Marketplace

Tax risk analytics (TRA)

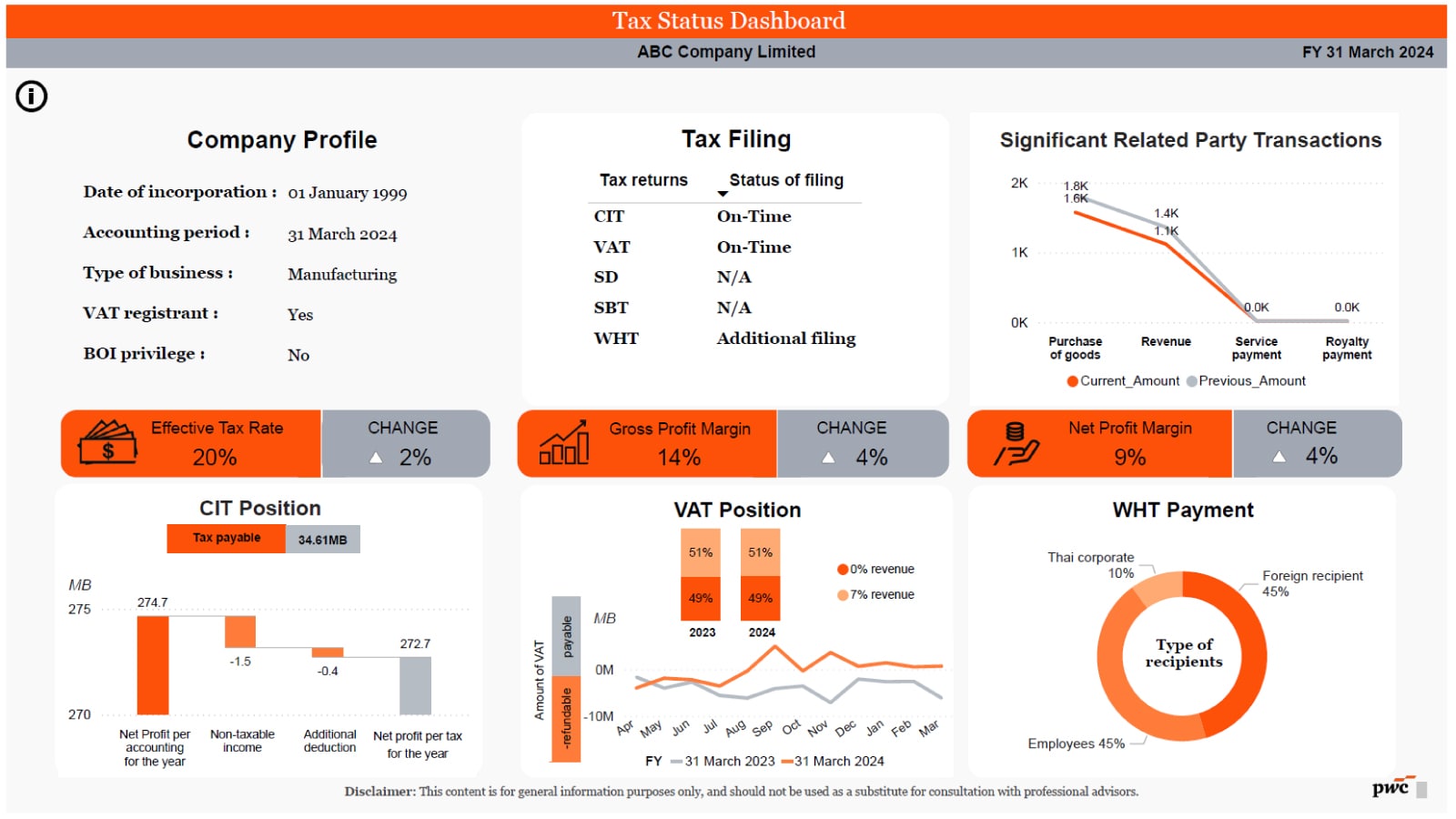

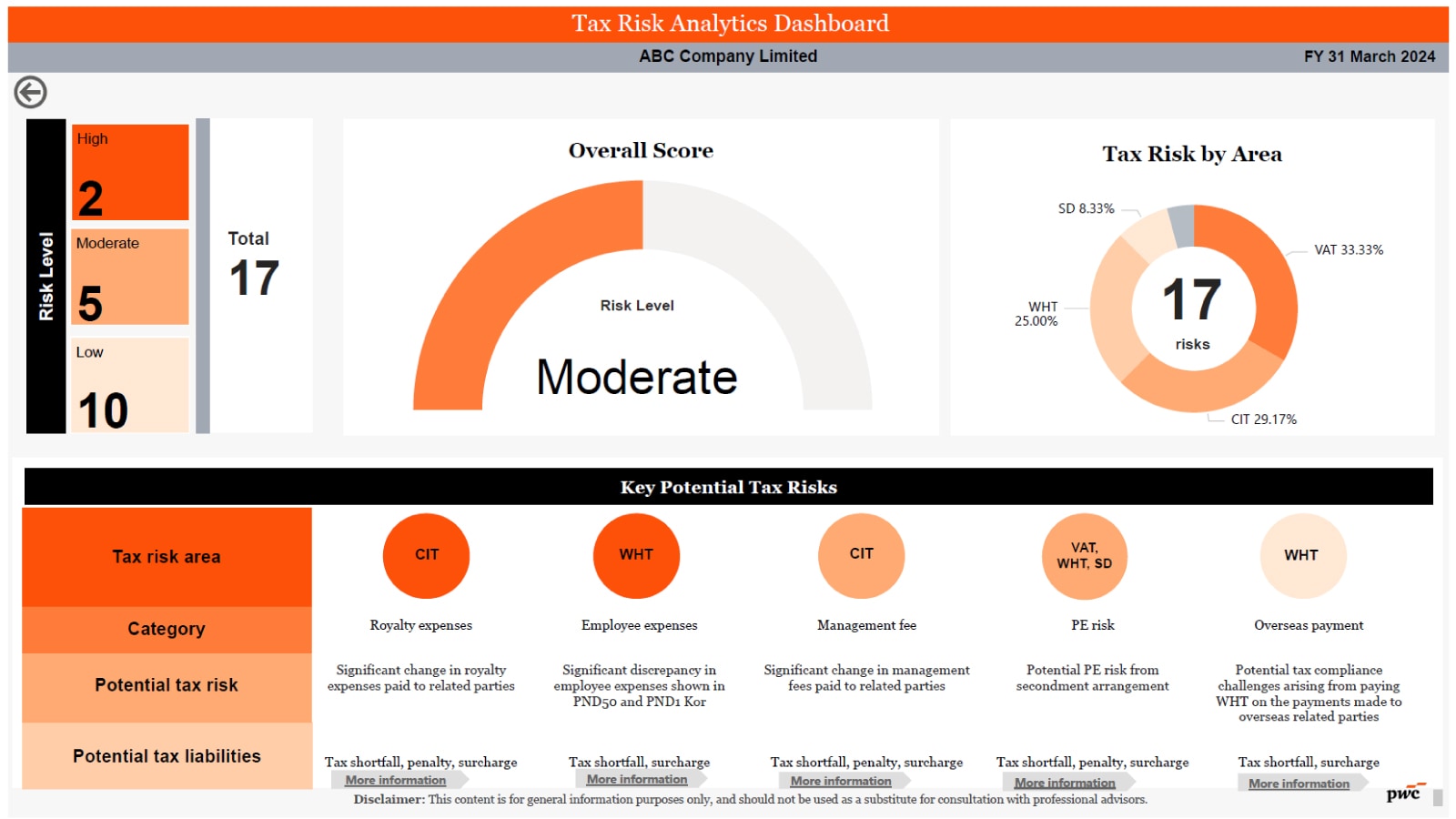

PwC’s Tax and Legal Services is redefining tax technology by integrating cutting-edge innovation through TRA services. The TRA tax assessment platform marks a significant milestone in our shift towards a technology-driven service model. By analysing client information and data, the TRA platform allows clients to understand their tax risk areas and their potential exposure to tax audits by the Revenue Department. This empowers clients to proactively manage these tax risks and develop strategic mitigation plans tailored to their specific business needs. This tool aims to enhance the accuracy and efficiency of tax processes, improve the client experience and satisfaction, and maintain PwC's competitive edge in technology-driven solutions.

Asset overview

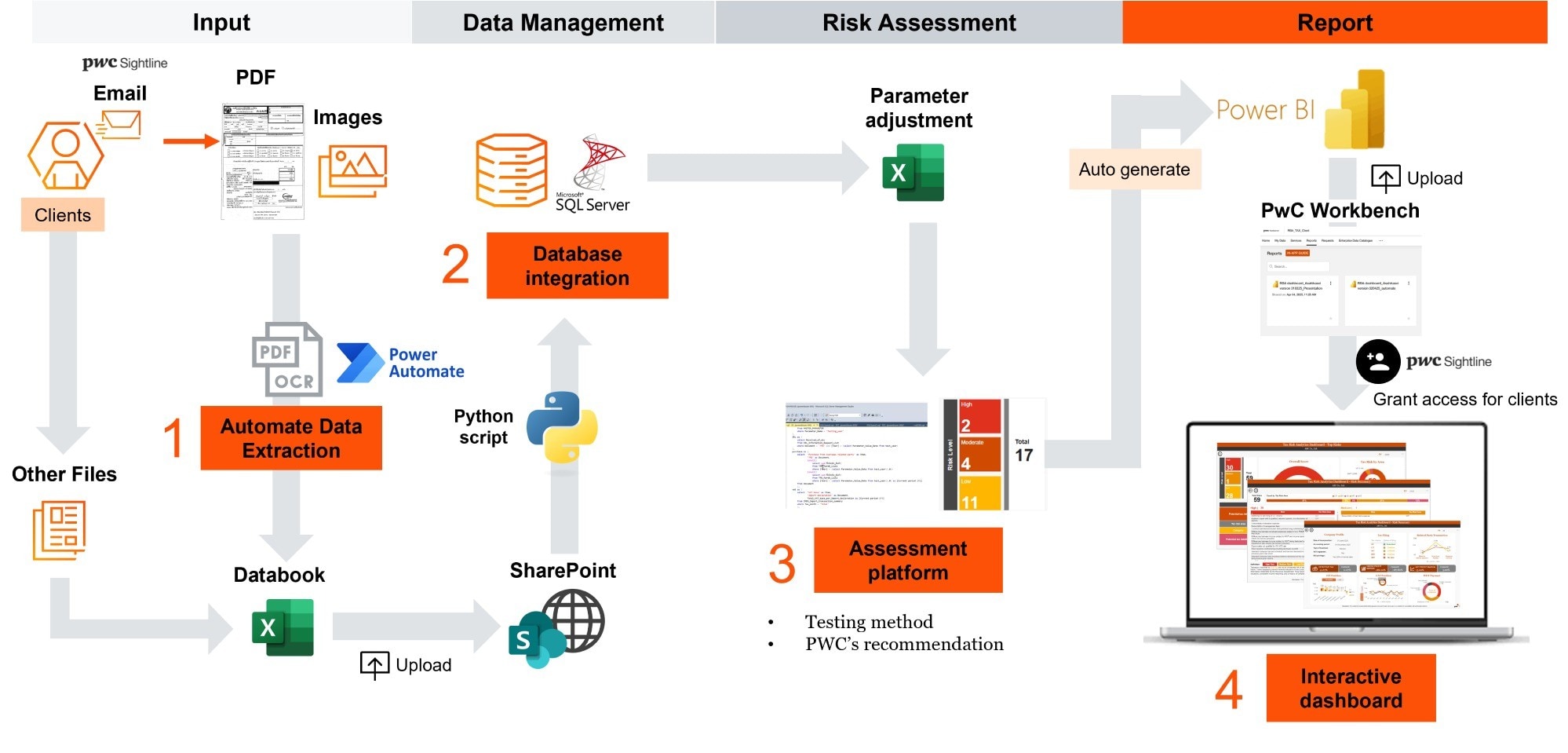

Users input tax filing data into the TRA platform, which automatically calculates a risk score. It identifies areas needing attention and displays the results interactively on a dashboard. The customer touchpoint of this platform occurs exclusively in the final phase called Workbench. Its global TRF validation ensures the tool is safe for external users.

Recommended for

- Head of Tax

- Chief Financial Officer

Issues it solves

Transforms PwC’s tax and legal services: Uses the TRA platform to integrate innovative technologies, enhancing accuracy and efficiency in tax processes

Enhances client satisfaction: Improves client experience and sustain PwC's competitive edge in technology-driven financial solutions

Tax risk analytics platform: Specialises in risk analysis for taxpayers by calculating a risk score from user-inputted financial data

Interactive dashboard: Highlights areas needing attention and presents results interactively on a dashboard

Customer touchpoint: Exclusively occurs in the final phase, Workbench, with global TRF validation ensuring the tool's safety for external users

Benefits

Enhanced precision

Reduces errors thanks to automated risk analysis and calculations.

Time saving

The streamlined tax assessment process increases efficiency, freeing up more time.

Insightful reports

Users receive detailed, interactive reports that clearly identify areas needing attention, which supports informed decision-making

PwC services and team

Tax risk analytics (TRA)

Using technology and data to create a panoramic view of risk landscape

Video demo