The sharing economy presents Europe with a €570 billion opportunity

06 Jul 2016

View this page in: Magyar

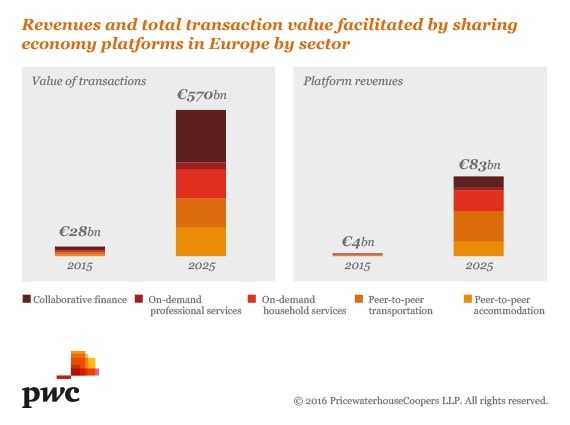

Total transactions for Europe’s five most prominent sharing economy sectors – collaborative finance, peer-to-peer accommodation, peer-to-peer transportation, on-demand household services and on-demand professional services – could see a 20-fold increase to €570 billion by 2025, up from just €28 billion today, according to new analysis by PwC.

This will particularly benefit service providers, who are predicted to pocket around 85%, or €487 billion, from the value of sharing economy transactions facilitated by 2025.

The growth of Europe’s sharing economy will be broadly spread, with four out of the key five sharing economy sectors each forecast to deliver over €100 billion of annual transactions by 2025, with only on-demand professional services falling short of this milestone. However, there is still a sizable growth opportunity for on-demand professional services, which PwC forecasts to expand by 40% per year to €20bn of annual transactions in Europe by 2025, up from less than €1bn in 2015.

Commenting on the potential for growth in Europe’s sharing economy, Ádám Osztovits, Advisory service line leader of PwC Hungary, said:

“The sharing economy is rapidly coming of age, as it progresses from a headline catch-phrase to the default choice for younger consumers in society. Over the coming decade, the strength of the sharing economy could well see it become a shining beacon amid a ‘new normal’ of lower growth across Europe.

“As well as providing opportunities for the proceeds of growth to be shared more broadly in the wider economy, Europe’s sharing economy has matured into an established socio-economic trend that is fundamentally changing the way we lead our lives. From freelancing platforms altering the way we work to food-sharing platforms creating ways to connect in local communities, sharing economy businesses are enabling new economic and social interactions across Europe.”

Across Europe, PwC analysis estimates revenues accrued by platforms in the five key sectors of the sharing economy could reach €83 billion by 2025, up from just €4 billion today.

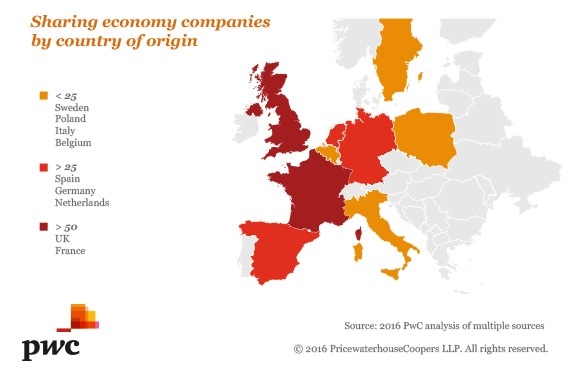

Beneath the headline names, a diverse sharing economy ecosystem has emerged: PwC’s detailed research of nine European member states reveals that at least 275 sharing economy organisations have been founded in those regions, to date.

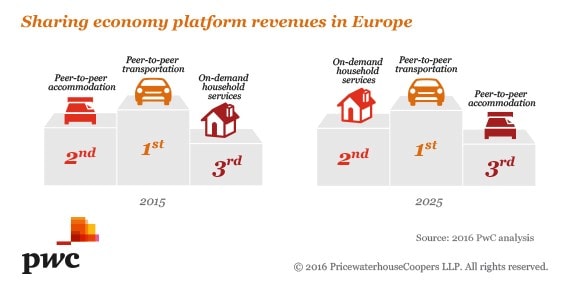

Of the five key sharing economy sectors, on-demand household service platforms look set to achieve the fastest growth, expanding revenues by roughly 50% per year to 2025. The sector’s development is being driven by a new generation of consumers who are increasingly turning to on-demand services to resolve their needs around the home, such as Deliveroo for restaurant food delivery and TaskRabbit for DIY tasks.

“Our view is that growth in the sharing economy is only just beginning. By 2025, we estimate that many areas of the sharing economy will rival the size of their traditional counterparts. Amid this dramatic expansion, Europe has the opportunity to build on its position as a global marketplace and innovation incubator for the sharing economy. But to achieve this goal, it will need to develop a more balanced, coordinated and dynamic regulatory framework across and within its 28 member states” said Ádám Osztovits.

Árpád Kőszegi, Advisory service line manager of PwC Hungary, added:

“The European Commission's announcement of a European Agenda for the sharing economy is a proactive first step on the journey to developing a successful framework. It offers the opportunity for each member state to review whether their regulations are fit for purpose and if there is scope to remove any barriers whilst safeguarding fair competition, employment rights and consumer protection. An evidence-driven approach will be key alongside an agile mind-set where policymakers feel empowered to collaborate with sharing economy enterprises and private sector organisations to experiment with new regulatory innovations.”

Notes

Infographics

In 2014, our global study into the sharing economy suggested that platform revenues generated in the UK would rise from £500mn in 2013 to £9bn in 2025. Two years on and we have revisited the question of the market opportunity from the sharing economy within the UK context.

Whilst the thorough market sizing and forecasting approach we have taken is consistent across the 2016 and 2014 studies, better data availability and granularity have enabled us to deepen our analysis and refine the selection and definition of the sectors we cover. For example, in 2014 we included the video and music streaming sector within our sectoral coverage, but did not estimate on-demand household services, which we have covered within our updated analysis. Whilst direct comparisons between the findings of the two studies should therefore be avoided, both studies reinforce our view of the significant economic potential for the sharing economy over the next decade and suggest a similar order of magnitude for the size of this opportunity.

The projections we cite in this press release builds on, but is separate to, the research we were asked to undertake by the European Commission on the current size and presence of the sharing economy within Europe. This research is available here: http://ec.europa.eu/DocsRoom/documents/16952/attachments/1/translations/en/renditions/native

Contact us