Overview:

Mobile employees fill a critical business need. Organisations want to get talented employees onsite where needed, often at a moment’s notice. But, like many other aspects of business, cross-border employee mobility is undergoing incredible change. As a result, its implementation is becoming increasingly complex.

Seminar content/objective:

We’re organising a three-hour session highlighting four big myths when sending employees to work in Thailand; and, how to mitigate personal income tax and legal risks associated with employee mobility.

During the session we aim to cover the following issues:

- Principles of personal income tax

- Updates on the new Thai personal income tax and regulations and deductions for allowances

- Employer’s withholding tax obligations and its pitfalls

- Typical tax planning strategies and common pitfalls affecting your cross-border employees

- High level overview of the issues surrounding short-term assignments

- Thai personal income tax treatment on expat non-cash compensation (e.g. equity-based compensation) so that you can identify Thai tax obligations or create a cost-effective expat compensation package

- Work permit requirements and exemptions

Date & Location:

Friday 8 November 2019

From 08.30 am to 12.00 pm

Response deadline : Friday, 1 November 2019

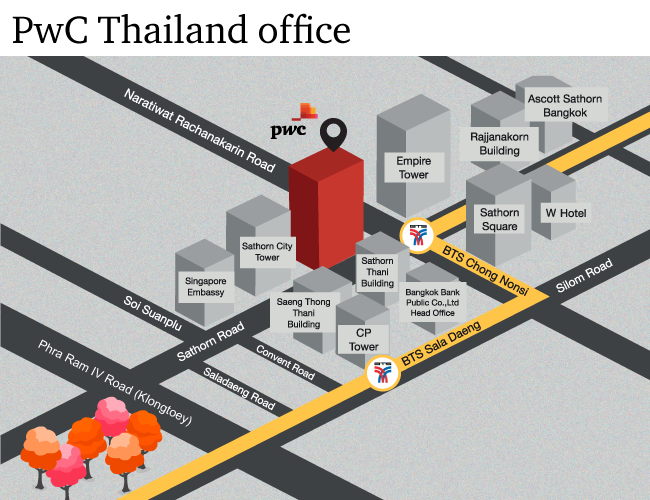

PwC Thailand office

Learning Room. 7th Floor

Bangkok City Tower

179/74-80 South Sathorn Road,Bangkok

Programme:

| 8.30 - 9.30 am | Registration |

| 9.30 - 12.00 pm | Seminar |

Remarks

- Conducted in Thai

- One seat per company

- Free of charge

- First come, first served

- Registration confirmed by email

- PwC reserves the right to change or cancel any part of the published programme in response to unforeseen circumstances.