"When starting a new business, it can be a challenging task to establish a sustainable financial infrastructure from the very beginning. For the investors focusing on start-ups, one of the most difficult tasks is determining how to price the investment. In other words, the investors need to decide on the amount of equity or ownership interest they should gain in exchange for the invested capital, whereas the entrepreneurs are concerned about the amount of equity they will need to issue. Deciding on the amount of ownership interest requires determining the enterprise value (EV) or business idea value. For that purpose, below we provide some start-up-specific information that will help you to understand and ensure a reasonable estimation of your start-up business value."

By its very nature, valuation is not an exact science, and this becomes even more obvious for valuation of start-ups. Start-ups as such usually have negative but growing cash flows, limited or no historical financial data and forecasts, and often their proof of concept has not been developed yet. For that reason, the traditional approaches such as income approach, market approach or net assets approach, which are used in determining the start-up business value/the EV, are not helpful because the start-ups and most of the early-stage companies do not have the financial performance indicators necessary for those approaches.

Valuation of a start-up brings various challenges, which require the potential investors to approach the process differently. As historical information is unavailable/limited and forecasts are uncertain, qualitative elements play a significant role. Accordingly, such indicators as management experience, first customers and revenue, defined target group or a minimum viable product (MVP) should be taken into account in the valuation process.

Start-up valuation methods

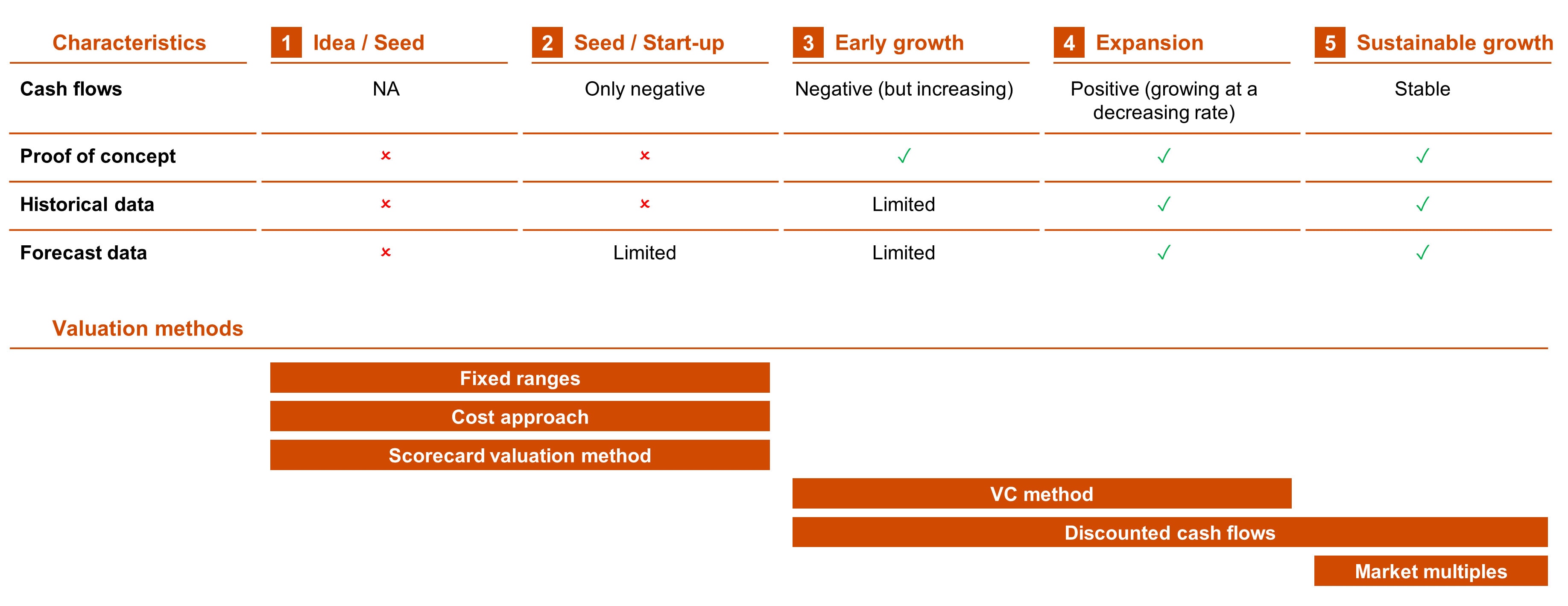

PwC sets out six different methods, which are often used in practice and applied to different stages of a start-up. The list is infinite, and valuation practitioners will often use a combination of the methods as per the table below:

Source: PwC analysis

The selected valuation method depends on the maturity stage of the target entity:

- For early-stage companies, the valuation methods would differ from those applied to more mature companies. As provided in the table above, for valuation of companies in Idea/Seed and Seed/Start-up stages, the fixed ranges approach, the cost approach, and the scorecard valuation method might be used. When using the fixed ranges approach, incubators propose a ‘take or leave’ investment, which is based on the fixed ranges of capital offered in exchange for a share of equity. The cost approach sets the idea that an investor is willing to cover the costs that have already been incurred to get the target entity to its current stage. Finally, in order to assess the value of the target company using the scorecard valuation method, the potential investors have a list of criteria based on which the target entity and its peers are evaluated.

- Valuation of companies in Early Growth and Expansion stages might be based on the venture capital (VC) and discounted cash flows (DCF) methods. Using the VC method, the value of the target entity is estimated as the value after a few years (the so called ‘exit-value’). That value is then discounted to the present value using a discount rate. The DCF method is used for companies where cash flows can be reasonably estimated. The DCF approach is a valuation method used to estimate the value of the target entity based on its expected future free cash flows. Those cash flows are then discounted to the present value using an appropriate discount rate, being the weighted average cost of capital (WACC).

- Finally, the companies that have reached the Sustainable Growth stage could be evaluated using the DCF or market multiples methods. When using the market multiples approach, the potential investors could consider either the current market price of publicly traded peer companies or the previous comparable transactions with disclosed multiples. In start-up valuation, the most often used multiples are the following: enterprise value-to-revenue (EV/R), enterprise value-to-EBITDA (EV/EBITDA), enterprise value-to-EBIT (EV/EBIT), and enterprise value-to-free cash flows (EV/FCF).

A start-up valuation performed by PwC

PwC has recently performed a start-up valuation for one of the innovative transport system developers located in Lithuania (the Target). The Target has already reached the Early Growth and Expansion stages, and therefore, the DCF method with free cash flow to the firm (FCFF) was selected as the main valuation approach. In addition, as the Target has already passed the Seed/Start-Up stage and was looking for additional funds, the VC method was chosen as a supplementary method.

As mentioned earlier, the VC method is often used in valuation of start-ups where it is easier to assess the potential exit value after a few years, when certain stages of maturity would have been reached. Return on investment (ROI) is assessed by estimating the profit the investor could expect from the investment, which depends on the specific level of risk.

Application of the VC method

During the valuation of the Target under the VC method, firstly, the expected exit value was assessed. The value was estimated at the time of exit from the investment, as expected earnings multiplied by a corresponding income multiplier based on the industry average. Taking into account the estimated exit value, the start-up value at the valuation date was calculated by discounting the exit value to the value at the valuation date using the selected discount rate. It is important to note that the discount rate to be used in a start-up valuation is estimated in a way that differs from the traditional estimation of the discount rate.

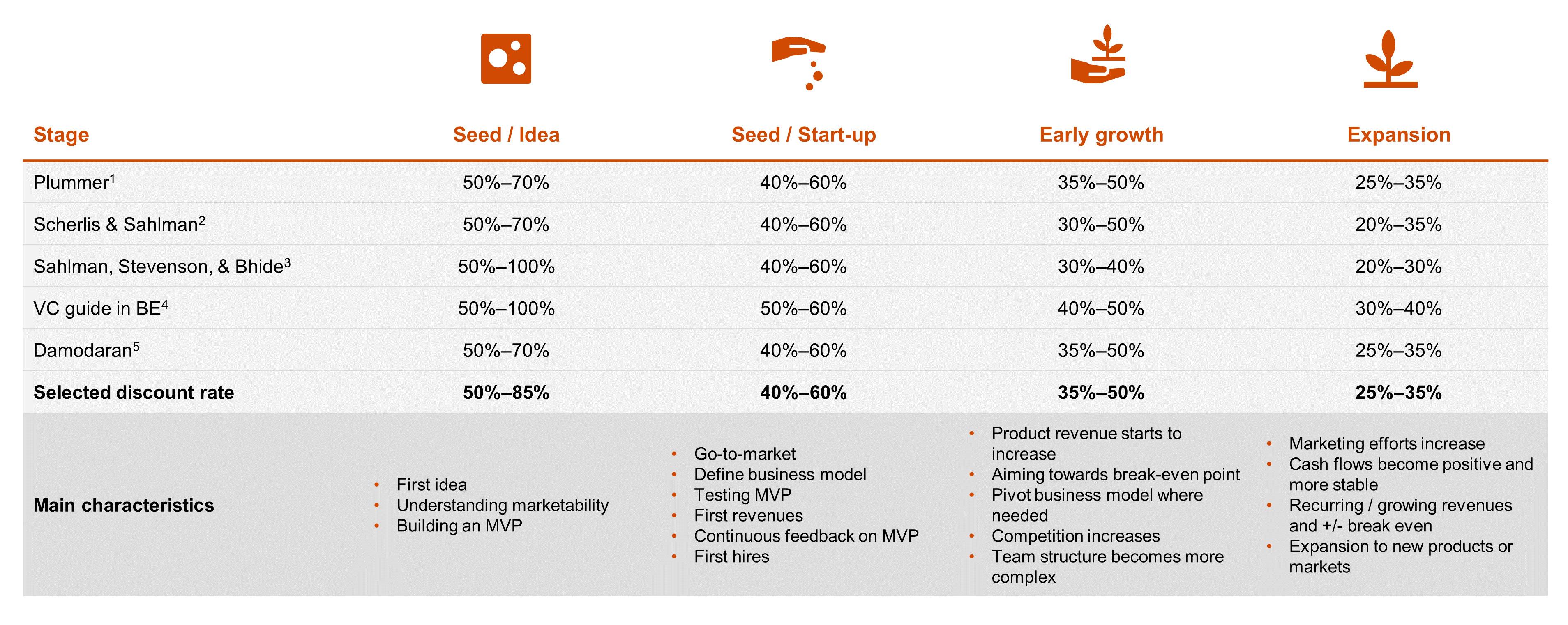

A range of discount rates may be used when estimating the specific discount rate in view of the maturity stage of a company. The table below shows a breakdown of potential ranges of discount rates by maturity stage and source of information:

Sources: PwC analysis and:

1. Plummer, QED Report on Venture Capital Financial Analysis, 1989;

2. Scherlis and Sahlman, A method for Valuing High-Risk, Long Term, Investments: The Venture Capital Method, 1998;

3. Sahlman, Stevenson, and Bhide, Financing Entrepreneurial Ventures, 1998;

4. Manigart and Witmeur, Venture Capital guide for Belgium, 2009;

5. Damodaran, Valuing Young, Start-up and Growth Companies: Estimation Issues and Valuation Challenges, 2009.

As the Target was at the Early Growth stage, the initial range of discount rates was chosen from the Early Growth column.

Application of the scorecard valuation method

Secondly, a qualitative assessment was performed by completing a questionnaire about the Target. This was where the scorecard valuation method was introduced. Despite the fact that the Target has already passed the Seed/Start-up stage, it still has some characteristics applicable to start-ups: historical financial data is limited or unavailable; product/service development is still in process; cash flows are negative.

Under the scorecard valuation method, the potential investors were provided with a list of criteria, based on which the Target and its peers were assessed and scored in a binary way. All the questions in the above-mentioned questionnaire were grouped into two categories:

a) the Target’s management and services / product; and

b) the Target’s market and business strategy.

Each answer received a certain score, and accordingly, the higher the score was given, the higher the Target’s value.

Finally, based on the specific formula, the precise discount rate from the initial discount rate range was calculated using the estimated weighted value from the questionnaire. The following formula was applied:

Estimated discount rate = minimum value from the discount rate range + (maximum value from the discount rate range - minimum value from the discount rate range) * (100% - relative share of the estimated value from the questionnaire).

To sum up, as mentioned above, valuation is not an exact science. Traditional methods such as income approach, market approach or net assets approach are not always appropriate for valuation of start-ups, as they are fresh entities with limited or no historical financial information. Alternative methods such as the VC or scorecard valuation methods might be more appropriate for start-ups. However, such methods require good understanding of the market, the company involved in the valuation, and the valuation process itself.

Footnotes

1. A minimum viable product (MVP) is a version of a product with just enough characteristics to be usable by early customers who can then provide feedback for future product development.

2. Start-up incubators help entrepreneurs solve some of the problems commonly associated with running a start-up by providing workspace, seed funding, mentoring, and training. Start-up incubators are usually non-profit organisations, which are usually run by both public and private entities.

Contact us