Key Takeaways

- Drivers for Transformation – Companies are undertaking treasury transformation to adapt to complex economic conditions, such as inflation and currency fluctuations. The transformation focuses on Automating Processes, Centralising Operations, Enhancing Resilience, and staying Compliant with regulatory requirements, thereby transitioning treasury functions from ‘Transactional’ to ‘Strategic’ roles.

- Essential Building Blocks – Successful treasury transformation centers around four core areas: Governance, People, Technology, and Process. These elements are crucial for aligning treasury functions with corporate goals, enhancing risk management practices, and promoting adaptability and innovation within the organisation.

- Customised Roadmap for Maturity – Treasury transformation is a continuous journey requiring customisation based on a maturity assessment to tailor the Target Operating Model (TOM). Organisations can progress from ‘Foundational’ to ‘Strategic’ treasury maturity, thereby consolidating and enhancing treasury operations.

Introduction

In an increasingly complex and challenging business environment marked by inflation, rising interest rates and FX risks, and recent banking stress events, treasury functions are evolving beyond their traditional roles. They are transitioning into strategic business partners that actively contribute to creating sustainable value within organisations. Drawing insights from the 2023 PwC Global Treasury Survey, it is evident that leading treasury teams are driving excellence beyond their conventional confines. Their focus now encompasses optimising cash efficiency, strengthening the balance sheet, generating insightful business forecasts, improving cash flow, and supporting decision-making across business units to manage financial and commercial risks while safeguarding company assets.

This evolution is encapsulated in treasury transformation, involving moving treasury’s responsibilities from primarily transactional tasks to embracing a strategic agenda that includes automation, centralisation, enhancing resilience, and ensuring regulatory compliance. It aims to expand the treasury scope with greater emphasis on strategic decision-making and data-driven insights.

Strategic rationale of Treasury Transformation

1. Impacts from macroeconomic landscape

2. Operational demands within businesses

In the rapidly evolving Vietnamese business landscape, companies are confronted with a range of operational demands that drive the need for robust treasury transformation. These internal challenges below underscore the critical need for effective treasury management to improve financial stability and efficiency.

Managing Cash Flow and Predictability |

Meeting Daily Cash Requirement |

Securing Reliable Funding and Managing Debt |

Navigating Key Financial Risks |

|

Challenges |

Inaccurate cash flow forecasting, leading to unexpected deficits or surpluses. |

Insufficient cash for daily operations and inefficient management of working capital needs. |

Challenges in securing stable funding and managing debt due to stricter credit conditions, increased financial scrutiny, and fluctuating interest rates. |

Exposure to risks from fluctuating interest rates and volatile foreign exchange markets. |

Impacts |

Liquidity issues and inefficient resource allocation for stability and growth. |

Insufficient liquidity can prevent businesses from meeting immediate obligations, damaging supplier and customer relationships as well as disrupting sales and operations. |

Operational slowdowns and higher capital costs strain businesses aiming to maintain or expand. High debt burdens worsen financial liabilities and interest expenses, impacting cash flow. |

Increased cost of debt, erosion of profit margins, and unfavorable financial reporting which may reduce investor confidence. |

Example |

An MNC operating in animal feed with a branch in Vietnam faces cash flow challenges including limited cash flow visibility, manual processing and inaccurate cash flow forecasts, hindering its strategic plan to integrate regional businesses for growth. |

A major Vietnamese fish and dipping sauce manufacturer faced negative operating cash flows for the past three years. This cash shortage caused delays in supplier payments, disrupting production and negatively impacting sales. |

A Vietnamese flexible packaging manufacturer struggled to secure additional funding due to unreliable financial metrics. Existing banks offered high interest rates, complicating their ability to gain favorable terms. |

An electronics company facing FX pressures has seen an 8% increase in chip and motherboard prices over six months. Further hikes could compel production cuts or local sourcing to maintain margins. |

Treasury Transformation Roadmap – What does the journey look like for different businesses?

1. Four Building Blocks of Treasury Transformation

To ensure a transformation process that delivers enduring benefits, it is essential to focus on two main priorities:

Define the project's objectives aligned with the company's commercial goals and business strategy. Formulate a Target Operating Model (TOM) that aims to guide the treasury function within the transformation program.

Use a "building block" method in designing the TOM. Treasurers should concentrate on four core areas (demonstrated in the table below), applicable across companies of all sizes and sectors. Planning and implementing changes within these four building blocks, and clearly communicating their purpose to stakeholders, are key to successful outcomes.

Four building blocks of treasury management

| No. | Building block | Definition | Implications to treasury management |

| 1 | Treasury Governance |

|

|

| 2 | People and Organisation |

|

|

| 3 | Technology |

|

|

| 4 | Process |

|

|

2. Five different levels of Treasury Maturity – Where is your company on the journey? Where do you aspire to be?

Although the enablers for treasury transformation are often similar across diverse organisations and industries, each entity's transformation path can differ significantly based on its unique situation.

Therefore, to navigate this transformation effectively, conducting a maturity assessment is necessary. This assessment provides valuable insights into current process gaps, controls, and systems, allowing treasurers to define and tailor their Target Operating Model (TOM) effectively. The blueprint for the transformation is influenced both by the treasury function's current starting point and the desired future state.

This model outlines five distinct stages of treasury maturity, providing a framework for evaluating and progressing your treasury function:

Foundational |

Developing |

Established |

Enhancing |

Strategic/Optimised |

|

How efficiently does treasury support the business? |

Some practices in place but they are inadequate in that there are many gaps which affect the day to day running of the organisation. |

Practices that are basic and allow it to function on a day-to-day basis but do not support the organisation to develop. |

Practices that are adequate in supporting the business under stable circumstances, and enable it to develop but will not be sufficient in challenging times. |

Professional practices which enable it to cope effectively in challenging times and will identify some opportunities to improve its performance. |

Practices that are leading edge and allow it to anticipate both challenges and key opportunities, to optimise its performance. |

3. Journeys of Treasury Transformation

Journey from 'Foundational' to 'Developing' treasury

- Treasury Governance

- People and Organisation

- Technology

- Process

Treasury Governance

Key actions to reach the target state:

- Roll-out a standardised treasury policy for all business units to follow.

- Establish centralised oversight at the headquarters with regular reporting from business units.

People and Organisation

Key actions to reach the target state:

- Identifying key personnel and developing their skills in fundamental treasury processes.

- Prioritise capacity building for roles that handle critical functions.

Technology

Key actions to reach the target state:

- Adopt cloud-based solutions to centralise data access, enhancing visibility and decision-making capabilities.

- Automate repetitive tasks such as cash forecasting and payments processing.

Process

Key actions to reach the target state:

- Centralise cash processes for improved visibility.

- Integrate basic systems for accurate financial data.

- Create a standardised model for cash flow forecasting, while conducting frequent reviews and updates.

- Create foundational risk management policies and an identification framework.

Example of a Vietnamese company that has been on this journey

Petrovietnam introduced an Enterprise Resource Planning (ERP) system, a core initiative in its digital transformation strategy.

Journey from 'Developing' to 'Established' treasury

- Treasury Governance

- People and Organisation

- Technology

- Process

Treasury Governance

Key actions to reach the target state:

- Implement unified treasury policy at group level

People and Organisation

Key actions to reach the target state:

- Establish specialised roles with clear definitions

- Implement structured training programs emphasising digital skills and best practices

Technology

Key actions to reach the target state:

- Integrate ERP systems with treasury management systems to streamline data flow and improve accuracy

- Ensure interconnectedness between technology platforms like TMS, ERP, and banking through APIs, Host-to-Host (H2H) connections, and SWIFT interfaces

Process

Key actions to reach the target state:

- Standardise and automate transaction workflows to improve efficiency

- Use predictive analytics tools to refine cash flow forecasting

- Gather financial data into a single repository, applying simple reporting tools

- Develop a centralised system to monitor risk across business units; conduct variance and root cause analysis for forecasted and actual risk exposure

- Create formal risk management policies and procedures

Example of a Vietnamese company that has been on this journey

A multinational agricultural product manufacturer in Vietnam sought to revamp its treasury operations for a centralised system across its entities.

Journey from 'Established' to 'Enhancing' Treasury

- Treasury Governance

- People and Organisation

- Technology

- Process

Treasury Governance

Key actions to reach the target state:

- Regularly review and update treasury policies.

- Form a Treasury Committee to discuss key matters.

- Implement KPIs and SLAs for clear commitments and performance measurement.

People and Organisation

Key actions to reach the target state:

- Use shared service centers to integrate treasury operations and enhance efficiency.

- Create a training plan for advanced skills in data science, API, RPA, and cloud computing.

Technology

Key actions to reach the target state:

- Establish a unified treasury system for consistent dataflows and a single source of truth.

- Implement advanced analytics and visualisation tools for real-time access and customisable reporting.

Process

Key actions to reach the target state:

- Automate updates for short-term liquidity and medium-term cash forecasts using digital solutions, aligning with financial statements and budgets.

- Frequently evaluate working capital policy and goals.

- Use digital tools to monitor funding sources, tenors, and interest types.

- Annually assess risk management strategies for alignment with company’s objectives and risk appetite.

Example of a Vietnamese company that has been on this journey

FPT, a technology corporation, operates globally with multiple subsidiaries, managing complex financial operations involving numerous currencies and accounting standards.

Journey from 'Enhancing' to 'Strategic' Treasury

- Treasury Governance

- People and Organisation

- Technology

- Process

Treasury Governance

Key actions to reach the target state:

- Eliminate organisational silos to achieve strategic alignment with company goals

- Proactively foster a culture of continuous improvement and innovation within the treasury team

People and Organisation

Key actions to reach the target state:

- Elevate treasury roles to strategic positions influencing business decisions and growth strategies.

- Provide leadership training for treasury professionals

Technology

Key actions to reach the target state:

- Centralise treasury data in a secure cloud data lake instead of disparate data resided at local / shared storage basis.

- Apply cloud AI/ML for predictive analytics and risk management.

- Implement group-wide data visualisation tools to identify patterns and trends.

Process

Key actions to reach the target state:

- Establish investment strategy and permissible transactions.

- Regularly monitor investments for optimal risk-return balance and performance.

- Adopt the forecasting system that can track timely reporting and generate variance reporting using actual cash balances.

- Centralise financing and review intercompany funding at least annually.

- Centralise risk management and compare forecasts vs. actual risk exposures.

Example of a Vietnamese company that has been on this journey

Vingroup plans to migrate its entire SAP footprint from on-premises data centers to Google Cloud's infrastructure, optimising areas like supply chain management, ERP, finance, human capital management, and manufacturing operations. This transition promises significant operational cost savings and will establish Vingroup in a scalable and reliable cloud environment with global application access, enhanced uptime, and low latency.

4. Critical Success Factors for Treasury Transformation

As businesses journey through treasury transformation toward strategic maturity, focusing on key success factors is essential to ensure smooth progress and alignment with organisational goals, ultimately securing lasting value and momentum.

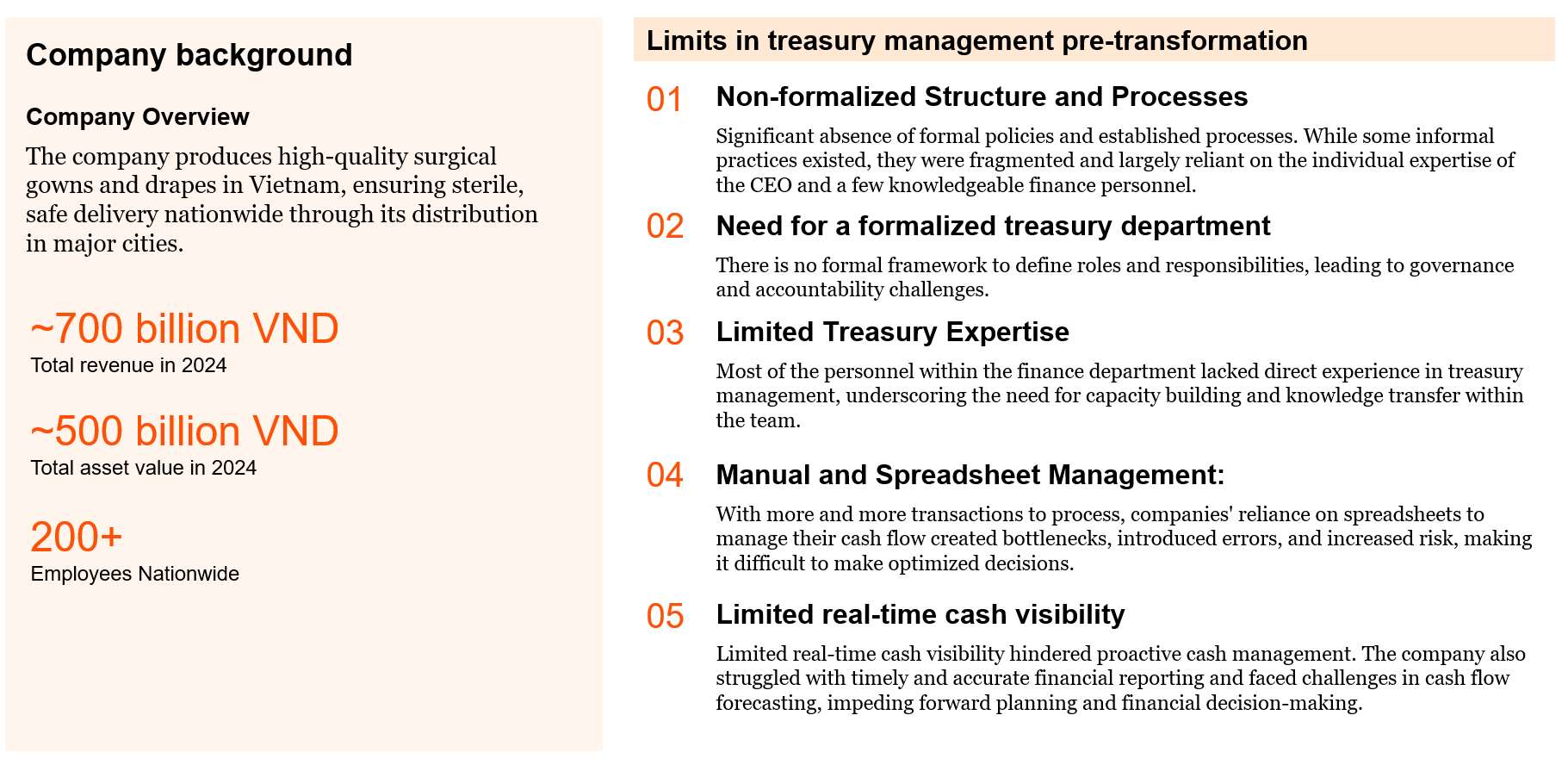

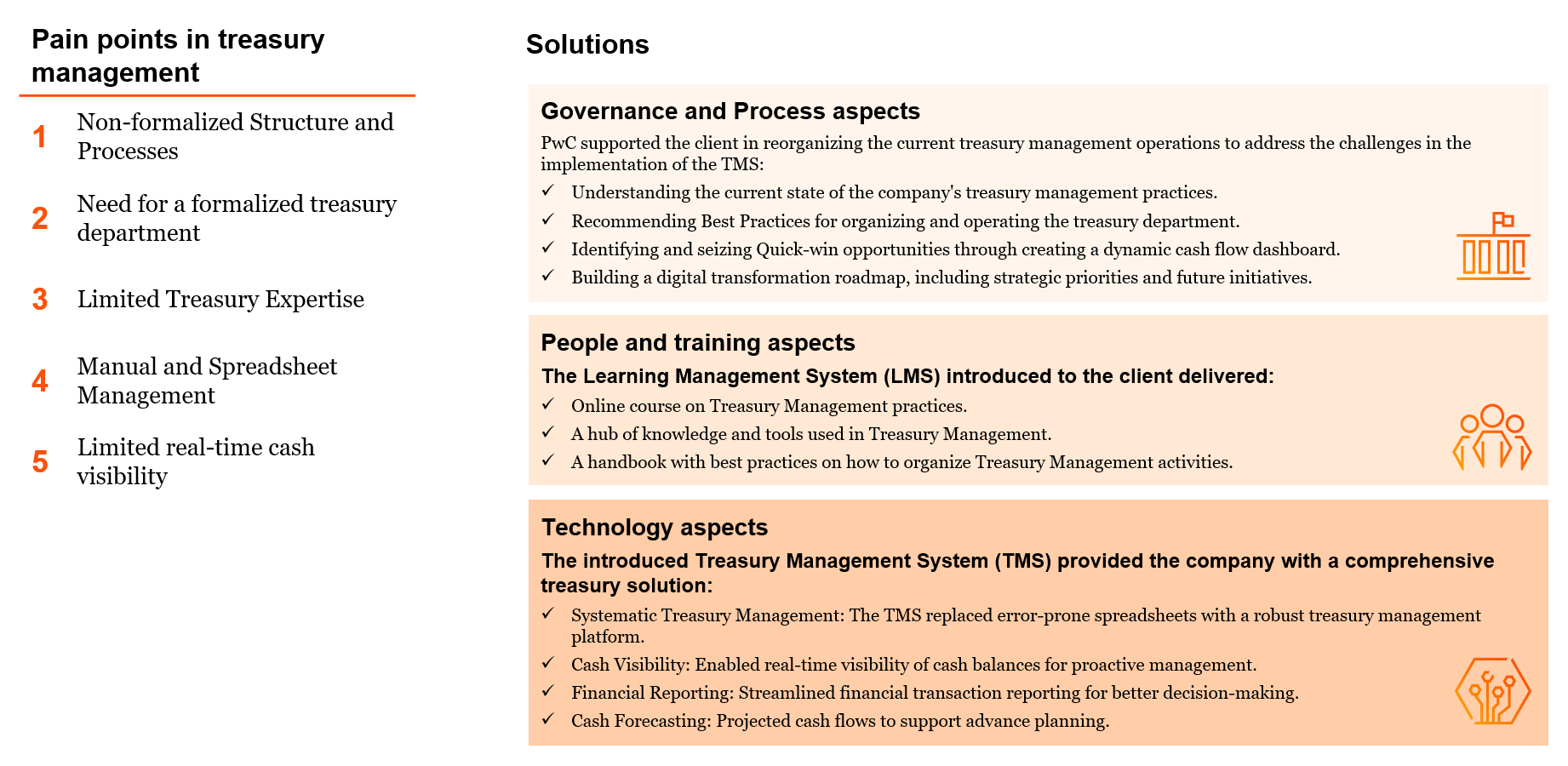

Case study of successful treasury transformation in Vietnam

Benefits realised

- Enhanced Decision-Making: Leveraging data insights, The Company can make more informed investment decisions.

- Improved Risk Management & Reduced Errors: Built a solid foundation for further growth, minimising errors associated with manual processes.

- Foundation for Future Growth: By building a foundational structure, The Company has established a solid foundation for further growth in the Vietnamese market.

- Actionable Insights: Post-assessment, leadership generated actionable insights and best practices for efficiently organising and managing their treasury department.

- Visibility Enhancement: The cash flow dashboard improved visibility and management of cash resources, serving as a foundational tool for future enhancements of TMS features aligned with operational needs.

Conclusion

In conclusion, treasury transformation is crucial for companies aiming to stay resilient amidst economic challenges and operational pressures. Achieving success in transformation requires ongoing development rather than a single, dramatic change. This process is a complex journey involving numerous dynamic components, necessitating thorough attention to all four fundamental areas to ensure the best outcomes in the long run.

Customisation is key in this journey; conducting a maturity assessment reveals existing gaps, helping to establish a tailored Target Operating Model (TOM) that aligns with both current and future organisational goals. Our suggested 5-tiered roadmap supports organisations starting from varied points, encouraging progress from foundational to strategic treasury maturity. Adopting this approach allows companies to consolidate and enhance treasury operations, enabling better scalability, compliance, and competitiveness.