{{item.title}}

{{item.text}}

{{item.text}}

Due to the economic downturn of recent years, a growing number of companies have been forced to review their corporate structure or, if necessary, streamline their supply chain in order to develop a more sustainable business model.

By adopting a transparent and justifiable risk and remuneration structure that is based on an appropriate transfer pricing strategy, companies can reduce their administrative expenses associated with transfer pricing. Our team of transfer pricing specialists can help you reduce that burden.

Whether it is fully-fledged, contract, or toll manufacturing, or various distribution models, services, intangible assets, or transactions relating to financial services, we can help you develop an acceptable and reasonably justifiable transfer pricing structure by aligning risks with remuneration, according to the characteristics of your related party dealings and industry sector.

In 1992, Hungary adopted transfer pricing legislation in the corporate tax act in line with the OECD Guidelines, acknowledging that the arm’s length principle (see below) is the international transfer pricing standard to be used.

“(When) conditions are made or imposed between two (associated) enterprises in their commercial or financial relations which differ from those which would be made between independent enterprises, then any profits which would, but for those conditions, have accrued to one of the enterprises, but, by reason of those conditions, have not so accrued, may be included in the profits of that enterprise and taxed accordingly.”

Article 9, OECD Model Tax Convention

In recent years, this has also been followed by detailed regulations (i.e. Decree No. 18/2003 (VII.16.) and Decree No. 22/2009 (X.16.) of the Ministry of Finance).

More and more emphasis is laid on the enforcement of these provisions, also demonstrated by the increasing number of transfer pricing related tax audits and more prepared tax authorities.

Transparent inter-company transactions, consistent and reasonable pricing policy – this is what transfer pricing means to us.

Failure to comply with Hungarian transfer pricing regulations may have severe financial consequences.

Transfer pricing risks primarily include the potential of a default penalty imposed in case of noncompliance with TP regulations. The penalty can be up to HUF 2,000,000 (approximately USD 10,000) per transaction per year significantly increasing for repeated non-compliance.

In addition, transfer pricing adjustments (assuming they are in favour of the tax authority) cannot only increase the tax liability of the taxpayer but also result in a tax penalty of 50% of any additional tax payable plus interest on late payment of tax at twice the base rate of the National Bank of Hungary.

There is also the risk of double taxation when a ‘corresponding adjustment’ is not accepted in the other tax jurisdiction involved.

These risks exist for qualifying agreements in any of the years open to scrutiny by the tax authority under the Hungarian statute of limitations.

Finally, taxpayers have a reporting obligation in relation to their related parties. Should the taxpayer fail to meet this obligation, a default penalty of up to HUF 500,000 may be imposed.

PwC’s Transfer Pricing team can help you to find solutions for your transfer pricing issues.

Action 13 of the BEPS Action Plan, published by the Organization for Economic Cooperation and Development (OECD) on 5 October 2015, introduced a new, three-level transfer pricing documentation requirement. The new documentation level – supplementing the existing Masterfile and Local File – introduced country-by-country reporting (“CbC”).

Pursuant to a Directive adopted by the Council of the European Union on 25 May 2016, Member States were required to implement the provisions of the directive laying down the regulations on country-by-country reporting on the basis of Action 13 of the OECD’s BEPS Action Plan no later than 4 June 2017. In complying with the above harmonisation requirement, on 3 May 2017 Parliament adopted an amendment to Act XXXVII of 2013 on Certain Regulations on International Administrative Cooperation in the Field of Taxes and Other Charges, transposing the provisions of the directive into Hungarian law.

These developments indicate that ensuring the transparency of multinational corporations is a key priority for international organisations. The new statutory obligation pertains to Hungarian resident companies that were, in the fiscal year preceding the reporting fiscal year, members of a company group with a total annual consolidated group revenue exceeding EUR 750 million. The first CbC reports and/or notifications must be filed for the fiscal year commencing on or after 1 January 2016.

In recent months, a growing number of multinational corporations have realised that complying with this new requirement, which at first seemed to be just another administrative task, could be hindered by major technical and organisational obstacles, and have accordingly made significant efforts to ensure compliance. Failure to submit reports or notifications, late submission, or providing incorrect, false, or incomplete information may be subject to a default fine of up to HUF 20 million. Therefore, companies should act with care regarding this matter.

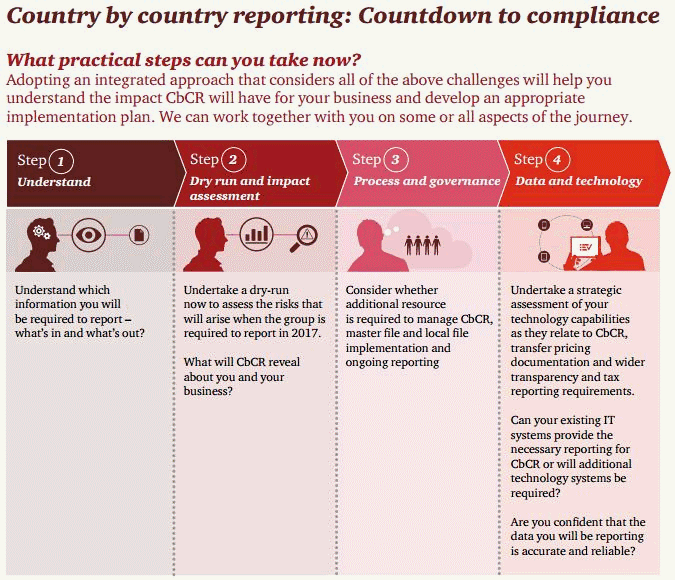

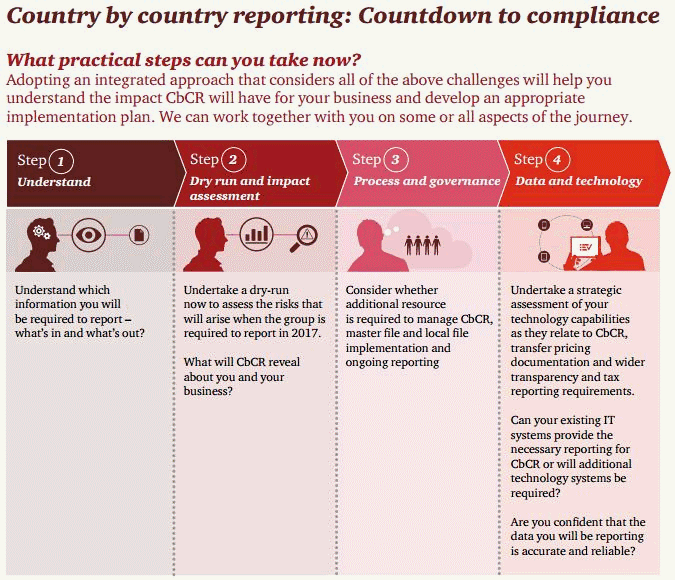

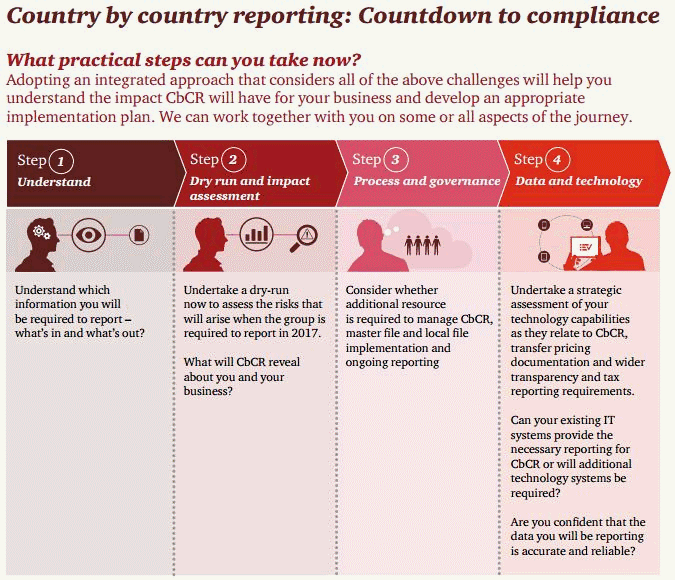

The graphic below provides guidance on the actions to be taken in connection with CbC reporting.

According to Section 18 of the Hungarian corporate tax act, if related parties use prices other than arm’s length prices in their transactions, the corporate tax base of the Hungarian taxpayer must be adjusted accordingly.

Enterprises qualify as related parties if they are connected by direct or indirect majority shareholding or they are able to appoint or dismiss the majority of the key management or the supervisory board of the other enterprise. |

|

Hungarian TP legislation requires taxpayers, except small enterprises, to document each inter-company agreement under which delivery was performed during the tax year in question by the time the corporate tax return was filed.

Based on current transfer pricing regulations, taxpayers may prepare a country specific or a combined transfer pricing documentation.

In case of low value added inter-company services the use of a mark up between 3% and 7% is arm’s length by law provided that special conditions are met.

Some transactions, transaction types are exempted by the decree from the preparation of the documentation. Among others, transactions not exceeding HUF 50 million in value, net of VAT, or transactions where third party costs are recharged in full to a related party, there is no need to prepare a transfer pricing documentation.

If you need greater certainty there is also a possibility to submit an APA (Advance Pricing Arrangement) request to reach an agreement with the Hungarian tax authorities in regard to your future inter-company transactions. For the period of validity of the resolution no transfer pricing documentation is required.

Documentation

APAs

Dispute resolution

Planning

{{item.text}}

{{item.text}}