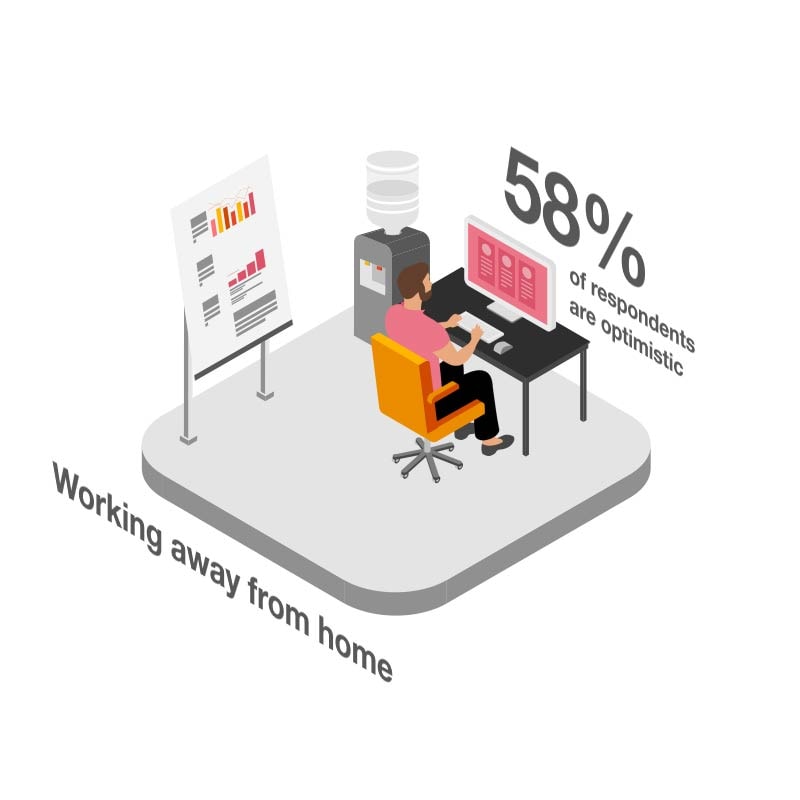

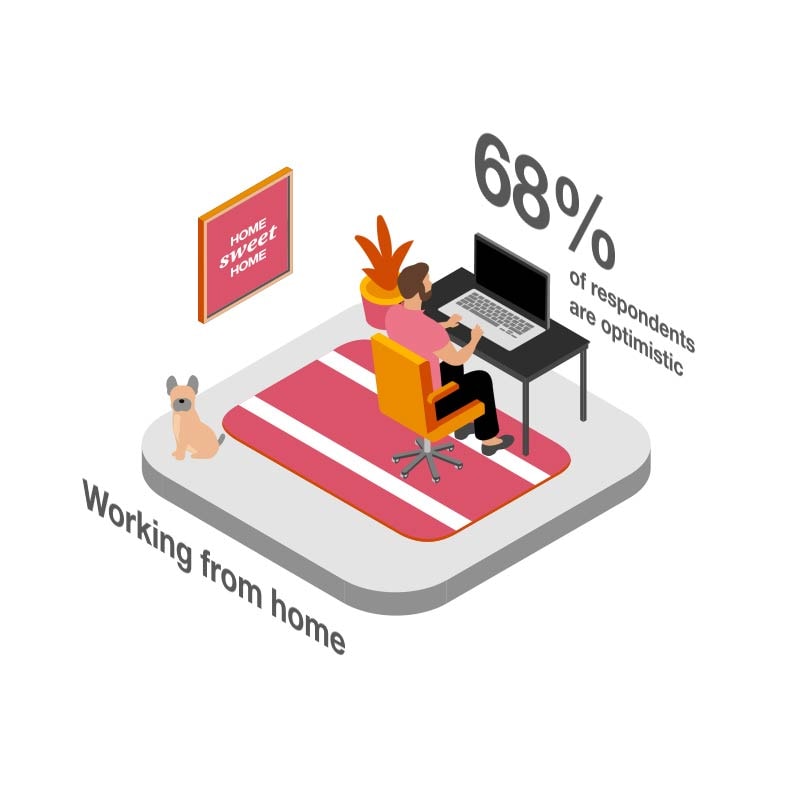

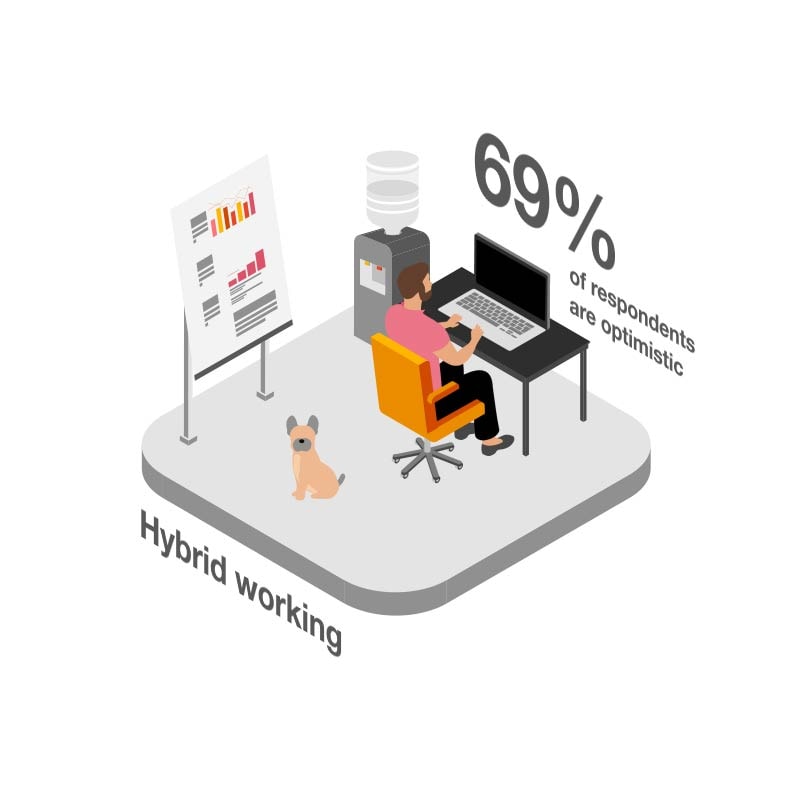

Millennials, city dwellers, those working mostly from home or in a hybrid way, and those who are vaccinated are the most optimistic cohorts. Presumably, because optimism is partly tied to vaccination rates, the climbing global vaccination rate will bode well for consumer confidence heading into 2022.

It's particularly important for business leaders to note the factors influencing optimism that they can control or affect, such as flexible work and vaccination. Supportive workplace policies that facilitate health and well-being will not only help companies rewrite the social contract with their people but could also create a ripple effect of activity and spending that yield business benefits.

Impact of vaccination status on optimism for the future

| Optimistic |

66% At least partially vaccinated | 43% Not Vaccinated |

|---|---|---|

| Not optimistic |

16% At least partially vaccinated | 27% Not Vaccinated |

The impact of workplace and working style on optimism