South East Asia’s increasing demand for electricity along with the region’s commitment to decarbonise means a need to rethink how the region can come together to achieve optimal electrification and decarbonisation goals.

ASEAN currently does not have an integrated electricity market. Each country’s electricity market is managed and regulated individually by countries, and interconnection between national grids are limited. Power generation projects are also largely intended to meet domestic market demand.

This report is an extension of our previous Energy Transition Readiness in Southeast Asia thought leadership publication. In this piece, we explore the current electricity trade in Southeast Asia and challenges relating to regional trade of renewable energy.

Grid infrastructure is a physical limitation to increased trade

With global and regional push for renewable energy, opening up new transmission to connect the multitude of new sources is crucial for users to access the future green generation.

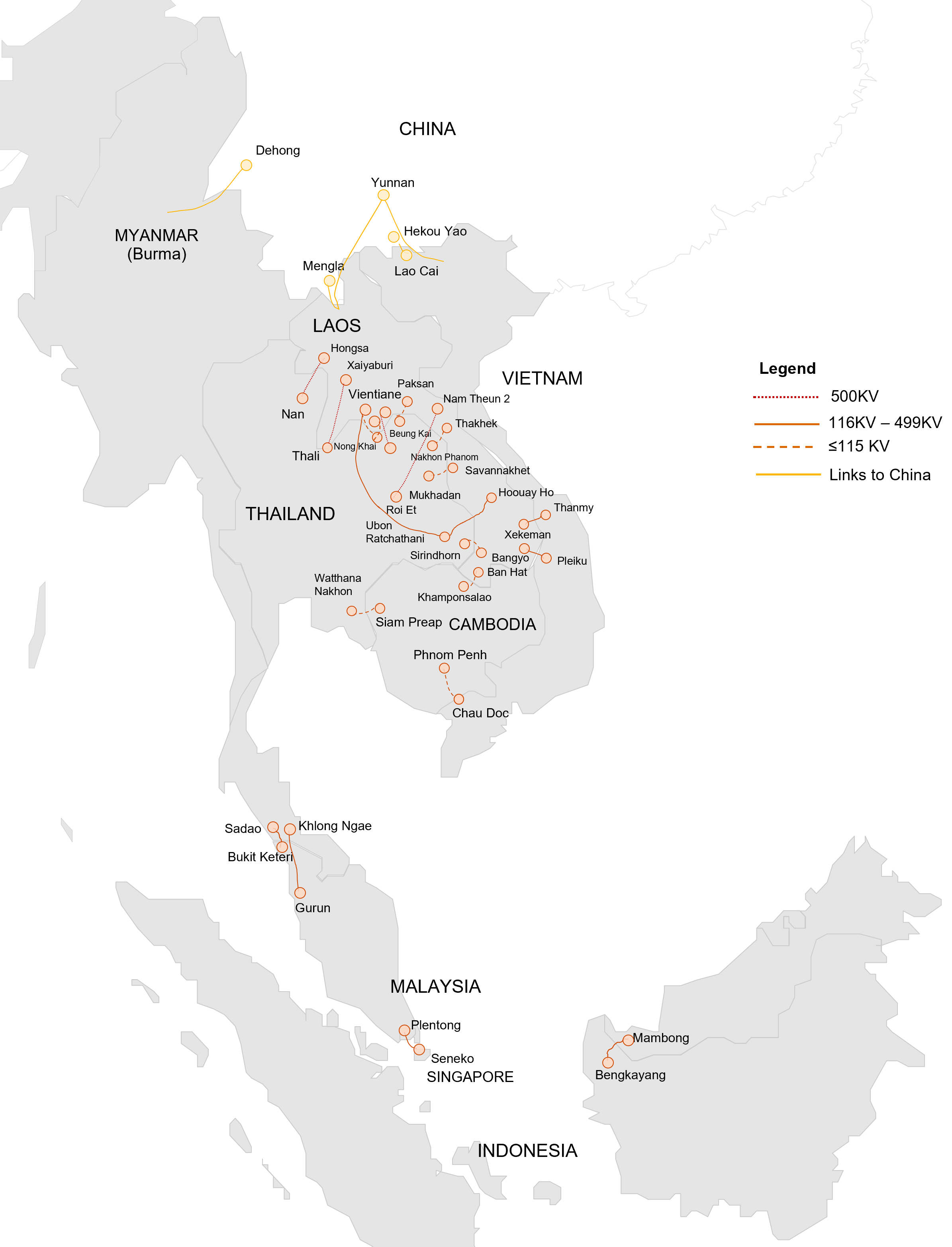

Existing cross-border interconnections in ASEAN

| China – SEA | 12 connections |

| Laos – Vietnam | 2 connections |

| Cambodia – Vietnam | 1 connection |

| Laos – Cambodia |

1 connection |

| Thailand – Cambodia | 1 connection |

| Laos – Thailand | 17 connections |

| Thailand – Malaysia | 2 connections |

| Malaysia – Singapore | 1 connection |

| Malaysia – Indonesia | 1 connection |

In Asia, efforts have been ongoing to develop a regionally connected grid since 1997, led by ASEAN and other regional bodies together with member country governments. To date, initiatives to establish shared grids are still in development.

However, there is continuous progress towards developing cross border transmission links to export and import electricity. As of 2022, there are 27 export links in ASEAN. 16 of these transmission links are more than 115 kV and allow for larger energy transfers.

Key benefits of developing more cross-border renewable energy in ASEAN

Government ❯

Government

- A regional grid allow governments to harness the technical potential of renewables for supply locally and regionally, creating economies of scale, and hence lower LCOE.

- Ability to optimise the plans for local transmission upgrades by using renewable energies with differing load profiles.

Investors ❯

Investors

- Ability to produce at scale where is it cheap and feasible, and sell where demand is higher.

- Greater number of potential bankable projects for investors.

Consumers ❯

Consumers

- Lower cost of electricity should in the long-run lead to lower electricity prices, if balanced correctly against increased cross-border transmission investment cost.

Key areas of focus for cross-border renewable energy

Technical

- Diverse power systems require increased technical harmonisation

Long-term policy perspective/ Market structure

- Clear guidelines and principles for cross-border electricity planning

- Revisions to national regulations

- Structure and ownership of the cross-border transmission links

- Interaction of renewable energy exports and NDC targets

Political will

- Political support, trust, and cooperation for new transmission projects

- Consistent intergovernmental collaboration framework

- Incentives to invest in and build grid connectors

Environmental and social impact

- E&S risks of new generation and transmission

- Proposed new developments should follow international standards

Financial feasibility

- Political risk, curtailment risk, asset ownership risk

- Stranded assets

- Clear cross-border trading framework

- Potential support from multilateral banks

Contact us